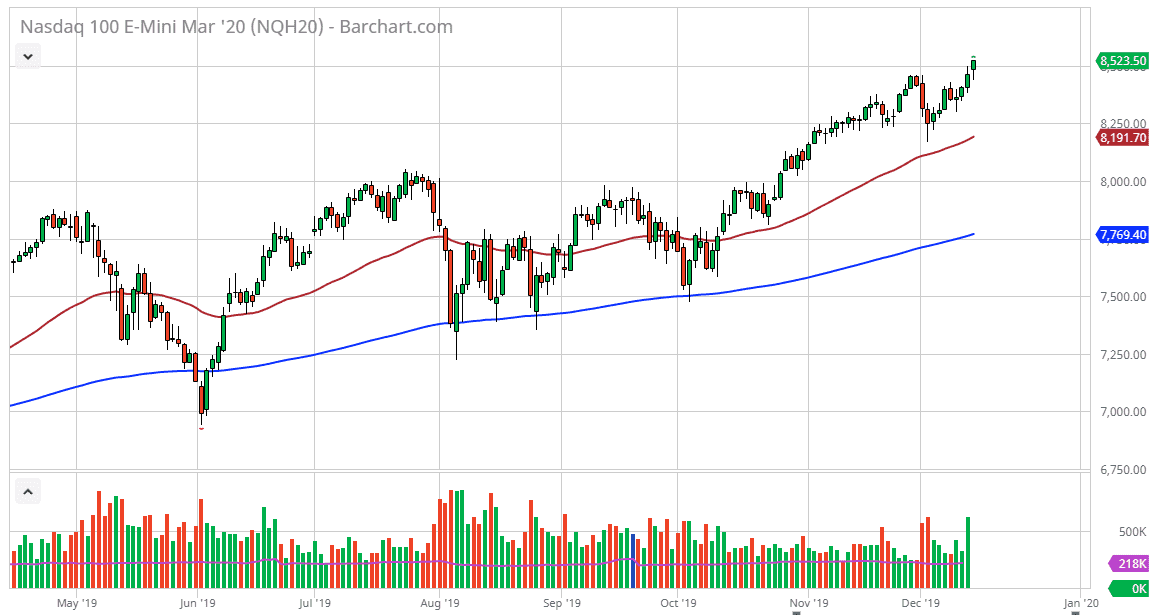

The NASDAQ 100 pulled back a bit during the trading session on Friday, but we have seen the NASDAQ 100 turn things back around. Ultimately, by breaking above the crucial 8500 level it’s likely that we continue the overall uptrend, and now that the United States and China have signed the so-called “phase 1 deal”, there is a slight bullish pressure to the market late in the day. Ultimately, this is a market that is also trying to celebrate the idea that there will be no punitive tariffs on Sunday, and that of course was the initial concern. That being said though, we are a bit extended so don’t be surprised at all if we see some type of pullback from here and go looking for buyers underneath.

Now that we have clear the 8500 level though, we could simply go higher as the ascending triangle underneath measured for a move to the 8800 level. If we can get the measured move, then we obviously have quite a bit further to go. Looking at this chart, the 8200 level has been massive support, such as the 50 day EMA. Both are looking very bullish at this point, so if we pull back from there it’s likely that we can find a bit of value. The trend has been strong for some time and it makes sense that it would continue based upon what we have seen recently.

Ultimately, this is a market that will continue to be very noisy but as we are late in the year, we typically get the “Santa Claus rally”, which is when money managers try to pad their results. As they do, the market rallies as they have to buy just about anything to try to make some type of return. Looking at the chart, it’s a nice uptrend and therefore it’s almost impossible to go against it. Now that we have not had that bombshell of tariffs, that should make the market continued the momentum that we have seen for several months now. It’s really not that difficult to imagine a scenario where we continue to see buyers jump in based upon value. Value hunting is the best way to play this market as well as all the other indices in the United States, and between now and New Year’s Day that’s probably going to be how this all plays out.