The S&P 500 went back and forth during the trading session on Tuesday as we await the trade tariffs this Sunday. Quite frankly, this point the markets will be moving based upon the latest headline, suggesting that perhaps we will move solely based upon the December 15 deadline. If the United States decides to delay the tariffs, it should be very bullish for stock markets, and at this point it appears that most Wall Street pundits have priced that in. That being said, if the market gets bad news, in the form of tariffs in fact being levied, it’s likely that the market has not price that in, and therefore we should probably break down.

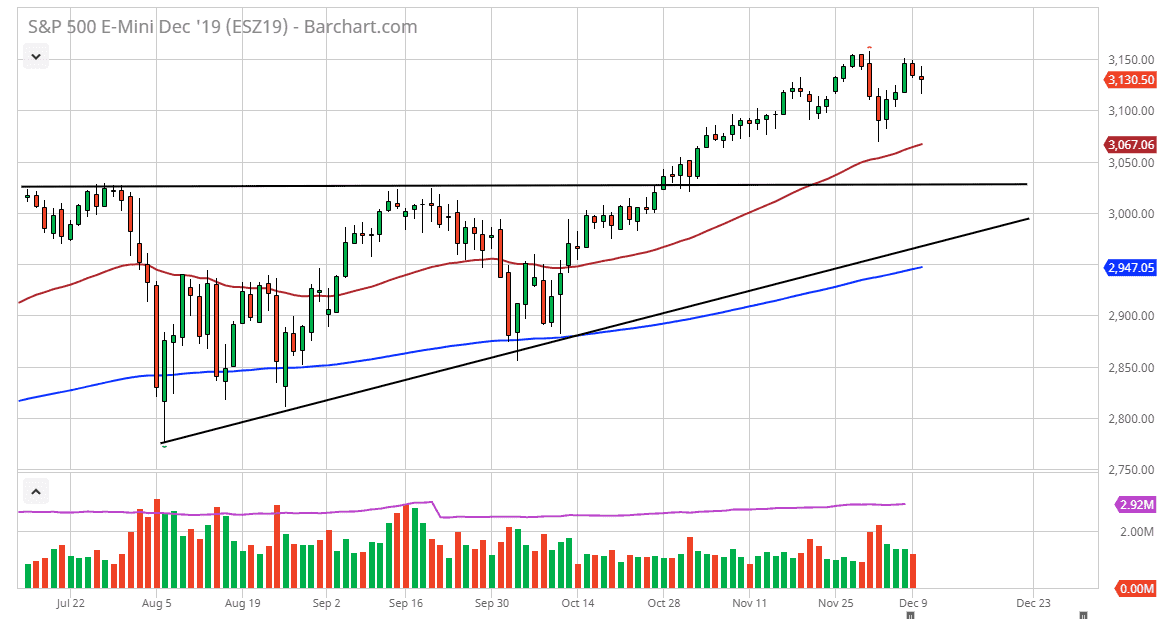

Underneath, the 50 day EMA should offer support, and it is currently sitting at the 3067 level. Underneath, I think there is plenty of support extending down to the 3000 handle, so it’s only a matter of time before the buyers would jump in and take advantage of value. I believe that the S&P 500 should continue to see buyers, and at this point I have no interest in shorting this market. Even if we break down to the 3000 handle it would simply be the market revisiting previous resistance and based upon the ascending triangle, we should be looking at a move to roughly 3200.

This doesn’t mean that we can’t get up there from here, it just means that we are likely to see a little bit of sideways action until we figure out what’s going to happen with those trade tariffs. If Friday closes without a deal, it’s more likely than not that we will be at lower prices than we are right now. That being said, I do believe that the market is simply waiting to see what happens next. Unfortunately, the news will probably come out via Twitter, or some other random headline. The closer we get to Friday, the more likely we are to see rumors pick up a bit of steam, and therefore things could get a little bit erratic towards the end of the week as well. Ultimately, we are in an uptrend and that has not changed regardless of what we have seen of the last couple of weeks. The so-called “Santa Claus rally” should be in full effect soon, and therefore I think it’s only a matter of time before people get involved and start pushing higher.