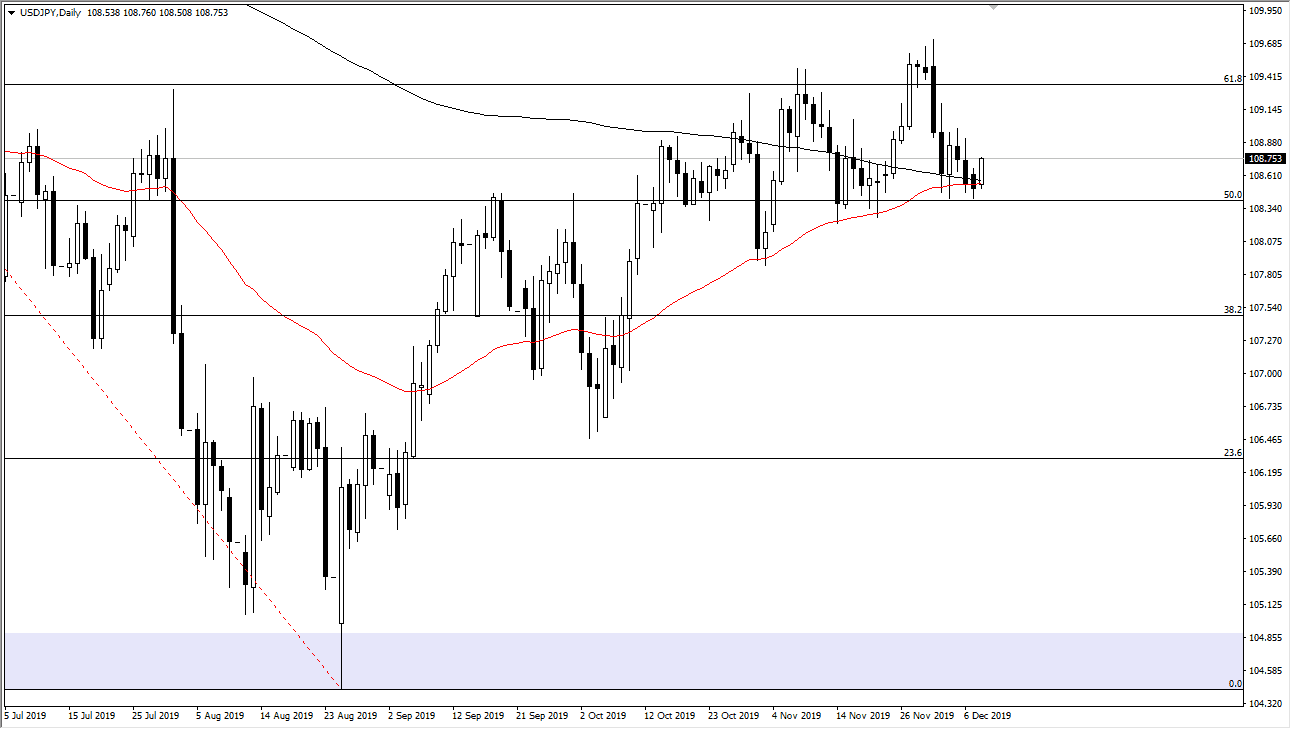

The US dollar gained a bit during the trading session on Tuesday, breaking the top of a fat hammer that formed on Monday. We are currently in the process of forming a potential “golden cross”, which is when the 50 day EMA crosses above the 200 day EMA. Regardless, both of those moving averages do suggests that we are going to find a certain amount of buying in that area anyway, and it now looks as if we are going to go looking towards the highs again. That being said, the real prize is to be found at the ¥110 level.

At this point, it’s very likely that we will see a lot of noise in the market, especially as we get closer to the end of the week. After all, the US/China trade war has a major event coming on Sunday, as more tariffs are scheduled to be levied upon Chinese goods. If they do in fact get levied, it’s likely we will see more of a “risk off” type of trade, and that should send this market lower. Alternately, if we get some type of delay of those tariffs, we could see this market go higher and go looking towards the ¥110 level. Speaking of that ¥110 level, keep in mind that’s the gateway to higher pricing.

If we did break above the ¥110 level, then I believe that the market goes looking towards the ¥111 level which has been the scene of a gap, and it’s likely that we will continue to see a lot of noise in that area. If we were to break above there then it’s likely that the market then goes looking towards the ¥112.50 level, which is the top of the most recent break down and essentially the 100% Fibonacci retracement level. Because of this, I do believe that we have plenty of room to run but we need good news in order to get there. If for some reason we get some type of extraordinarily negative news when it comes to the trade war, we could then break down to the ¥108 level. If we were to break down below there, then we could even go as low as ¥107.50 level, perhaps even ¥107. All things being equal, this is all about the US/China trade war and should continue to be highly driven by that.