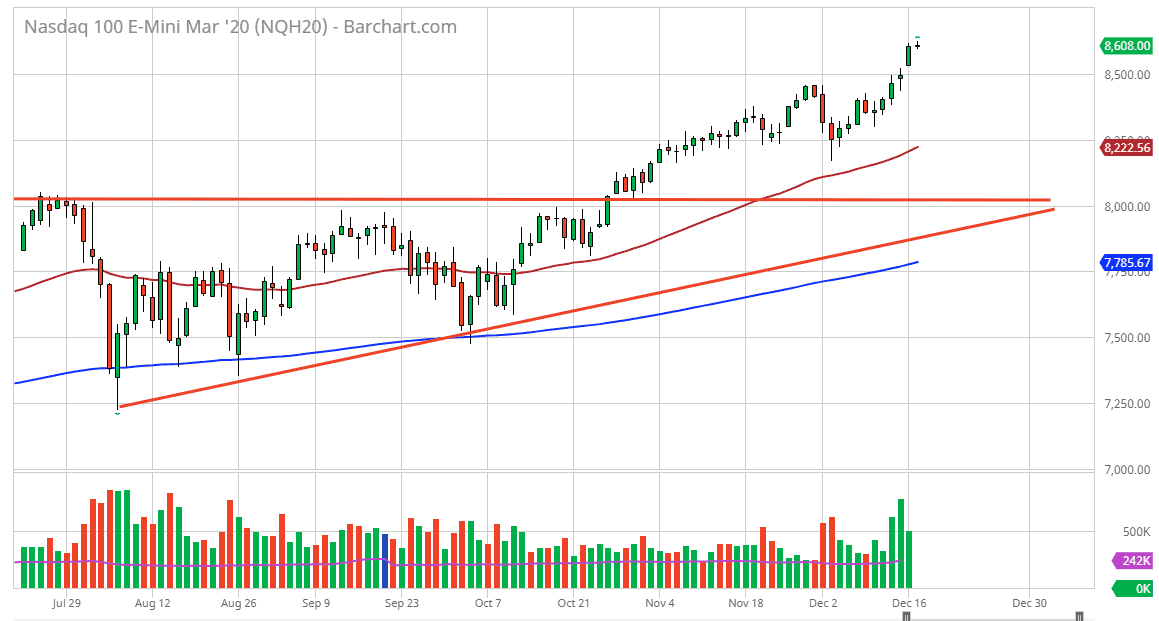

The NASDAQ 100 did almost nothing during the trading session on Tuesday, as we continue to hang around the 8600 level. We ran out of momentum though, which could be expected after the bullish move that we had formed during the trading session on Monday. Ultimately though, this is a market that has been going higher for quite some time and it looks as if we will eventually continue to go higher overall. I like the idea of buying dips in this market, and after the exhaustion that we have seen during the trading session on Tuesday, it is possible that we will get that move relatively soon. In my mind, I believe that the 8500 level will be supportive, but below there we could also see the 8250 level after that.

The 50 day EMA underneath will offer a significant amount of support, which is sitting at the previously mentioned 8250 handle. If we were to break down below there, it’s likely that the market will then go down to the 8000 handle. The 8000 level is the top of the previous ascending triangle that measured for a move all the way to 8800. I think we do get there, and we may even get there between now and the end of the year but it’s very likely that the market will see the occasional pullback. I look at those pullbacks as potential opportunities, as we continue to see this uptrend play out. The question now is where we go next year, which I think at this point we will probably have a relatively significant pullback early, but in less something changes dramatically the stock markets in general should continue to go higher.

That being said, next year is going to be a little harder to match the type of returns a lot of traders have gotten used to. Because of this, you should have plenty of opportunities to take advantage of value as it occurs. I have no interest in shorting this market, although I do recognize that a pullback could come as early as today. Overall, this is a market that still hasn’t fulfilled its 8800 target, and I think still has some work to do to get there. By breaking above the 8500 level, it’s likely that the market is trying to build up for that momentum play, but again, pullback should be thought of as an opportunity to pick up the index “on the cheap.”