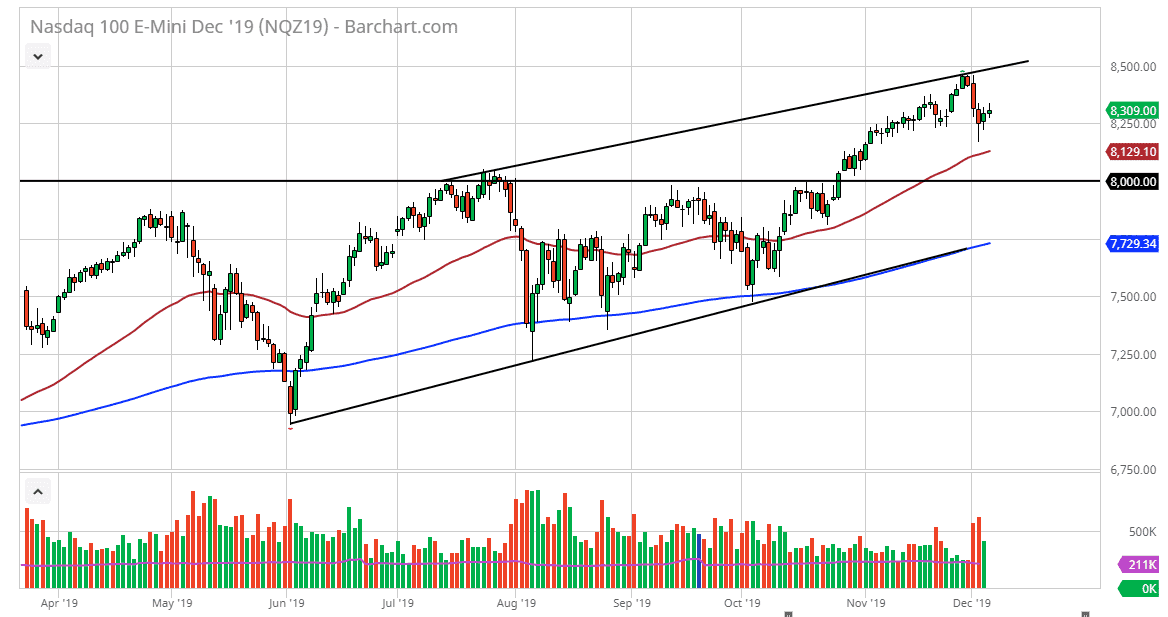

The NASDAQ 100 has rallied slightly during the trading session on Thursday, as we await the jobs figure on Friday. The jobs number of course will move the markets quite drastically, in low liquidity environments. The 8250 level underneath should offer support extending down to the 8200 level, but after that it’s likely that the 50 day EMA will also offer a bit of support, and so will the hammer that formed during the Tuesday session.

Looking at this chart, it’s in a nice uptrend and as we continue to see a lot of help from the Federal Reserve, and of course politicians that continue to goose the markets back and forth. Ultimately, this is a market that looks likely to continue the overall move to the upside as we broke above the top of an ascending triangle that measures for a move towards the 8800 level. Because of this, I’m still bullish and as we have not hit that target, and with this being the case I am looking for pullbacks as bits and pieces of value just waiting to happen.

The “Santa Claus rally” is fully in effect, and even though we have seen a couple of days of negativity, this is been based upon random words coming out of the mouths of the US/China trade negotiation to actors, but at the end of the day we have all learned just how fleeting a lot of those comments are. With that being the case, the market is likely to continue seeing a “buy on the dips” mentality, and therefore I am not going to fight it. In fact, I’m not interested in shorting this market anytime between now and the end of the year, unless of course something catastrophic were to happen and we would break down below the 200 day EMA. That would probably be some type of obvious issue that will make itself known in the markets. Until that happens, I continue to look at short-term pullbacks as buying opportunities, but I recognize that we are very unlikely see some type of massive move in one direction without the occasional pullback. Ultimately, this is a market that is bullish, and you should not be fighting the trend. I do expect the 8500 level to offer a bit of resistance though, as it is a large, round, psychologically significant figure in the top of the channel that we have been trading in.