The NASDAQ 100 has fallen pretty significantly during the trading session on Tuesday as Donald Trump suggest that perhaps the US/China trade deal could be after the presidential election. It spoke the markets, but quite frankly this is a market that is oversold during the day, and algorithmically driven. By having the algorithms control the market, you get these ridiculous swings in price, and as a result we have turned around to calm down by the end of the session. In other words, the seller simply cannot keep this market down and this time a year is typically very bullish.

Granted, people are going to be a bit worried about the December 15 tariffs being added the Chinese consumer goods, but quite frankly this is a pattern that we have seen here against the backdrop of the trade war, as the President of the United States feels comfortable bashing the Chinese in public to bring pressure towards the negotiations when the markets are at extreme highs. Afterwards, there is almost always some type of call mean Tweet or headline coming from either Washington DC or Beijing to send the markets higher. I anticipate that a lot of traders out there have caught onto this and reacted as such.

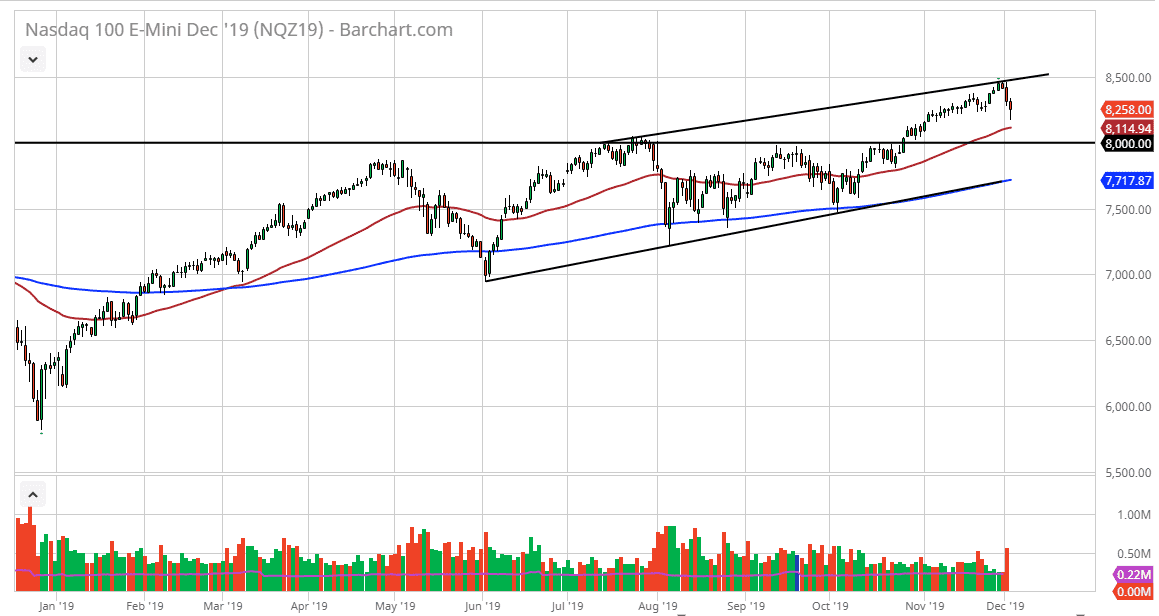

What’s even more interesting is that a lot of the gains, or at least short covering during the day happened late. This means large institutional flows of money came in and bought. We are just above the 50 day EMA and that is a very good sign. I suspect that even if we pull back from here it’s only a matter of time before the buyers get involved. Based upon the ascending triangle, the market is looking at a move towards the 8800 level, and obviously there is a massive amount of support at the 8000 level both from a psychological standpoint and of course the fact that it is the top of that triangle.

We are in a major uptrend, and that has not changed regardless how volatile things have been during the Tuesday session. With this, it’s only a matter of time before we start going higher, and I think that will continue to be the case on the longer-term charts as well. I have no interest in shorting this market, because every time it looks as if the uptrend is over, we eventually get some type of massive rally. There is no point in trying to fight the trend.