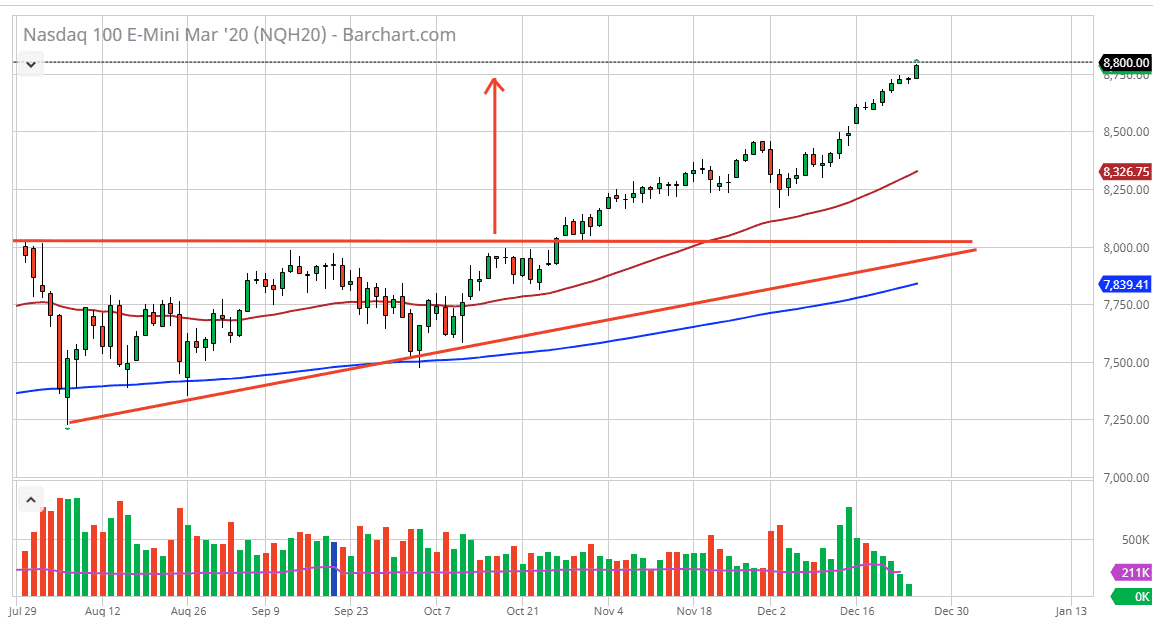

The NASDAQ 100 rallied significantly during the trading session on Thursday considering that there was almost nothing out there as far as volume or news. The NASDAQ 100 has rallied and suggests that we are going to continue to go higher. Ultimately though, the 8800 level is a target that I have been following, due to the fact that the ascending triangle had been broken and that’s with the measurement was, a move to this 8800 level. Whether or not we can break above there is a completely different story, but it is worth noting that we are at this level now.

This probably sets us up for some type of short-term pullback, but that short-term pullback will more than likely offer a buying opportunity. Alternately, if we do break above the 8800 level, then the market is free to go much higher, reaching towards the 9000 level which is the next psychologically important figure. Underneath, I see a lot of support at the 8500 level, and of course the 50 day EMA as well. All things being equal, this is a market that I do like going higher going over the longer term, but keep in mind that the US/China trade situation will be a major issue as the market will go up and down with the attitude of the trade war. Recently, it has been much better, so it’s very likely that the NASDAQ 100 will be a major beneficiary as a lot of the technologic companies will continue to do a lot of business between the United States and China. Simply put, a lot of technologically-based firms will continue to find plenty of buyers.

To the downside, if we were to break down below the 8500 level, then we could look at the 50 day EMA as a support level. Underneath there, the 8250 level would be targeted and then eventually the 8000 level. I would be very surprised to reach down to this level, at least not unless there was some type of major issue between the Americans and the Chinese. Until that happens, this is a market that you should be looking at the pullbacks as potential buying opportunities as there are plenty of people who have missed out on this rally. Now that we are getting close to the end of the year, I would anticipate a bit of a pullback and therefore an opportunity heading into the new year as traders will come back to work January 6 overall.