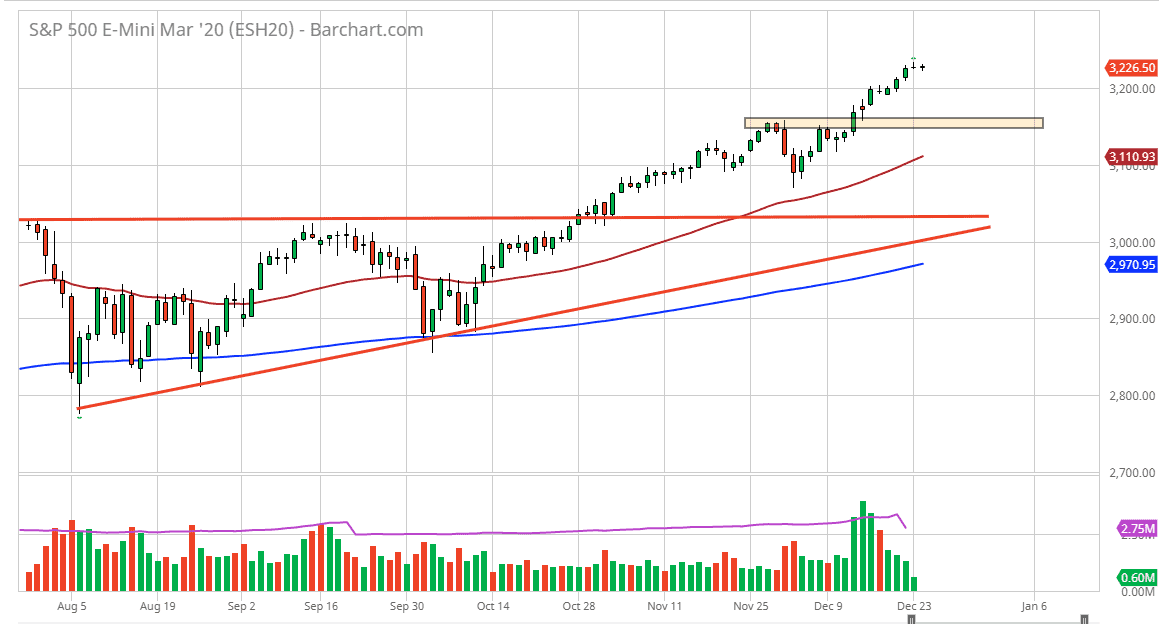

The S&P 500 has done very little on Christmas Eve, but quite frankly that should not be a huge surprise. At this point, it’s likely that the market will continue to see buyers jump into this market based upon value, but we are a bit overextended at this point. The 3200 level should be an area that the market may go looking towards, but I would anticipate that there should be plenty of buyers there. If not, the 3150 level will also be an area that attracts a lot of attention, followed by the 3100 level which also has the 50 day EMA.

Ultimately, this is a market that is in an uptrend and it’s ridiculous to think that it’s suddenly going to change trends. When you look at the longer-term attitude of the market, buying has worked out most of the time. I think at this point it’s likely that the market may drift a bit during the next few sessions as there will be a serious lack of volume, but longer-term it’s only a matter of time until fresh money comes into the markets, probably after New Year’s Day. Between now and then I would expect to see a lot of noise in this market, but I do think that value hunters will continue to come out and try to support it. Longer-term, I believe that the market continues to go much higher, probably closer to 3500 but obviously there are a lot of headlines out there that could turn things around.

As long as the Federal Reserve continue to liquefy markets it’s likely that we will continue to see buyers jump in and pick this up. The Federal Reserve is doing the work of Wall Street, and now that they are heavily involved in the repo markets, that will continue to have traders looking for some type of decent returns with low yielding bonds out there not offering anything to them. To the downside, it’s not until we break down below the 3100 level that I become remotely concerned about the market, and quite frankly I think the 3000 level is probably even more important. While it will be quiet and somewhat lackadaisical between now and New Year’s Day, as soon as January 6 comes, liquidity will return to the market and we should see a resumption of the overall uptrend. I look at pullbacks as an opportunity.