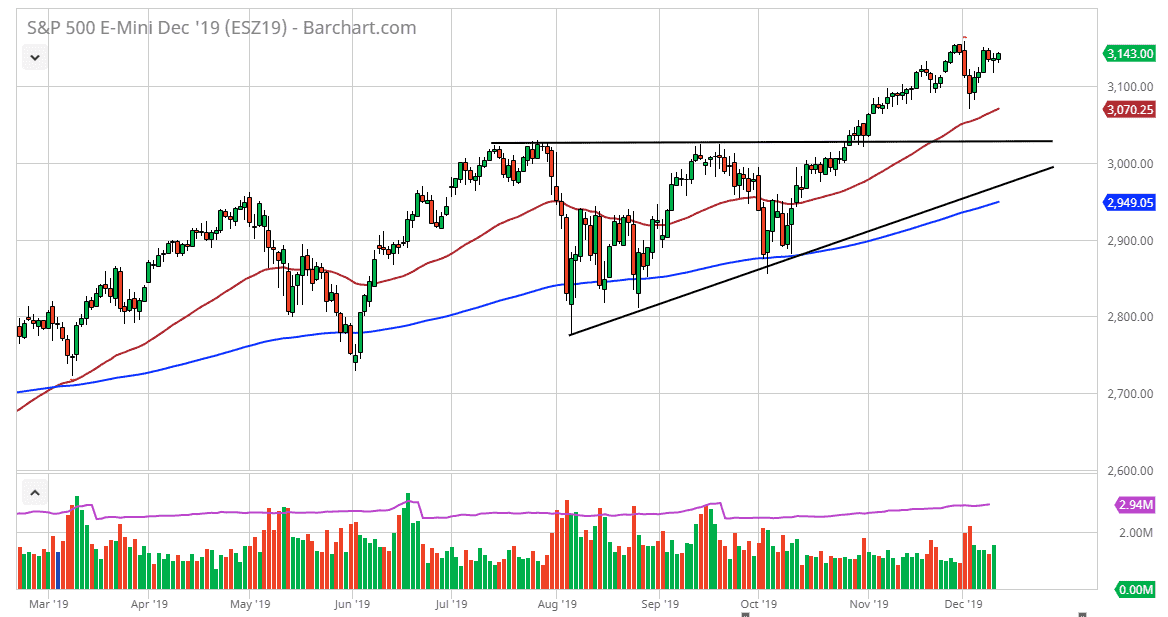

The S&P 500 showed signs of strength again during the trading session on Wednesday, although at this point in time it’s very likely that the US/China trade situation will continue to cause a lot of issues. At this point, the market looks likely to test the 3150 handle, and then perhaps go even higher than that. If we do break the 3150 level, then it’s likely that we go much higher and look towards the 3200 level which has been the target for some time.

The reason that target exists is that the ascending triangle measures for that movement. Short-term pullbacks at this point in time continue to be buying opportunities in the 50 day EMA underneath continues offer plenty of support. With that being the case, I like the idea of buying pullbacks as it gives us an opportunity to pick up bits of value, in a market that is obviously very strong longer term. It does makes sense that even though it was bullish during the trading session on Wednesday that there are a lot of concerns when it comes to the December 15 deadline, so it would be a bit much to ask the market to suddenly shoot through the roof. That being said, there are a lot of people out there on Wall Street that believe there will be a bit of a delay in the tariffs, and it therefore it’s likely that we will continue to see more of a bullish movement.

I believe that we have support all the way down to at least 3000, so even if we do get a significant sellout based upon some type of negativity between the Americans and the Chinese, it will be short-lived. After all, we have seen a lot of tariffs in the past and that has generally been negative for the short term, but then the market turns around based upon the fact that there is a lot of momentum to the upside and it’s likely that we will continue to see that be the case. The “Santa Claus rally” is a fact, and therefore a lot of traders will be looking for a reason to pad their stats for the year. With this, I am bullish, but I recognize we may get the occasional pullback that offers value that you can take advantage of. Selling isn’t even a thought at this point.