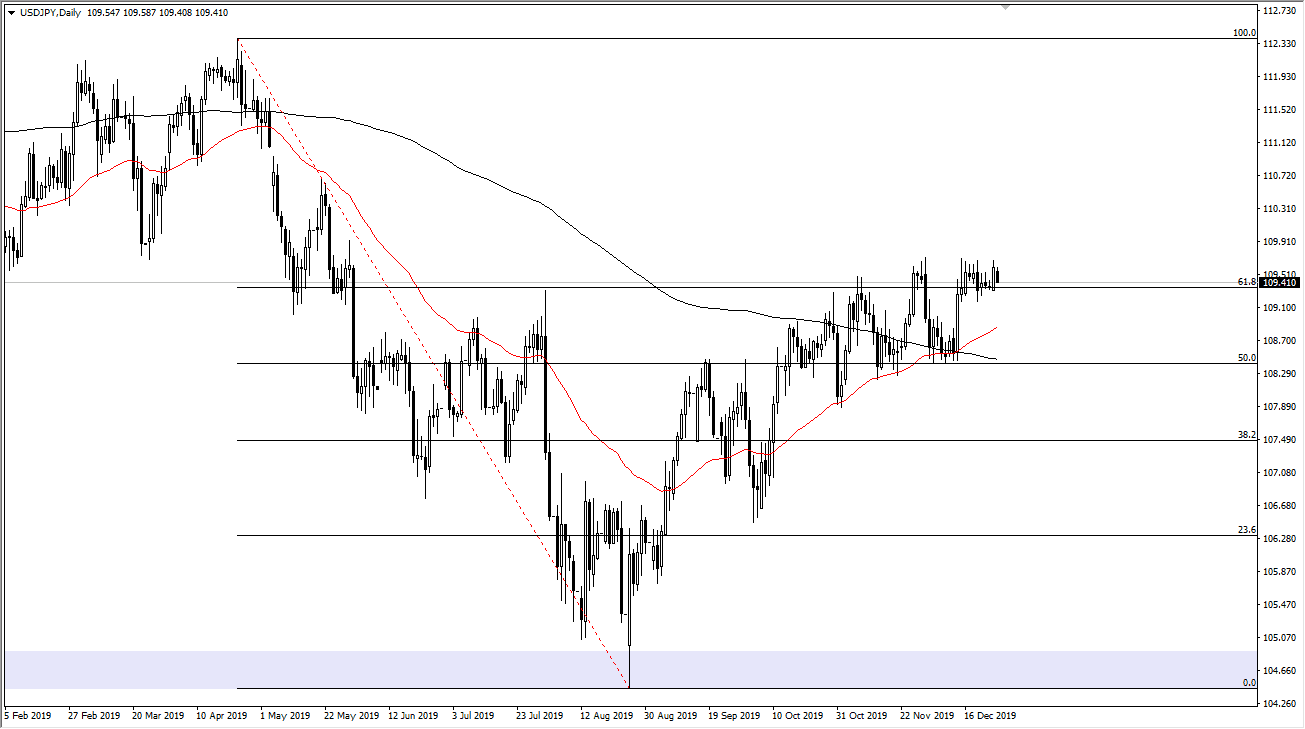

The US dollar has fallen a bit during the trading session on Friday, showing signs of weakness for the short term, but when you look at the daily chart you can see that we are clearly testing the ¥109.50 level for a bit of “balance.” Ultimately, this is a market that I think continues to see a lot of choppy in back-and-forth trading, as the ¥110 level is so significant. If we can get above there, the market is free to go much higher as we will have clearly broken above the 61.8% Fibonacci retracement level and of course the psychological important round figure itself.

If and when we do that, the market is very likely to go looking towards ¥111 level above where there is a gap. If that gap gets touched it could cause a little bit of resistance, but I think ultimately, we will probably go looking towards the ¥112.50 level over the longer term. I believe that the area will attract a lot of attention based upon historical trading in of course the fact that the Fibonacci retracement traders will be paid attention. When looking at the longer-term chart though, you should recognize that we are at roughly “fair value” in the overall consolidation of marketplace that we have been in for the last several years and that is part of why we are struggling because we are essentially where price should be based upon the last couple of years.

That being said, the 50 day EMA has broken above the 200 day EMA, forming a “golden cross” which attracts a lot of attention. This is a highly risk sensitive pair as well, so pay attention to the US/China trade situation. In the short term, I would not expect much simply because traders will be paying attention to the New Year’s Day holiday, and that of course the jobs number coming out a few days later. I think that pullbacks are to be bought, as long as we can stay above the ¥108.50 level. I look at pullbacks as value that I should be taken advantage of, just as I would take a breakout above the ¥110 level on a daily close as an opportunity. I have no interest in trying to put in big-money though, because I recognize that we are essentially stagnant at the point. All things being equal though, I do expect this pair to go higher eventually.