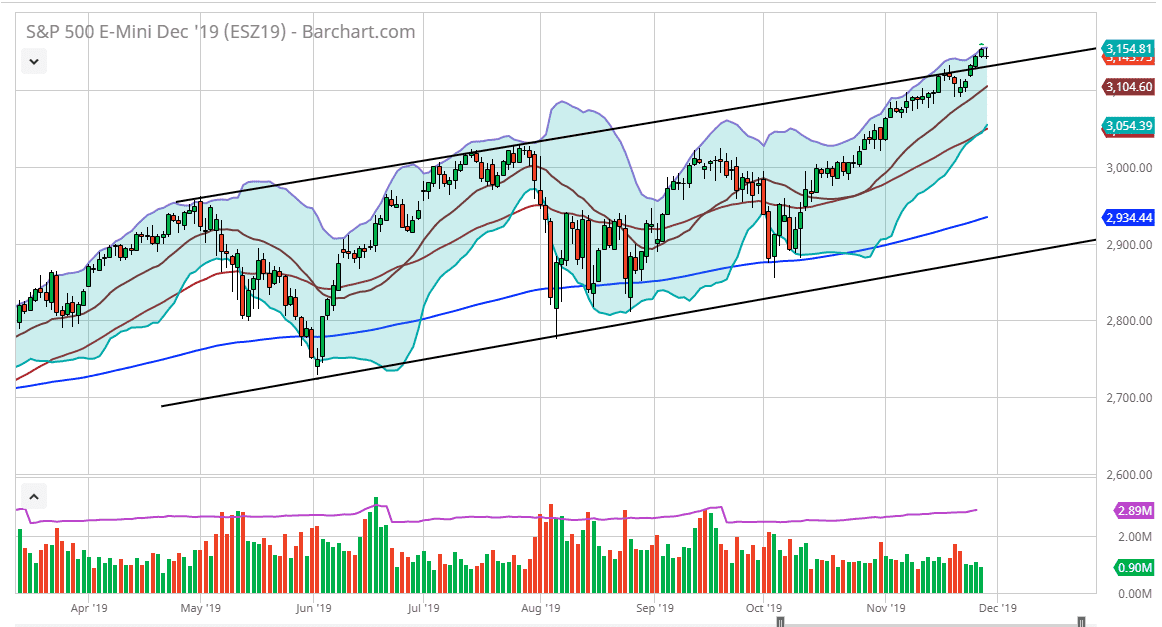

The S&P 500 went back and forth during the trading session on Friday after gapping lower, but this would have been extraordinarily low volume. With that being the case, the market should perhaps pull back a bit after the most recent run higher, but there is a ton of support underneath near the 3100 level, and at the 20 SMA which sits right around the same area. We are at the top of the Bollinger Bands indicator, and that suggests that we are a bit overdone.

At the bottom of the Bollinger Bands there is the 50 day EMA, and it should offer significant support. It is the bottom of the indicator which also would be a “oversold” condition, so it makes quite a bit of sense that we continue to find buyers. We are at the end of the year and that means that the fabled “Santa Claus rally” should come into play, as traders tried to boost their returns for the end of the year. At this point, the market looks as if it is one that you can buy on dips as it offers value, and what the Federal Reserve stepping on the sidelines it’s likely that we will continue to see money flowing into the equity markets.

While it has been a very relentless march higher, it hasn’t necessarily been impulsive. While we have a bit of an overbought condition, we aren’t off the rails as far as that is concerned. Because of this I think that we could continue to go higher but sideways action might be just as possible as well, as it gives the market the possibility to count down some of the gains and digest the move higher. All things being equal, pullbacks should continue to be buying opportunities, and based upon the ascending triangle underneath, the market is projected to go to the 3200 level. That’s only 50 points away, so it shouldn’t take much to get there, especially between now and the end of the year. At this point, markets continue to be positive, so therefore it’s almost impossible to short this market. In fact, it’s not until the market breaks below the 50 day EMA that I would even remotely consider selling, and that is a look to be very likely to happen in the short term. With this, the buyers are still very much in control despite what we have seen on Friday.