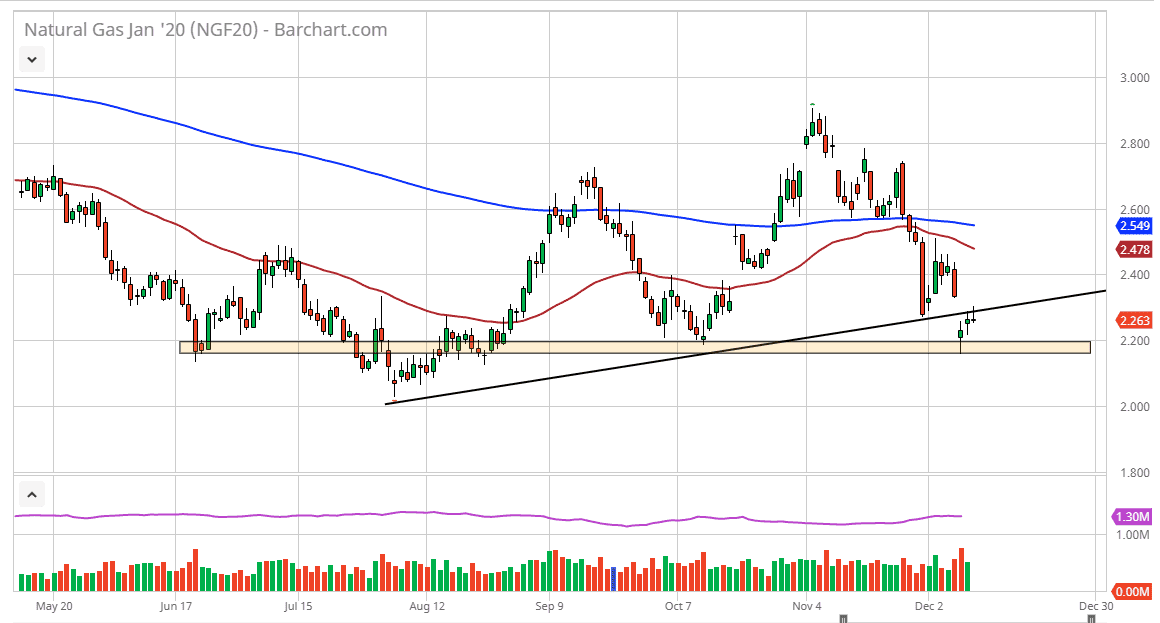

Natural gas markets rallied initially during the trading session on Wednesday, reaching towards the previous uptrend line. That being said though, we still haven’t filled the gap and therefore it’s likely that we could see a little bit of a push higher. The weather reports for December in the United States continue to be a bit better than anticipated, so it’s very likely that natural gas will continue to have a bit of a wait upon it shoulders. However, it’s only a matter of time before we see a bit of a bounce, because we are at such low levels.

That being said, natural gas has essentially been a disaster for natural gas suppliers this winter, and then last temperatures drop drastically, there will be a bit of an overhang going forward. That means that the selloff after any potential winter pop this year is going to be absolutely brutal. Because of this, it’s likely that we will continue to see extreme amounts of volatility and with the inventory number coming in the next 24 hours it’s likely that we will see a lot of noise in this market. Ultimately, if we can break above the $2.40 level it would be a very bullish sign but it’s unlikely to happen in the short term. To the downside, breaking of the candle from the Monday session would be extraordinarily negative and open up the door to the $2.00 level.

While that is a viable trade, the reality is that it’s hard to short this market during the month of December. It may turn out that the best trade is to simply wait for that massive spike and start selling. That doesn’t mean that you can start buying in the middle of that pop, but quite frankly it has been such a disappointment this winter that it’s difficult to get overly excited. That being said, as soon as we get signs of bad weather coming, it’s very likely that we see natural gas spike straight through the roof. Breaking above the $2.40 level could send this market as high as $2.60, and then eventually $2.80. However, buyers of natural gas will continue to be very quick to take profit. Quite frankly, this market has cost most people I know a lot of money over the last couple of months as the bullish behavior that is typically found during the month of December just hasn’t shown up.