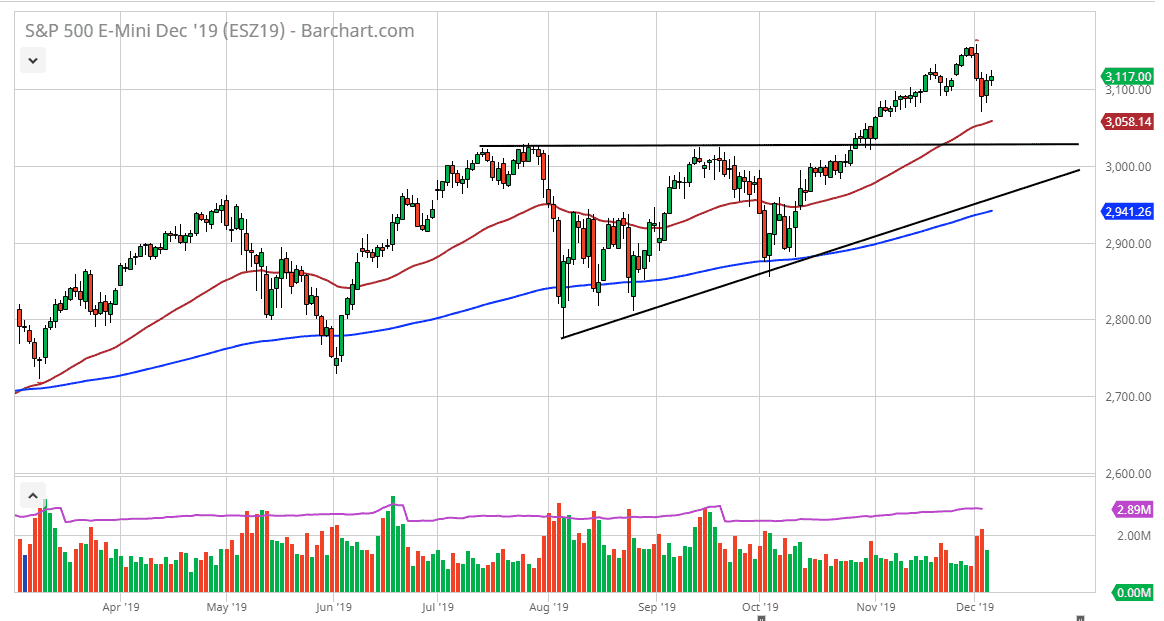

The S&P 500 rallied rather significantly during the trading session on Friday, closing at the highs near 3150. We are not quite at the all-time highs we had hit last week, but we are deadly close to it and the weekly candlestick is starting to form a hammer. The hammer of course is a very bullish sign and if we can break out to the upside it’s very likely that we continue to go much higher. Based upon the ascending triangle underneath we should be reaching towards the 3200 level, and that is but a scant 50 points from here. We can get there in a couple of days with the right news.

With jobs still looking very strong in the United States, it shows that the Federal Reserve won’t need to come in and loosen monetary policy and that they have the ability to adjust monetary policy if needed in the future. The Federal Reserve isn’t anywhere near needing to do anything with policy, and therefore sitting on the sidelines is what they will continue to do, patiently waiting for when Wall Street needs them to back them up. All things being equal at this point, short-term pullbacks will continue to be ways to pick up a bit of value, in a market that obviously has further to go.

We are getting close to the “Santa Claus rally” and is very likely that the market participants will continue to try to get involved in the seasonal trade, which is almost always a positive December. Ultimately, the 3000 level should be a bit of a “floor” in the market, as it is the top of the previous consolidation area that formed an ascending triangle. The measurement suggests that we are going to move towards the 3200 level, but I think at this point we are likely to go even further than that. We are in a bit of a perfect situation right now in the United States as the jobs number is strong but not so strong that we need to see monetary policy tightening. With this, it’s very likely that we are going to continue to go higher under almost any circumstance. If we pull back at this point, there will be plenty of people that have “fear of missing out” and willing to come in and pick this market up. Quite frankly, it would take some type of disaster as a result of the US/China trade situation to make this market rollover.