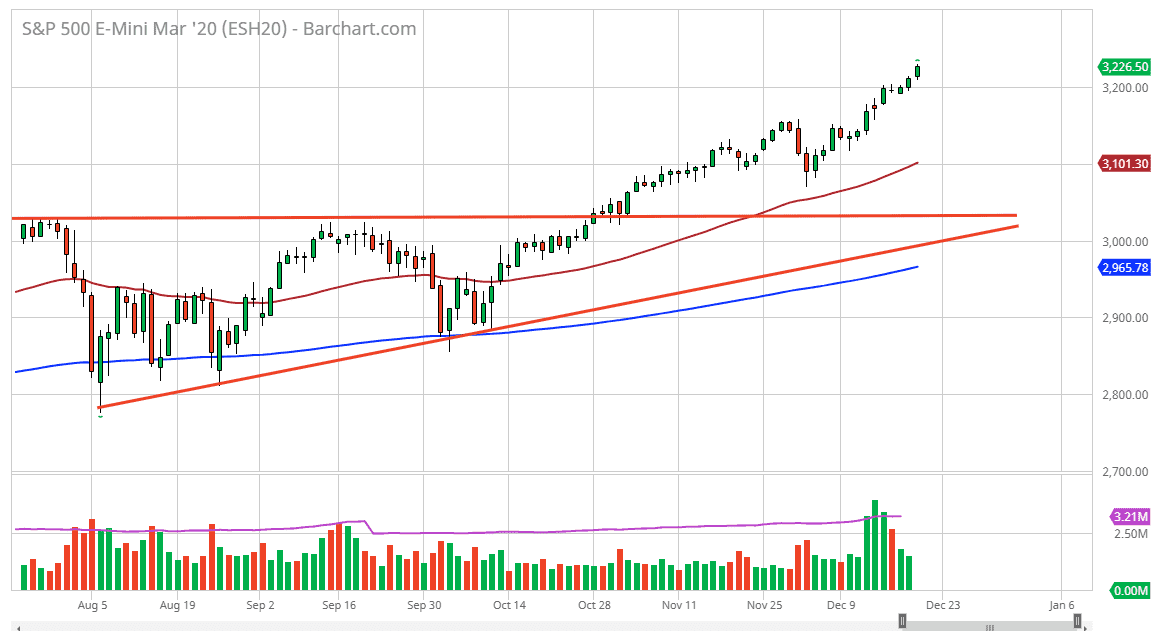

The S&P 500 rallied a bit during the trading session on Friday, as we continue to see the so-called “Santa Claus rally” in the marketplace. The 3200 level has been left behind, and it’s likely that the level will start to offer a little bit support if we do pull back a little bit. That’s an area that will continue to be interesting as it is a large, round, psychologically significant figure, and now that we are above there, it’s likely that we go looking to the next midcentury level, the 3250 level.

A lot of analysts that I respect have been calling for 3250 and in full disclosure my target was closer to 3200. That being said, it looks like we may make that 3250 level, possibly even as early as the end of the day on Monday. Regardless, pullback should continue to offer plenty of buying opportunities as money managers flood into the market to try to pick up a bit of gains for their clients. As they report for the end of the year, a few percent can make a huge difference as to how their clients see their performance.

The shape of the candlestick is rather strong, although the range is necessarily huge. We are closing towards the very top of this range and as we are heading into the holidays that’s a huge statement as to what people believe. Either way, I have no interest in shorting this market as it is far too strong, and I believe that it is only a matter of time before we continue to see buyers come into the marketplace based upon any type of value they perceive. I also believe that the 50 day EMA underneath is going to continue to be important, sitting at the 3100 level. If we break down below there, then the 3030 level is crucial and that of course the 3000 level. It’s not until we break down below the 3000 that I would be truly concerned about the S&P 500 from a longer-term standpoint, and I don’t think that’s in the cards anytime soon. Granted, I do think that we are going to pull back a bit from time to time, but I look at those as nice buying opportunities. Right before New Year’s though, I would anticipate a more significant move to the downside.