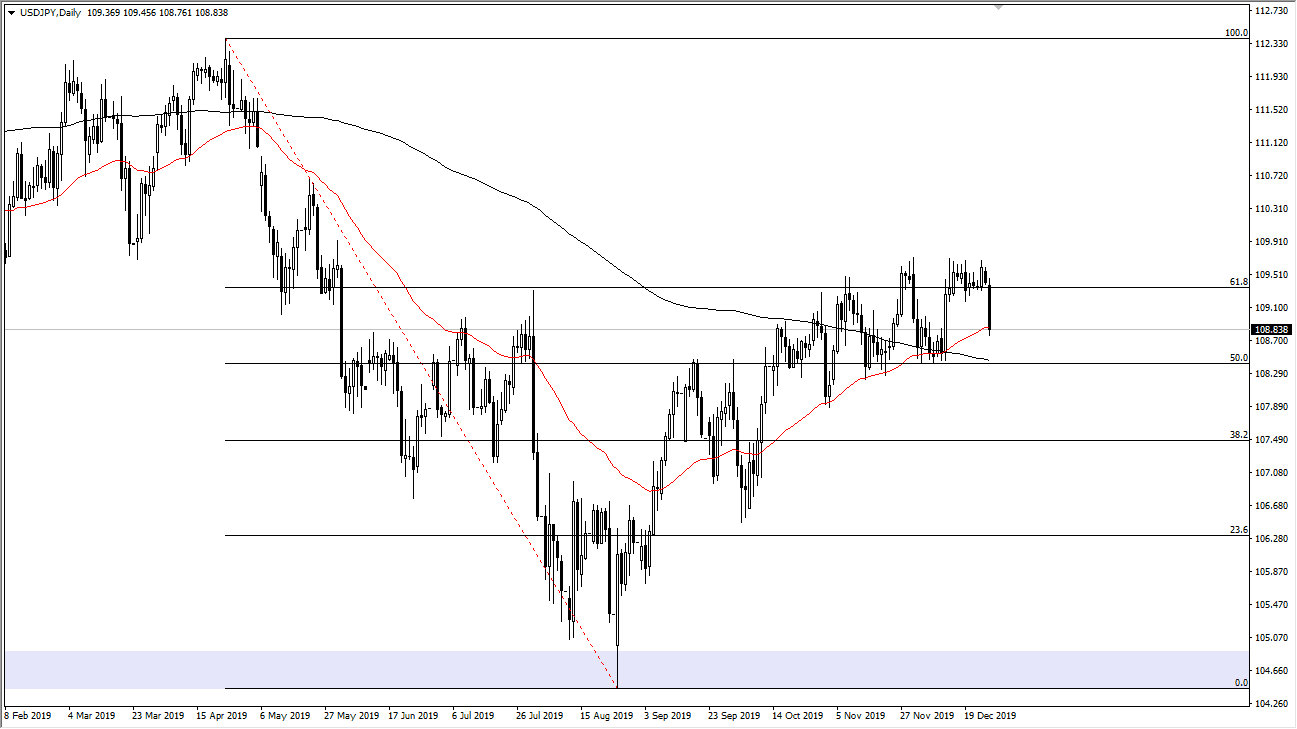

The US dollar has broken down significantly during the trading session on Monday as traders came back from the weekend. Keep in mind that the pair does tend to be very risk sensitive, so keep in mind that the USD/JPY pair will go back and forth along the lines of what the stock markets do as well. Ultimately, I like the idea of buying this pair but as we have had a bit of profit-taking at the end of the year in the S&P 500, it makes sense that the USD/JPY pair would pullback as a result. We are currently trading at the 50 day EMA and that will attract a certain amount of attention in and of itself, but at this point I think it’s only a matter of time before the buyers return.

In the 50 day EMA has recently crossed above the 200 day EMA causing the “golden cross” which is something that a lot of longer-term traders pay attention to. That being said, it’s likely that the longer-term traders are already invested, and most certainly will be willing to hang on to this trade for a significant amount of time. Beyond that, you should keep an eye on the ¥110 level above because I think it’s the gateway to much higher pricing. A break above the ¥110 level allows the market to go looking towards the ¥111 level, and then the ¥112.50 level. I believe this happens, but probably after New Year’s Day as liquidity will be a bit of an issue not only in this market, but obviously the S&P 500 as well.

To the downside, I see a lot of support at the ¥108.25 level, so as long as we can stay above there, I feel relatively confident in the overall uptrend. Unless we get some type of headline coming out of the US/China trade situation that is negative, I anticipate that this pair will continue to go higher. Keep in mind that the overall trend of the S&P 500 and therefore risk appetite in general is to the upside so that should continue to favor a move to the upside as the Japanese yen is considered to be the “safest currency” that Forex traders use. Ultimately, the market has seen a lot of buyers on dips and I think that continues to be the way going forward. However, with the low liquidity over the next couple of days it’s probably best to leave this alone.