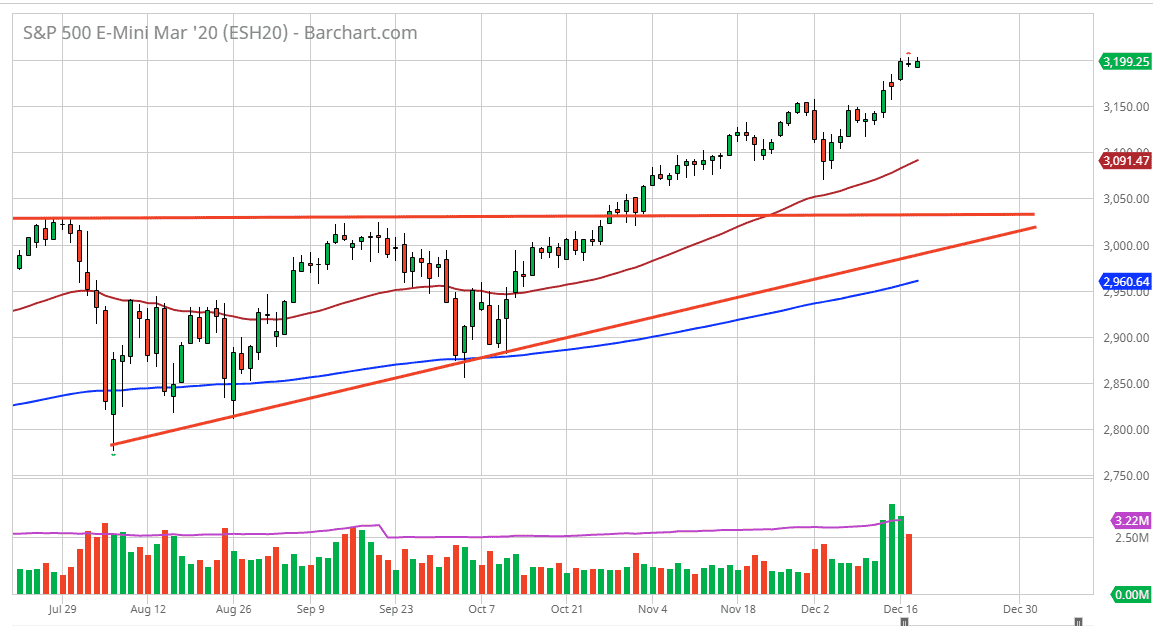

The S&P 500 has been relentless in its attack on the 3200 level, and during the trading session on Wednesday we have seen much more of the same. Ultimately, the market should continue to see a lot of bullish pressure as traders are trying to boost their returns at the end of the year, giving their clients something to cheer about. The 3200 level was the target that I had based upon the ascending triangle underneath, and at this point it’s likely that the markets will continue to look at pullbacks as potential buying opportunities as we have been in such a bullish run as of late.

Looking at the chart, I believe that the 3150 level underneath will offer a significant amount of support, as it was previous resistance. All things being equal, it is likely that the market will continue to be very noisy but if we get some type of headline coming out of the United States or China involving the trade deal, we will see a significant reaction in this market. Yes, we have “Phase 1” agreed to between the Americans and the Chinese in principle, but nothing has been signed and it’s only a matter of time before somebody somewhere says something stupid. As soon as that happens, the market will tank based upon algorithmic trading. In the meantime, though, it looks as if traders are willing to ride out the uptrend through the end of the year, and perhaps even higher than that.

Ultimately, this is a market that I think will continue to see a lot of volatility as volumes will get thinner, but in the end it’s very likely to be a scenario where we simply looking to buy short-term pullbacks as they should offer value in a market that is obviously very strong longer term. The Federal Reserve continues to be on the sidelines cheering the market along, so therefore it’s the only thing that matters. As the cost of money is very cheap, there are a lot of large funds and perhaps even more importantly in this scenario, corporations, willing to jump in and buy shares. I think that continues to be the case, and as long as big players like the Swiss National Banker going in buying American shares hand over fist, it’s difficult to short this market and therefore think it’s only a matter of time before we break above the 3200 level in continue much higher.