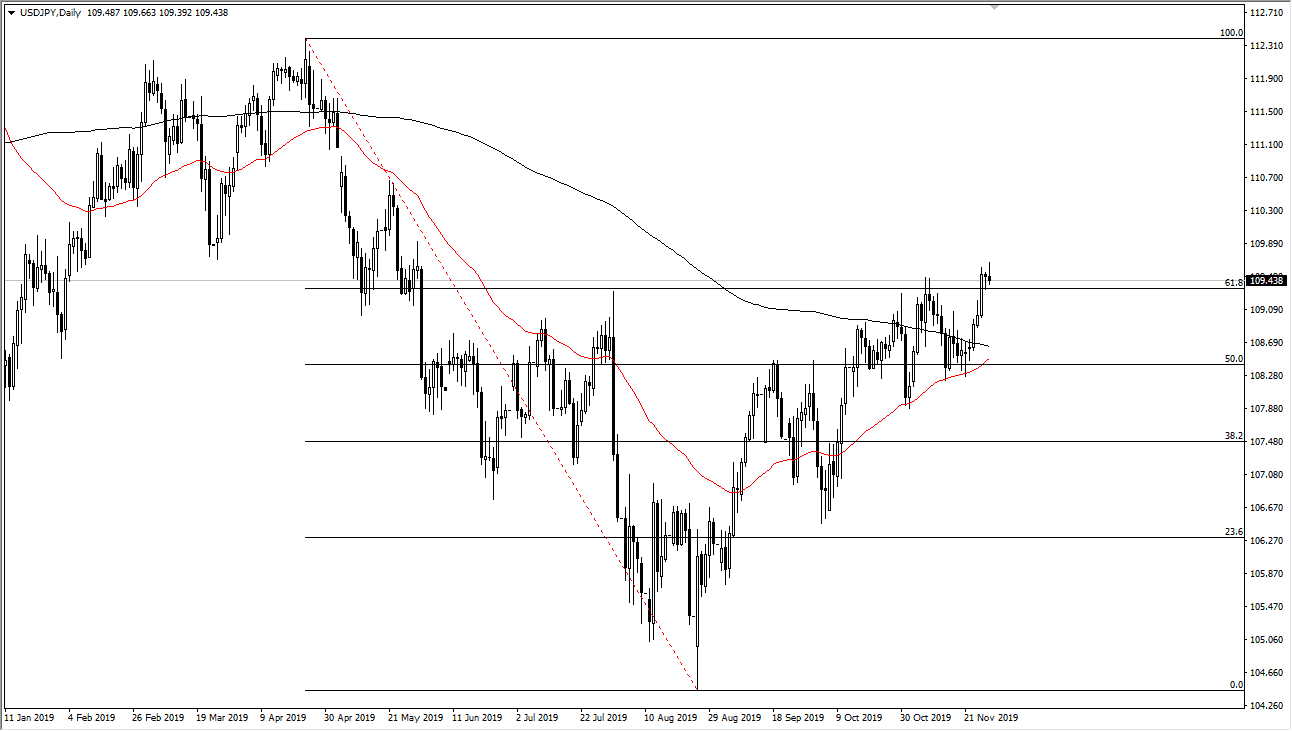

The US dollar continue to go back and forth against the Japanese yen, and on Friday initially tried to rally but gave back some of the gains. It is trying to fight back against the hammer like candle from the Thursday session, but there is a lot of upward momentum here and it looks as if we are going to try to break out given enough time. Overall, the market has been banging up against a major resistance barrier in the form of the ¥110 level, and it’s likely that we will see the market eventually try to go even higher. If we can kill the ¥110 resistance barrier, then the market is free to go looking towards the ¥111 level, and then eventually the ¥112.50 level.

That being said, there is a ton of support underneath as well, so I think at this point pullback should be thought of as a potential buying opportunity in a market that has been so obviously bullish. Remember that the Japanese yen is a safety currency, so therefore if we get some type of fear-based move, we could see the market fall, but unless it’s something terminal I don’t think it happens for any significant amount of time. Beyond that, we also have the 50 day EMA getting ready to cross above the 200 day EMA, the so-called “golden cross” which brings a lot of people into the market for the longer-term move.

At this point, the market is likely to continue showing signs of life, but I also think that it’s only a matter of time before we eventually get that the fact that I’m expecting, the “Beachbody underwater.” What I mean by that is that if you can imagine holding to beach ball under the water, and releasing it, it will shoot straight up in the air. I think that’s the most likely move coming out, but we need some type of catalyst, perhaps in the idea of a “Phase 1 deal” being signed finally. There is also the “Santa Claus rally” that happens this time of year as well, so that tends to make the markets a little bit more “risk on.” With that I look at pullbacks as an opportunity to start buying again and have no interest in trying to short this market. Longer-term, I believe that we will see the ¥111 level tested rather soon.