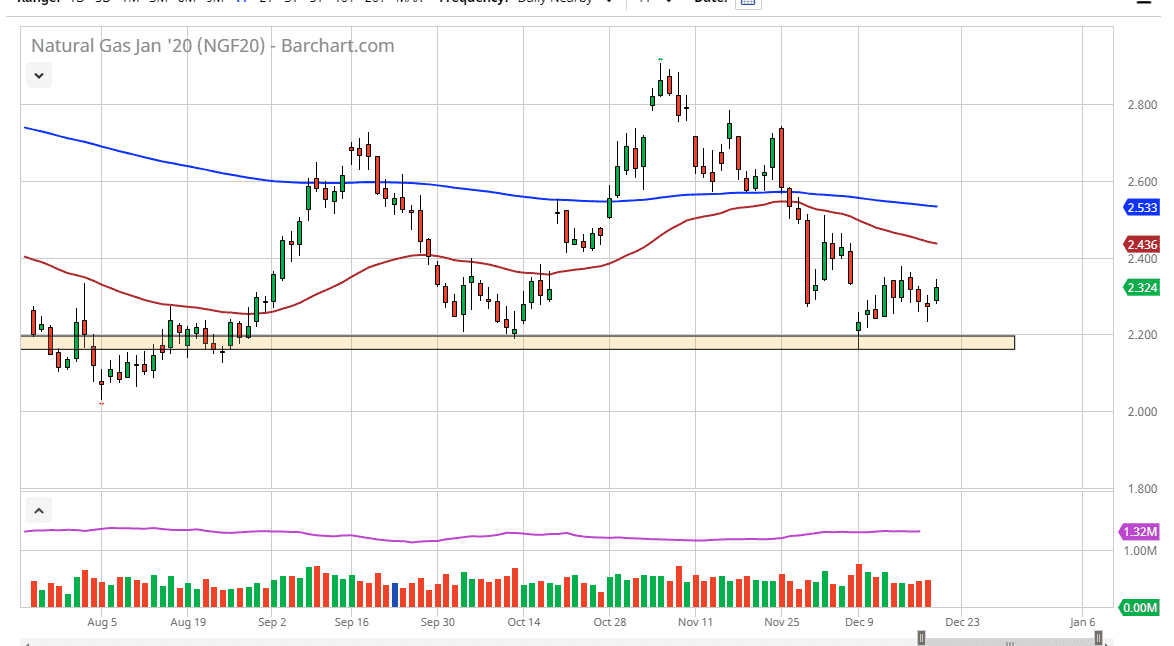

Natural gas markets bounced a bit during the trading session on Friday, breaking above the highs from the Thursday session after that very bullish inventory figure. Ultimately, this is a market that looks as if it is going to go looking towards the $2.40 level, which I think is the next major barrier to overcome. Above there, then I believe that the natural gas markets will move in $0.10 increments. Having said that, I also recognize that the 50 day EMA is just above the $2.40 level, and the 200 day EMA is sitting near the $2.50 level. Ultimately, I also see the $2.60 level offering structural resistance and so on.

Just below, I look at the $2.20 level as being massive support and if it holds, we should continue to bounce going forward. We are most certainly in the most bullish time a year for natural gas, but we have yet to see a massive spike higher because the Americans drilled 17% more this year than last. That is quite a bit of supply to overcome, and as a result the bounce this year probably isn’t going to be a strong as I had anticipated previously.

In fact, I believe that the real story here is going to be that the natural gas markets are going to stay extraordinarily weak over the course of 2020. I believe that the real money is probably made shorting natural gas stocks, because natural gas suppliers are going to get absolutely crushed unless we work through some supply this winter. So far, we have just now had a bullish inventory report. Looking at this marketplace, it’s obvious that the support underneath at the $2.20 level should be rather crucial, but ultimately this is a market that has formed a bit of a double bottom and now it looks as if it is trying to support that concept going forward. That being said, if we were to break down below the $2.20 level, the market probably breaks down to the $2.00 level and this of course would be catastrophic for the market as we continue to see a lot of lackluster performance here. In fact, in general natural gas is to be sold on rallies but this time year is typically a bit more bullish because of the cold temperatures in places like Boston, Philadelphia, Cleveland, and New York City.