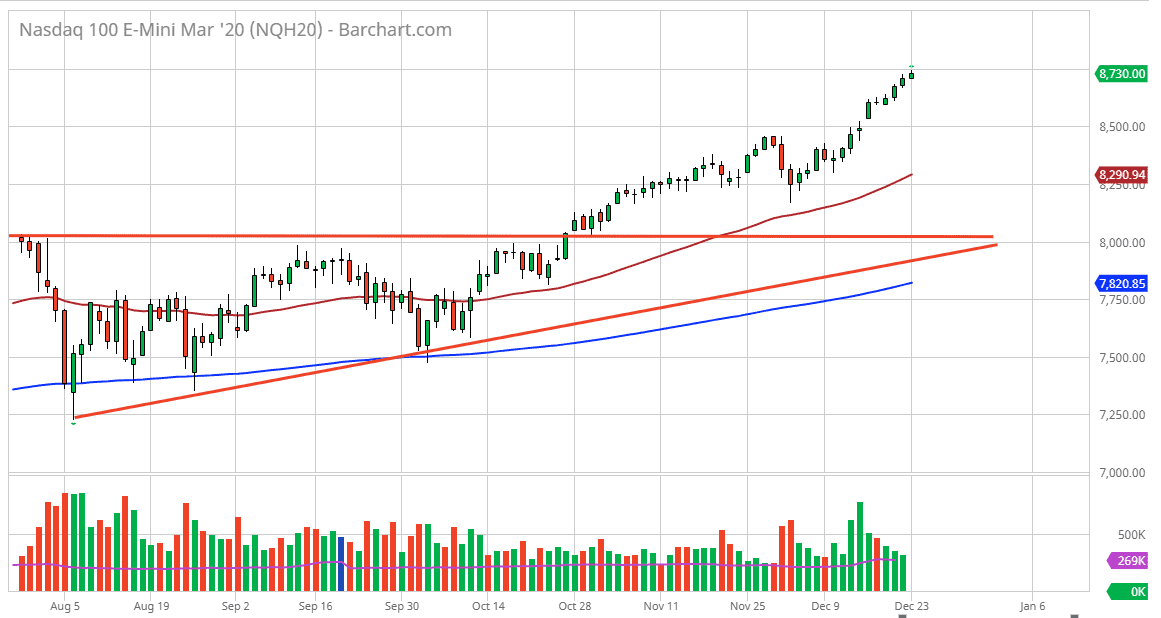

The NASDAQ 100 has rallied a bit during the trading session on Monday, which is pretty impressive when you think about the fact that we are in the middle of the Christmas week. I had previously suggested that 8800 was my target based upon the ascending triangle underneath that I have marked on the chart, and we are essentially right there at this point. I think it’s likely that we could see an attempt on the 8800 level and then a short-term pullback. If we do get that pullback it’s likely that the 8500 level, think there would be plenty of buying opportunities for people to come in and take advantage of what should in theory be support for a very strong uptrend.

Keep in mind that the Americans and the Chinese getting along is going to be crucial to where this market goes, as most of the big players on this index do a lot of business in both countries. Ultimately, this market does tend to move right along with the idea of trade going back and forth across the Pacific Ocean, so therefore I do like the idea of buying this is long as things move forward. Having said that, we are a bit overextended and therefore a pullback makes quite a bit of sense thus the idea of looking at the 8500 level.

The 50 day EMA underneath continues to rally and I think it looks like we are getting ready to break above the 8300 level, and then should go looking towards that very same 8500 level. Ultimately, this is a market that I have no interest in shorting, because we have seen so much in the way of momentum as of late. Beyond that, once we get a lot of the traders back to work January 6, that should increase the volume and therefore the velocity of moves. In the short term I think small gains and that of course pullbacks will be the best way to go going forward. With all that in mind I am bullish, but I also recognize that finding value might be the best thing to do. With Christmas Eve being a partial day, I highly doubt that there is going to be much of a trade going over the next 24 hours, so I’m hoping that a bit of profit-taking allows for the market to reach towards my buying area.