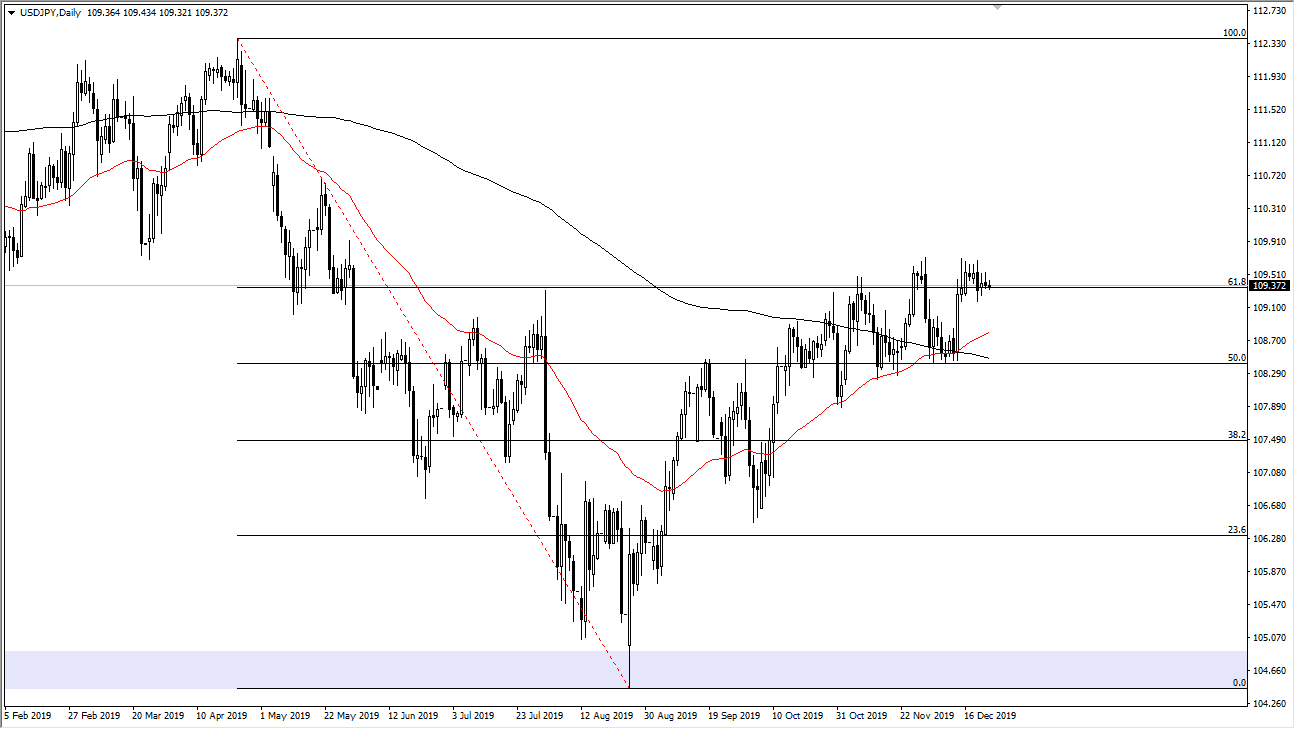

The US dollar did very little on Tuesday, which in and of itself wasn’t a major story considering that it was Christmas Eve, but looking at the longer-term chart you can see that we continue to see a lot of issues. The ¥110 level above continues to be a major resistance barrier and if we can break above there it’s likely that it will signal the next major rush in this market. Overall though, when you look at this chart it does look as if we are trying to break above resistance barriers and go much higher.

You should keep in mind that this pair is highly sensitive to risk appetite, so therefore it’s likely that we will see it react to the US/China trade situation, with the Japanese yen being a “safety currency.” At this point in time though, it does look as if the Americans and the Chinese are at the very least cooling off trade tariffs and the like, so overall this is a likely candidate for a massive move higher, especially if something actually get signed. If we can break above the ¥110 level, then it will wipe out the 61.8% Fibonacci retracement level. This is a major sign of bullish pressure, and it’s likely that the 100% Fibonacci retracement will be targeted. The ¥112.50 level will be an area that will be targeted and will be highly anticipated. I believe that if we can break above the ¥110 level, the market then will probably accelerate.

To the downside, the ¥180.50 level underneath will be the massive support level, as the market will continue to see that as an area where we could have a lot of interest. The 200 day EMA is down there, and it’s likely that we will continue to see that area offer a significant amount of support as well. Short-term pullback is possible, but I think at this point it’s more than likely going to be an opportunity to pick up a bit of value going forward. In general, I do like buying the dips, but I also recognize that you will need to be very patient in order to take advantage of this potential opportunity. However, if we were to break down below the ¥108 level, then the market probably breaks down rather significantly. That isn’t necessarily something that I’m looking to happen, but I realize that it’s a possibility.