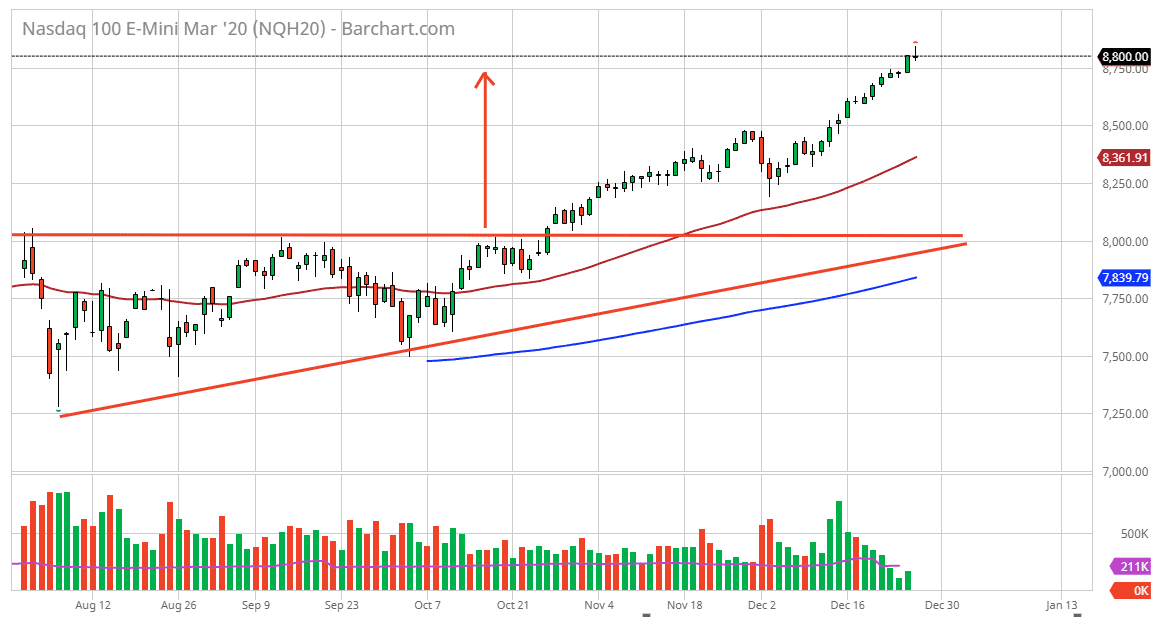

The NASDAQ 100 rallied a bit during the trading session on Friday, to finish the week testing the 8800 level. That’s an area that has been targeted for quite some time, as we broke above the ascending triangle underneath at the 8000 level the measured for that move. Now that we have reached that level and pullback, it looks like a short-term pullback is probably in the cards. This makes quite a bit of sense though, considering that the market is a bit overextended and we are heading into yet another situation of low liquidity as the New Year’s Day holiday is around the corner. Ultimately, this is a market that will continue to be very bullish in general, but I think at this point we have gotten a bit ahead of ourselves and now we start to look for value.

This is a market that has quite a bit of potential support at the 8500 level, which is the previous resistance that we broke out of. At this point, a pullback to that area should offer plenty of value for longer-term traders as we are most certainly in an uptrend. The 50 day EMA underneath should offer quite a bit of support as the longer-term trend does tend to follow it. I think that given enough time; the market probably will break higher than we are right now, perhaps reaching towards the 9000 handle.

Ultimately though, if we were to break above the top of the candlestick for the Thursday session, that could be a very bullish sign, as it would lead to the next leg higher. All things being equal though, it’s very unlikely that the market can do so with any type of longevity, because we are so overbought and of course traders out there will be looking to take profit at the end of the year in order to realize profits Before New Year’s Day. Money managers will need to show clients some type of positive return, so therefore it does tend to lead to a bit of selling right before the calendar changes. With that being the case, I think that a pullback is in the cards and looking for a value proposition underneath makes quite a bit of sense. I have no interest in shorting even though I do expect the market to drop from here in the next couple of sessions.