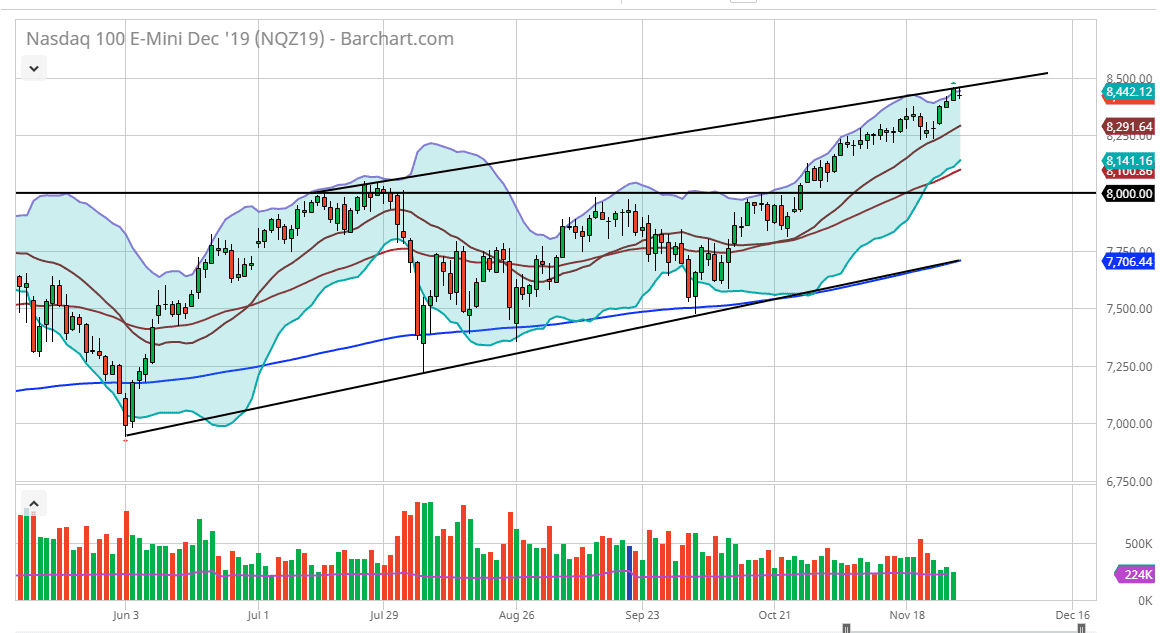

The NASDAQ 100 went back and forth during the trading session on Friday, in what would have been very light trading. The underlying index hardly moved, and the E-mini contract of course has been a bit light as well. That being the case, the market is very likely to see a bit of pullback as we are at the top of the overall channel, and even more so we are at the top of the Bollinger Bands, so it’s likely that we need to pull back a little bit. The 20 day SMA in the middle of the indicator is closer to the 8300 level, so we could get a bit of a short-term pullback.

If we do pull back from there though, I think it’s only a matter of time before the market continues to go much higher. After all, a lot of this is going to be due to the US/China trade situation, which in theory should continue to get better based upon the most recent headlines. Keep this in mind: Donald Trump recently signed the “Hong Kong bill”, with the US Congress back in the Hong Kong protesters. That angered China, but in the end, they didn’t do anything to retaliate. Beyond that, market participants are starting to go a bit numb when it comes to the situation, so more than likely we will continue to see the buyers jump in and pick this market up.

Beyond that, there is a seasonality that is quite often referred to as the “Santa Claus rally” at the end of the year when traders come in and try to pad their results for clients. Furthermore, the Federal Reserve has stepped to the sidelines and won’t interfere with the market, giving up on the idea of raising rates anytime soon. As long as money is almost free, traders will continue to take advantage of that in the stock market. Another driver of markets would be the fact that we have broken above an ascending triangle that shows resistance at the 8000 level. By doing so and breaking above it measures for a move towards the 8800 level. I do believe that we get there between now and the end of the year. That being said, we will go straight up in the air so short-term pullback should continue to be an opportunity to take advantage of value.