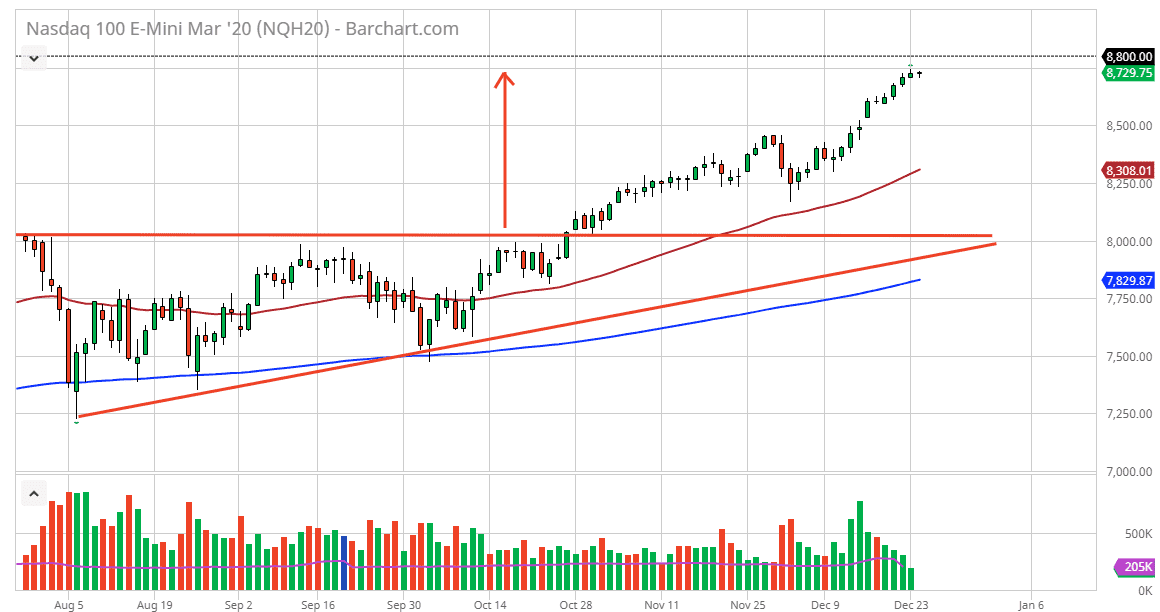

The NASDAQ 100 has done almost nothing during the Christmas Eve session as expected, because quite frankly most people won’t be bothered trading the E-mini contract. At this point, the NASDAQ 100 is extraordinarily bullish, and therefore I don’t have any interest in shorting this market, but I do recognize that we will more than likely see buyers looking to get involved in this market sooner or later. Because of this, I like the idea of buying pullbacks as it gives you an opportunity to pick up a bit of value, especially with an eye at the 8500 level, an area that should offer a significant amount of support based upon the fact that it was previous resistance. All things being equal it’s very likely to be a scenario where value hunters will continue to push much higher and perhaps eventually break above the 8800 level.

The 8800 level is of course the level that I have been looking for the market to reach for some time now, based upon the ascending triangle underneath that had been broken out of near the 8000 handle. At this point, I believe that the market will trying to reach that level based upon technical analysis, but I also believe that it’s only a matter of time before we break above there. Once we do, the market is likely to go looking towards the 9000 handle.

The 50 day EMA is currently at the 8300 level, and that of course is an area that could also come into play, giving an opportunity for longer-term traders to use it as dynamic support ultimately, the 9000 level will course offer a lot of resistance, just as the 8000 level had been. Pullbacks at this point are likely due to the fact that we will have less volume, and of course as we get close to the New Year’s Day holiday, large money managers will continue to close out positions in order to realize gains for the year, and then will more than likely jump back in after the calendar flips over. I believe at this point it is only a matter of time before the long term trend continues, so therefore it is a scenario where you can only buy this market, and I believe that building up a longer-term core position continues to be the way going forward.