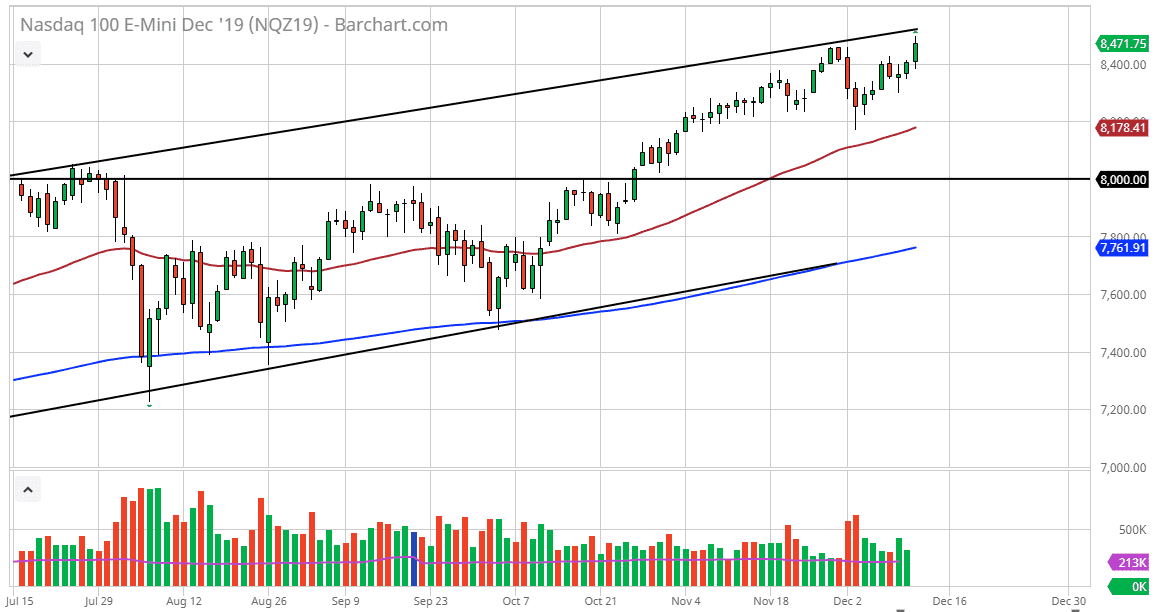

The NASDAQ 100 initially pulled back a bit during the trading session on Thursday, dipping below the 8400 level. We turned around to rally towards the 8500 level which coincides with the top of the uptrend and channel that we have been in. At this point, we are testing that, and Friday should be very interesting to pay attention to as we are looking likely to move on the next couple of tweets that Donald Trump does.

The main reason I know this is that the bullish trading session on Thursday with almost all about Donald Trump suggesting that a China deal was “very close.” Ultimately, this is a market that should continue to see a lot of jittery nerves, and the longer we get into the Friday session without some type of sign of a delay in tariffs, the more likely we are to see a significant pullback. The ascending triangle measures for a move to the 8800 level, but that doesn’t mean that we get there tomorrow. Quite frankly, this is a market that should continue to see a lot of noise, and therefore I think if you wait a bit, you may be able to buy the market at a cheaper level.

Some of the candidates for value probably are as follows: 8400, 8200, the 50 day EMA, and then obviously the 8000 level. If Trump does in fact levy tariffs on the Chinese on Sunday, it’s very likely that Monday opens up with a major gapped lower. This is because so much of Wall Street is on the other side of the trade that they have gotten overexpose. Quite frankly, the “base case scenario” of a lot of the talking heads is that there will in fact be a delay of the tariffs but clearly, they haven’t paid attention to Donald Trump over the last couple of years. He will do what he wants, and on his own timeframe. Although he boosted the market to the upside during the trading session on Thursday with his Tweet, we’ve seen that before only to be followed by tariff shortly after. With this in mind, I think that we are likely to see some type of pullback and really at this point it’s probably best to stay out of this market until we know what happens on Sunday, meaning that the real trade is probably going to be at the open on Monday.