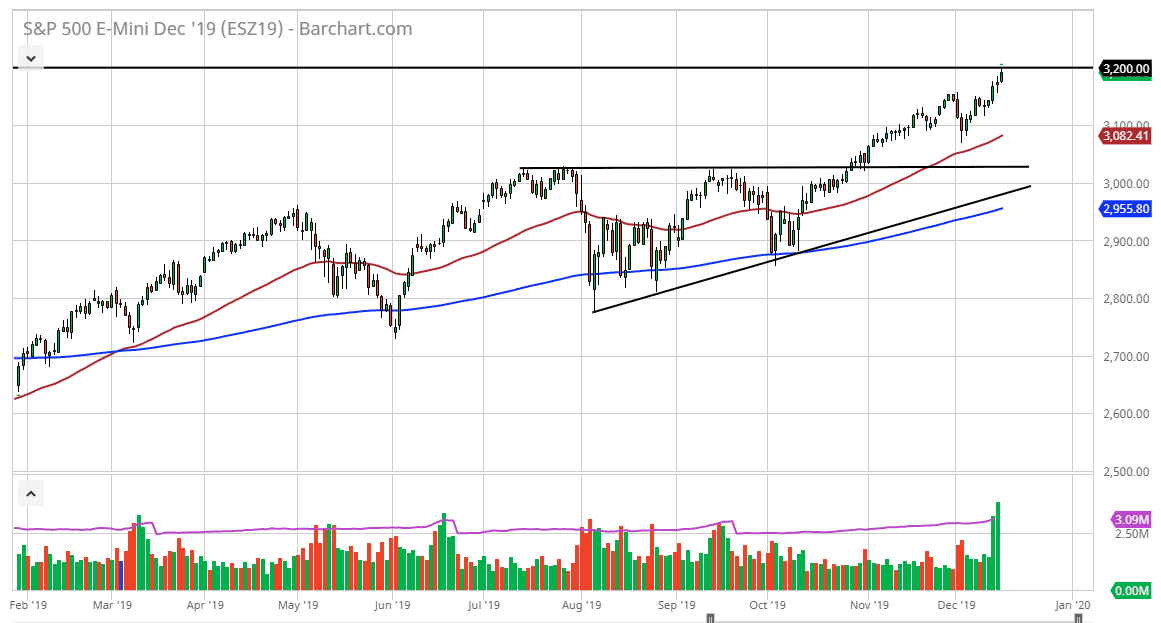

The S&P 500 has rallied a bit during the trading session on Monday, hitting the projected 3200 level based upon the ascending triangle underneath. I measured that move several weeks ago and then saw the market grind its way higher. We have had a lot of noise involving the US/China trade situation again, and therefore it makes sense that it has been very difficult. That being said, the market is likely to see a bit of a pullback from this target, as a lot of triangle traders will have put in take profit levels at 3200. At this point in time, the market is likely to find plenty of buyers underneath who have missed most of this move.

On a pullback, the market is likely to find the 3100 level as support. This is an area where we have seen support more than once, and now that we have the 50 day EMA sitting just below there it’s likely that there will be plenty of buyers jump in at that point. Underneath there, the 3000 level of course is an area that will attract a lot of attention. Ultimately, I have no interest in shorting this market, unless of course there is some kind of complete collapse in the US/China trade deal, which is still somewhat of a fluid situation.

If we can break above the 3200 level, then I think we probably go looking towards 3250, which is the next midcentury figure. Above there, then 3300 would of course be worth paying attention to. Ultimately, we are in an uptrend and that’s really all it matters when you look at the chart. Looking at this market, it’s obvious that the buyers continue to find plenty of value in this market, so at this point I think simply buying pullbacks probably works out to be the best way. However, a daily close above the 3200 level simply brings in more money as the market continues to grind in a very bullish market. It’s not until we break down below the 200 day EMA that I would be a seller. A breakdown below the level would send more market participants shorting this market, but I don’t see that happening anytime soon. Ultimately, this is a market that offers value on pullbacks and therefore that’s the best way to look at this market.