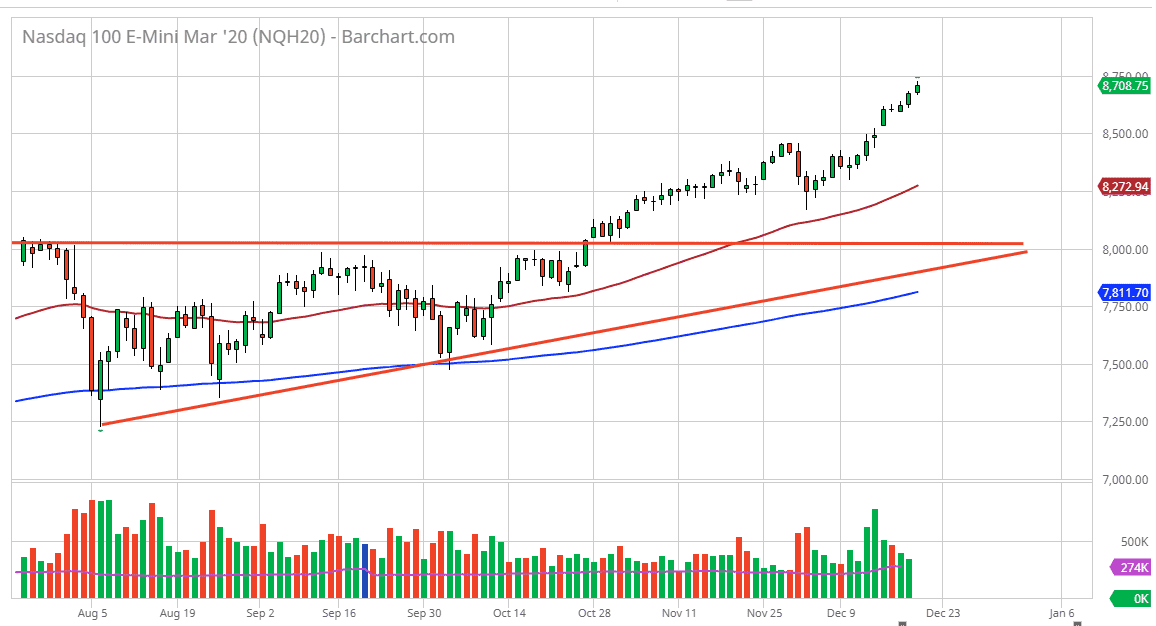

The NASDAQ 100 has rallied a bit during the trading session on Friday, making a fresh, new high yet again. I had been seen for some time that the target is the 8800 level, based upon the ascending triangle that we had broken out of. We aren’t quite there yet, but I think that we do eventually hit that level. Ultimately, pullbacks at this point will probably continue to see buyers try to grab onto some gains, and I think the next couple of days will still plan on being bullish, but overall, it’s very unlikely to be a breakdown. At this point, the 8500 level underneath is an area that should offer a significant amount of support as it was previous resistance. All things being equal it’s likely that the value hunters will show up somewhere around there.

Looking at this chart, it’s a simple matter of buying on the dips as the market looks so bullish. All things being equal I don’t have any interest in shorting this market as it is far too strong. I do think that we will eventually get a pullback but that might be more towards New Year’s Day as people are starting to collect their gains for the entirety of the year. Money managers are trying to flood into the marketplace and take advantage of the obvious bullish pressure, and of course the idea of adding to gains in order to show their clients that they have been working hard for them all year.

Ultimately, this is a market that is likely to see a lot of choppiness given enough time, but I think that is probably more or less due to being a bit overextended. I suspect that is probably between Christmas and New Year’s Day, so I like buying the dips because I don’t think anything serious will happen until the end of the year. Even then it will just be thin volume profit-taking that drives the market lower. The 8000 level underneath should be the massive floor” in the market going forward, so ultimately this is a market that is one that you can only buy. There is no way to short this market in this type of environment, so simply looking for a little bit of a value play is probably the only thing that we can do. Keep your position size small.