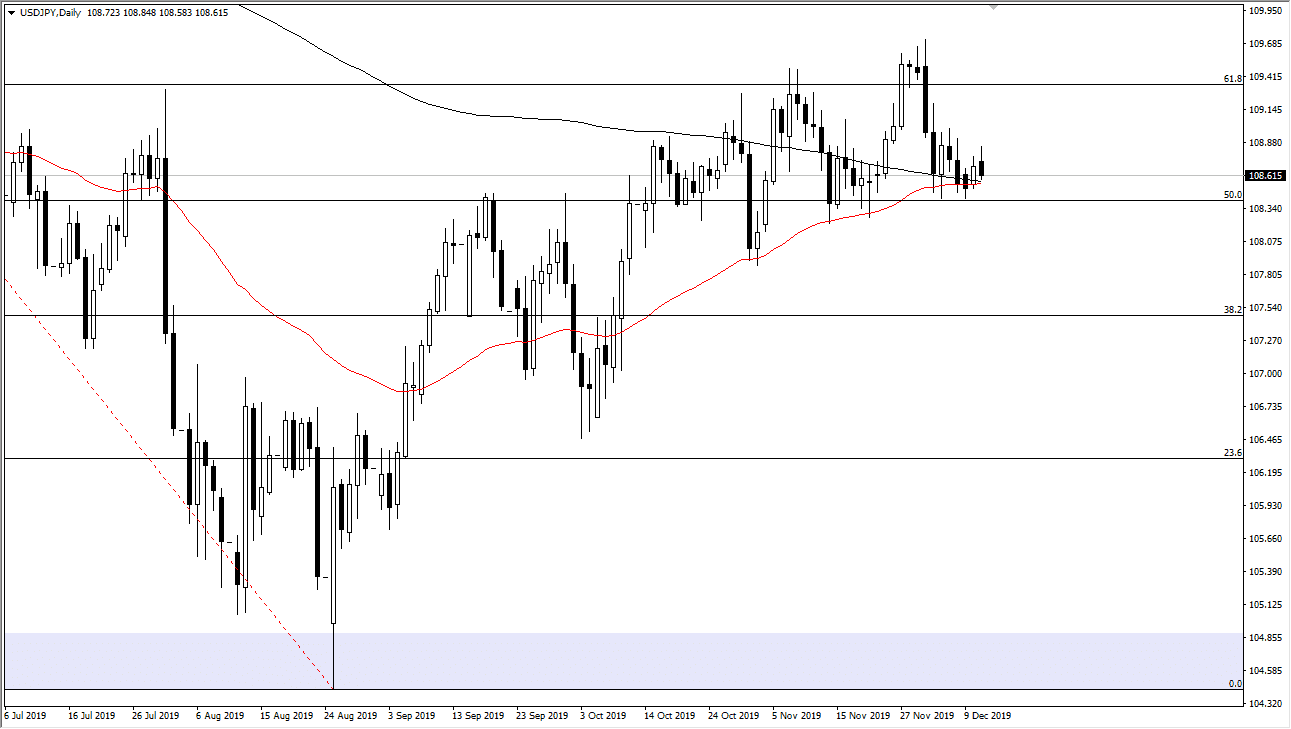

US dollar has been all over the place during the trading session on Wednesday, as the market was awaiting the Federal Reserve statement. That being the case, the market is likely to continue to look at this general vicinity as important. The way we have traded shows just how much support there is underneath at the ¥108.50 level, and the confluence of the 50 and the 200 day EMA indicators.

Keep in mind that this market has shown its proclivity to continue going higher over the longer term but we have been chopping around quite a bit in this area, and it looks at this point that we are about to see a “golden cross” in the form of the 50 day EMA crossing the 200 day EMA. Ultimately, this is a market that is going to continue to be back and forth but overall, I believe that the market will continue to move right along with risk appetite. When it comes to risk appetite, the US/China trade situation is going to be the most important factor in the short term.

Ultimately, this is a market that continues to be bounced around by that situation, but on Wednesday we also have had the Federal Reserve state that it was going to take a significant pickup in inflation before they were to raise rates. This obviously weighs upon the US dollar, but as we continue to see more of a “risk on” move, it’s likely that we then go looking towards the ¥110 level above. If we were to break above there, then the market is likely to go looking towards the gap at the ¥111 level. Beyond that, the market could then go to the ¥112.50 level which is the 100% Fibonacci retracement level.

Otherwise, if we break down below the ¥108 level it could start quite a bit of negativity that sends this market down to the ¥107 level. That would probably be based upon a major “risk off” event, such as worsening tensions between the Americans and the Chinese, something that is a very real likelihood as the December 15 deadline is coming rather quickly. If we get some good news out of that situation, this market will probably make a serious move towards the ¥110 level. Until then, expect a lot of choppiness but it does look as if we have a proclivity to go higher over the longer term.