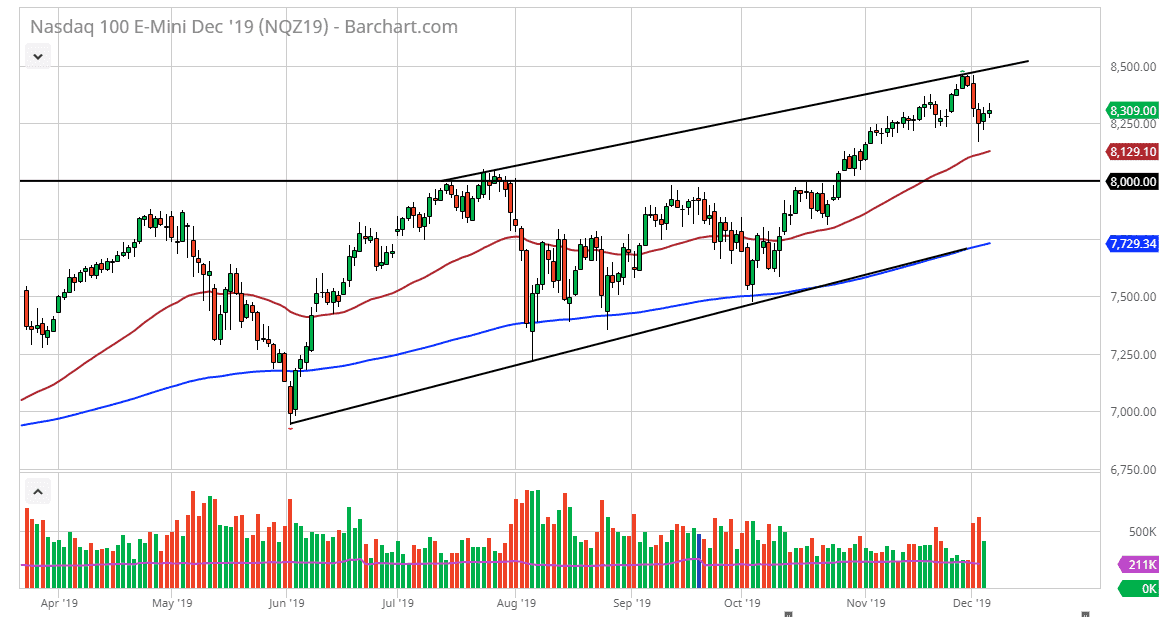

The NASDAQ 100 got a huge boost during the trading session on Friday as the US job figures were much better than anticipated. By doing so, the market has reached above the 8400 level and it looks as if we are going to go towards the highs again, perhaps even higher than that. There is the 50 day EMA underneath that continues offer a lot of support and I think it’s only a matter of time before buyers come on these dips. Remember, this is the time a year where we see a bit of a cyclical tailwind anyway, as the “Santa Claus rally” should continue.

At this point, the market is likely to reach towards the 8500 level and then eventually the 8800 level based upon the previous ascending triangle that has been broken out of, because of its measurement. With that in mind I believe that the market continues to grind its way to the upside and now it looks as if the United States is still going to be the place to invest. I believe that it’s only a matter of time before the markets will find plenty of buyers on dips, and as money managers are likely to continue to try to pad their results for clients.

I think that the fact that we have almost wiped out the losses from early in the week in one day tells you everything you need to know. The market certainly wants to go higher, as the market is showing during the Friday session. I think that looking for value is the best way to go, and a break above the highs probably sends the market much higher as it would be more or less a “blow off top.” Ultimately, this is a market that has much further to go, and that’s probably going to continue to be the case until New Year’s Day.

To the downside, if we were to break down below the 50 day EMA it’s likely that the 8000 level will offer support as well. It’s not until we break down below the 200 day EMA at the 7736 level that I would be interested in shorting this market, and obviously there would have to be something somewhat catastrophic happened to make that a possibility as it is so far away and we have seen so much in the way of bullish momentum. Buying the dips continues to work.