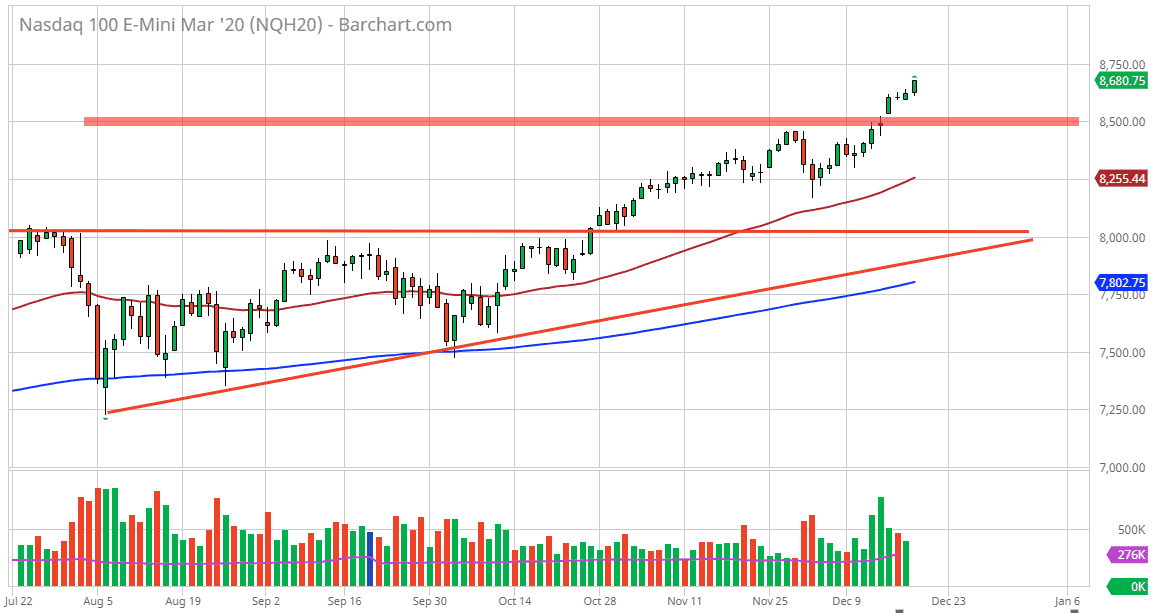

The NASDAQ 100 has rallied quite nicely during the trading session on Thursday, breaking higher and above the 8600 level. Ultimately, this is a market that continues to see a lot of bullish pressure and I do think that pullbacks at this point will more than likely offer an opportunity to go long. The 8500 level will offer a bit of psychological support based upon the fact that it is a large, round, psychologically significant figure. Pulling back from here would make a bit of sense especially considering that it is expiration day for several different options, and that will cause a lot of noise. Ultimately, this is a market that is in an uptrend so I think that we will find buyers sooner or later, and I think that the 8500 level will be a prime area to see that happen.

However, if the market does break above the highs for the trading session on Thursday, then we will extend towards the 8750 level. I think we get there anyway, because based upon the ascending triangle underneath I still anticipate that we get to the 8800 level. I think pullbacks will be looked at as healthy and value propositions as the Federal Reserve is still on the side of the stock market and could even start to think about cutting rates next year. We have gotten a little extended though, so the pullback should be thought of as healthy.

It’s not until we break down below the 8000 level that I would be concerned, and quite frankly that 680 points from here so I don’t anticipate that being the case anytime soon. Ultimately, this is a market that will have a lot of noise in it, but the US/China trade situation does greatly influence the tech companies in this index. There are plenty of buying opportunities ahead, but you need to be cautious and wait for the occasional pullback or the potential break out. This is a market that I have no interest in shorting anytime soon and quite frankly I think it will be almost impossible to happen as the market is trying to add to gains by the end of the year to produce to clients. Money managers tend to move in a pack, especially this time a year. Unless we get some type of catastrophic news out of the Chinese or Americans involving one or the other, it’s likely we go higher between now and New Year’s overall.