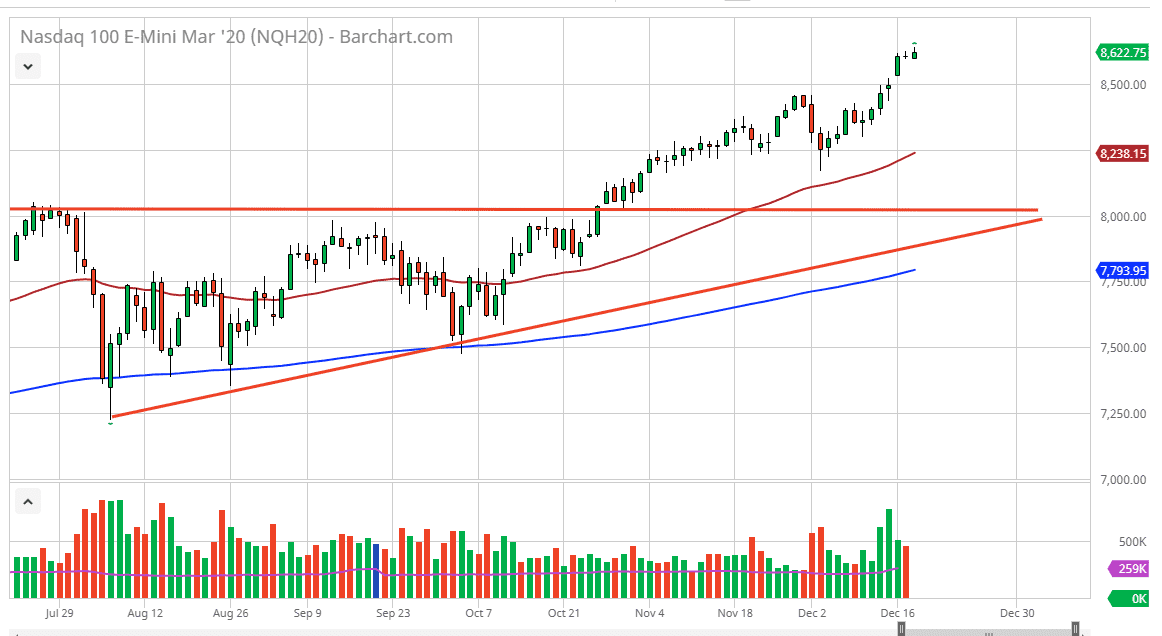

The NASDAQ 100 has rallied a bit during the trading session on Wednesday as we continue to see a lot of strength in the US stock markets. We are rallying our way into the end of the year, and it makes sense that we should continue to see a lot of buying pressure in this market. Looking at the chart, there is the ascending triangle underneath that measures for a move to 8800, and there’s nothing on this chart that suggests that can’t happen. Ultimately, I think we will probably get there between now and the end of the year.

Short-term pullback should be a buying opportunity, as there should be plenty of value hunting out there due to the fact that it has been such a strong move higher. I think that the 50 day EMA will be a major support level near the 8250 handle, assuming that we can even break down below the 8500 level which is a massive level that previously had been resistive. Ultimately, I think that the market will see buyers on any dip as it should offer plenty of value.

The US/China trade deal has an extraordinarily huge effect on what happens to the companies in this index, so it makes quite a bit of sense that it will continue to strengthen due to the idea that the situation is at least getting better, or at least a little less hostile. The fact that there were not more tariffs levied over the last weekend is a good enough sign for the market to read something into it. Ultimately, I believe in buying dips and I think that will continue to be the way trading the NASDAQ 100 going forward. Whether or not we can break above the 8800 level is a completely different question, but I do anticipate that target will eventually be reached. The way we are going I think it’s very likely to happen between now and the end of the year, but even if it doesn’t, we should continue to grind higher because of this potential move. I have no interest in shorting, at least not until we break down below the 8000 handle, something that looks to be very unlikely to happen anytime soon, and even then, I’d have to reassess the entire situation. Volumes will dry out, so keep in mind that we may get some erratic moves the closer we get to the holidays.