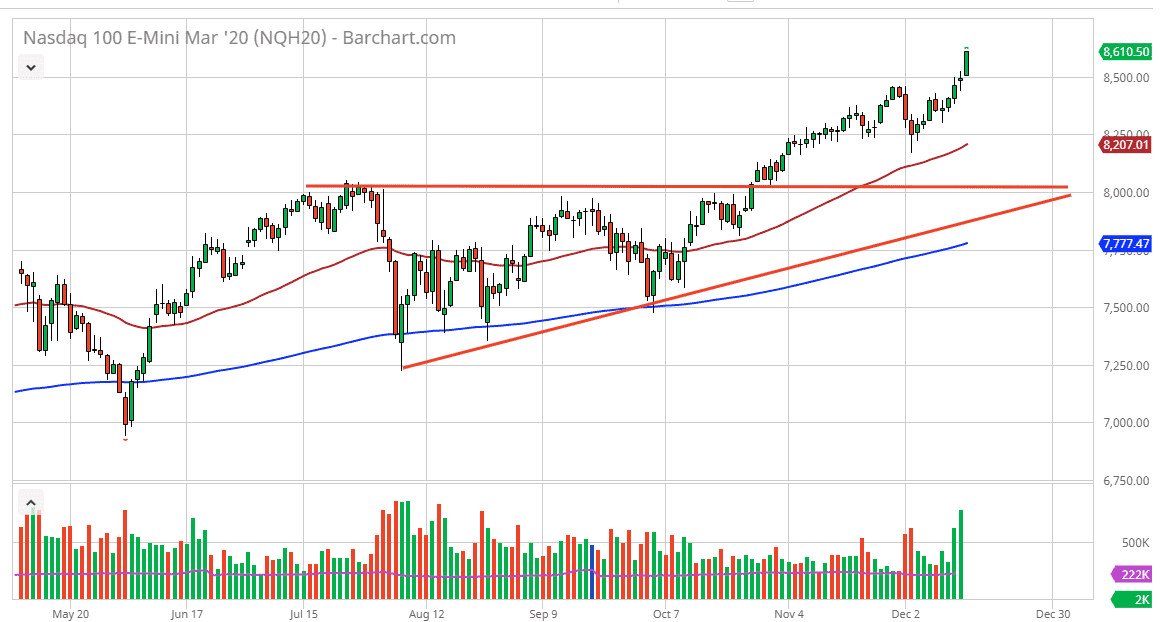

The NASDAQ 100 has rallied significantly during the trading session on Monday, leaving the 8500 level behind. The market should continue to go much higher, but I do think that the occasional pullback is probably in the cards. Based upon the ascending triangle that I have marked on the chart, there was a projected target of 8800 above. Because of this, it’s very likely that the market will find buyers based upon “fear of missing out”, as we have cleared the 8500 level which of course has a certain amount of psychological importance attached to it.

To the downside, the 50 day EMA is sitting just above the 8200 level, and I think there is significant support at the 8250 level as well. Because of this, it’s only a matter of time before we continue to find buyers as the market has been so bullish. At this point, we are a little bit overextended but there is also the so-called “Santa Claus rally” that people will be paying attention to. The market is also perhaps celebrating the whole idea of a “Phase 1 deal” between the United States and China. Granted, it’s interesting that the stock market has rallied in a major “risk on” situation, but at the same time many of the other markets don’t seem to be willing to show “risk on” attitude. This shows a lot of confusion, but all things being equal this time a year is typically very strong for equities so it would make sense to see the NASDAQ 100 climb. Beyond all of that, the NASDAQ 100 is chocked full of highly sensitive companies to Chinese and American trade, so it would make sense that this might be a bit more reactive than other indices such as the S&P 500.

Pullback should be supporting all the way down to at least the 8000 handle, which of course is the top of the previous ascending triangle. The ascending triangle deed measure for a move towards the 8800 level, so therefore it’s likely that the market will eventually try to get there. In fact, I anticipate that we will probably get there relatively soon, barring some type of major disappointment in the market as the “Phase 1 deal” is still somewhat in flux so it’ll be difficult to see what the next move is other than simply paying attention to the fact that we are in an uptrend.