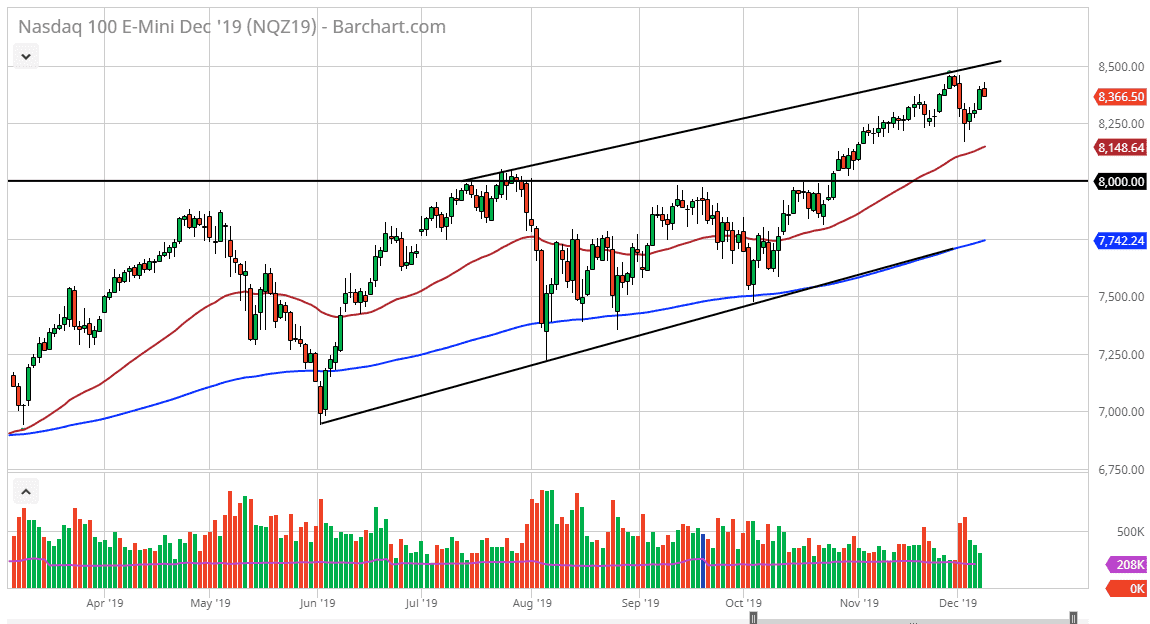

NASDAQ 100 traders sold off initially during the trading session on Monday, but at this point it hasn’t been much of a sellout. This is a market that continues to look very bullish and therefore any time it pulls back there is more than likely going to be a handful of buyers willing to step in. The 50 day EMA underneath will continue to offer support, as it has more than once. The 8250 level is also an area that seems to be attracting a lot of attention. Granted, there is the usual finger-pointing is out there, but in the end of people are using the US/China situation to blame the market movement. The question now is whether or not we can hold support underneath. It does look very likely to happen, so look at pullbacks as value.

The 8500 level above is going to continue to be resistance, but if we can break above there it’s likely that the market goes to the upside. Based upon the ascending triangle underneath, the market should be heading towards the 8800 level as per the measured move. At this point, value hunting is probably the best way to go, and I do believe that it is only a matter of time before the rest of the market participants see it as such.

All things being equal, this is a market that should continue to find plenty of volatility based upon headlines, but in the end it’s in an uptrend and that’s the most important thing to pay attention to. Beyond that, we are at the end of the year, and then typically has the fabled “Santa Claus rally” coming into play. This is when money managers try to pad their results for clients, reporting at the end of the year. The 8000 level underneath should continue to be massive support as it was massive resistance previously, based upon the ascending triangle. I would be rather surprised if that gets broken, but if it does you can pretty much guarantee that it has to do with some type of extraordinarily negative headline, probably coming from the US/China situation going forward. The one main possibility would be tariffs being levied on December 15 against China, which are in fact set to happen. If that does end up being the case, that could spook the markets into selling off, but it will probably be a short-term phenomenon.