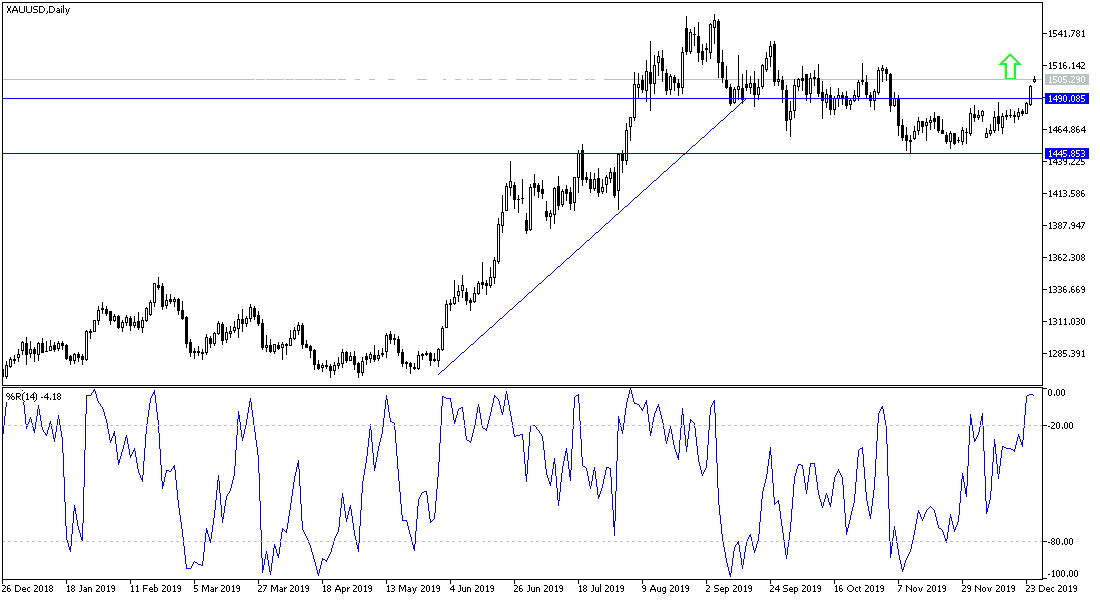

With the return from the Christmas holidays, the gold prices stabilized above the $1500 psychological resistance, and rose more to $1505, its highest level in more than a month and a half. We noted since the middle of this month, that there is an upcoming price explosion for the price of the yellow metal after several trading sessions of gold being stable around very narrow ranges. Despite the rebound, it should be borne in mind that announcing the date of the formal signing of the Phase1 trade agreement between the United States and China, and the details of the deal, will negatively affect the recent gold gains.

Gold gained momentum amid geopolitical tensions and increased demand for the metal during the holiday season. There are fears that North Korea will test an ICBM, with the aim of seeking concessions in the stalled nuclear negotiations with the United States. North Korea said earlier this month that it would surprise Washington with the Christmas gift.

Also, concerns about the global economic slowdown have contributed to a sharp rise in gold prices.

On the trade front, the United States and China are likely to sign a deal soon. As US President Donald Trump confirmed on Saturday that the United States and China will sign "very soon" the Phase 1 of the trade agreement. Also, the Chinese Ministry of Finance announced plans to reduce import duties on a range of products, including frozen pork, pharmaceuticals and some high-tech components.

According to the technical analysis of gold: The upward trend will still be supported by the stability of the price of an ounce of gold above the $1500 psychological resistance because it may push bulls to move towards stronger levels, with the closest currently are 1512 and 1525, respectively. On the downside, weak momentum may push the gold back to support levels 1493, 1485 and 1472, respectively. I still prefer to buy gold from every bearish level. The yellow metal is the ideal safe haven for investors in times of uncertainty due to global trade and geopolitical tensions.

Today's economic calendar has no important economic data, and it contains nothing but announcing the jobless claims from the US.