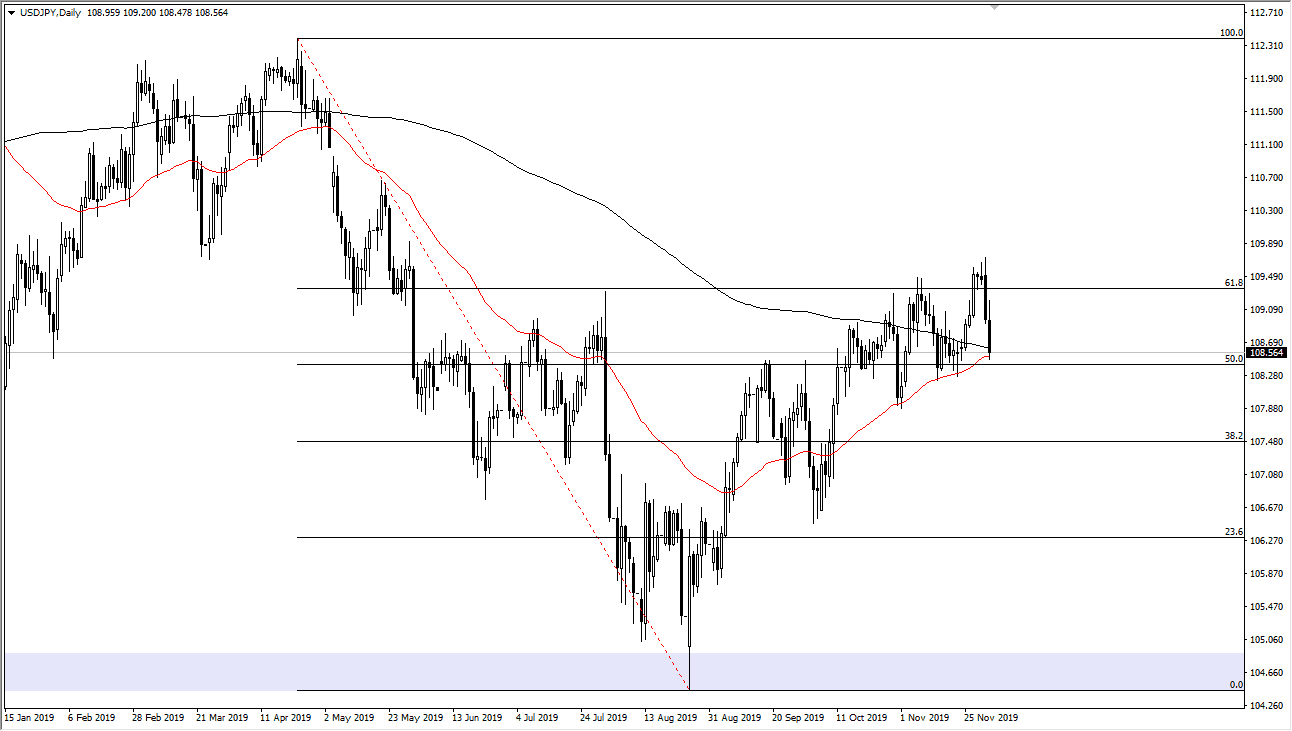

The US dollar initially tried to rally during the trading session on Tuesday, but then collapsed as Donald Trump started talking about how the China deal might be better served having been dealt with after the election. This freak everybody out, and of course the algorithmic traders went over the top. At this point, the currency pair is testing the ¥108.50 level, and of course a couple of major moving averages.

On the chart, the red moving average is the 50 day EMA and of course the black EMA is the 200 day EMA. We are getting ready to do a bit of a “golden cross”, which is a very bullish sign. At this point, there are a lot of technical factors all in one place that will probably lift this market. That being said, if the market does break down from here, I think that the ¥108 level will be support as well, so it’s only a matter of time before buyers would come in and pick this market up. That being said, as we have a lot of traders out there using algorithms that read Twitter feeds and headlines, you will have these erratic movements.

This pair is highly sensitive to risk appetite so keep that in mind. Risk appetite is something that isn’t easily quantifiable, but pay attention to the Japanese yen overall, as it is considered to be a “safety currency.” Look at this chart, it’s likely that it’s only a matter of time before things calmed down, and that the traders continue to push to the upside. If we can break above the ¥110 level, it’s likely that the market will then go looking towards the ¥111 level, and then eventually the ¥112.50 level. At this point, it’s going to take some good news or some type of big shift to a more positive tone. If we get that, then this pair is very likely to continue going higher. Quite frankly, if you look at the chart, you can make an argument for an uptrend and channel as well. With that in mind I still am somewhat bullish of this pair, but I recognize that a little bit of stability will be needed before putting money to work in this pair as it does tend to react without thinking quite often. I’m a buyer but may have to wait a day or two to get that opportunity.