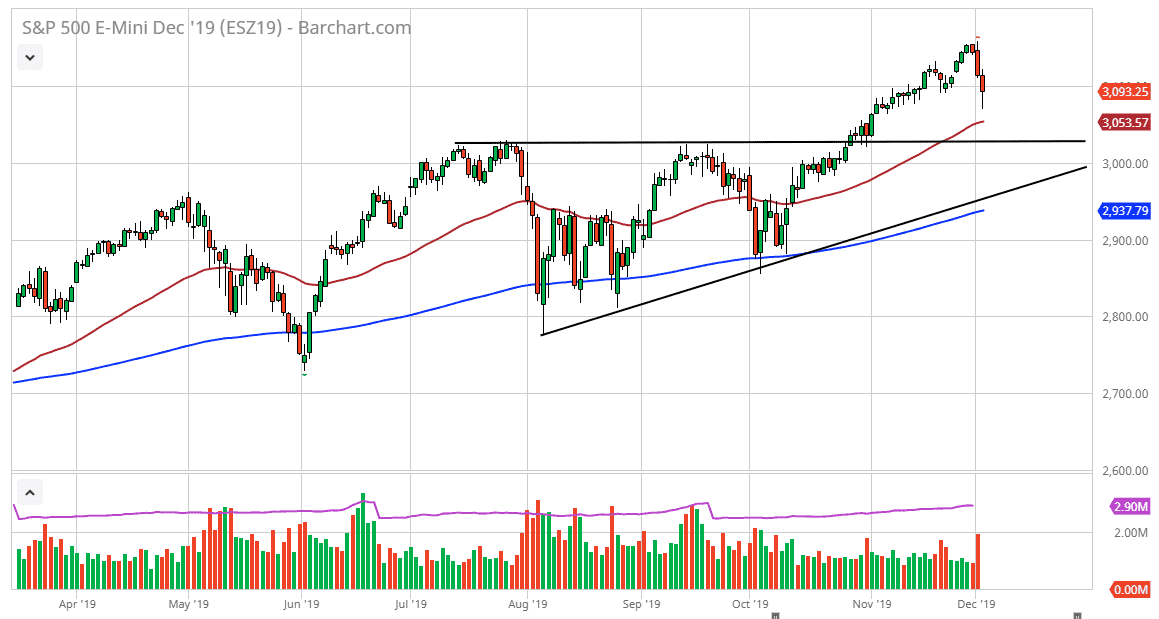

The S&P 500 broke down rather significantly during the trading session on Tuesday, mainly because of the comments of Donald Trump suggesting that the deal with China could perhaps wait until after the election. This of course has people concerned about whether or not there is more tariffs being levied on Chinese consumer goods on December 15, and that of course has a lot of people concerned. That being said, we have also seen an excellent recuperation of the selling pressure, and in fact ended up forming a somewhat bullish looking candle.

Looking at the chart, the 50 day EMA is just below this candlestick, so it’s very likely that this market will continue to go higher. After all, this is the so-called “Santa Claus rally” type of pullback, where buyers will come in to try to pad results for the year. Ultimately, the market should go looking towards the 3200 level based upon the breakout above the ascending triangle. Because of this, the market should continue to go towards that area, and I do think that it’s a bit of a self-fulfilling prophecy just waiting to happen.

Even if we were to fall from here, I think it’s only a matter of time before the buyers return, based upon the overall uptrend. The overall uptrend is still very much intact, despite the fact that we have seen a significant pullback. With this in mind I am bullish, but I recognize that a certain amount of patience may be needed in order to realize gains. If we were to break down below the 3030 handle, then the 3000 level will be a major barrier for the sellers to overcome. Breaking down below there would of course be very negative, but it still doesn’t end the overall trend. In fact, I think it only offers value that people will be looking toward, as we have seen time and time again in this market and anything else related to US equities. Going forward, I anticipate that by the end of the week we probably print a green weekly candle.

The market is starting to figure out that every time it gets close to a new high, Donald Trump feels comfortable enough to start threatening the Chinese. Sooner or later, people will ignore this and simply focus on the Federal Reserve which is the main driver of stock markets to begin with.