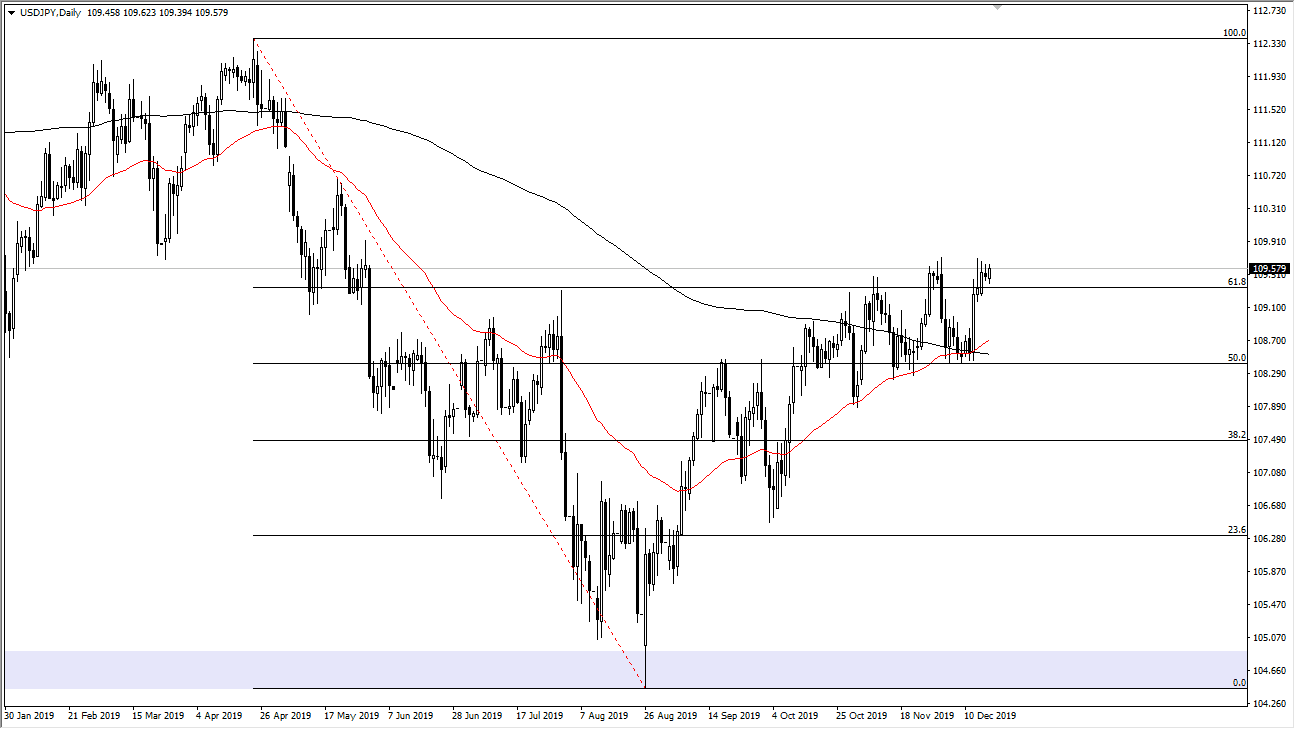

The US dollar continues to struggle to break out to the upside, as the ¥110 level continues to be a massive problem when it comes to the buyers going forward. If we can break above the ¥110 level, it’s likely that we will then go towards the ¥111 level, which is the gap on longer-term charts that have not been filled yet. Beyond that, the 100% Fibonacci retracement level is to be found at the ¥112.50 level, and I believe that will ultimately be the target longer-term.

That being said, the market is more than likely going to continue to be very choppy and sideways in general, as we head into the holidays, it typically very quiet time of year. If we do break above that ¥110 level though, it would be a massive “risk on” type of move, and it would make sense that we would see buyers jump in and try to take advantage of any momentum that shows up. Ultimately, this is a market that is going to be paying close attention to the US/China trade situation which although we have reached the so-called “Phase 1” part of the deal, the reality is that we don’t have a whole lot in the way of details. It would not take much to have the market worried again, and therefore sending this market lower. That being said though, if we do get a bit of a push forward by both the Americans and the Chinese to get this thing signed, that could be the reason we break out to the upside.

I wish that I could tell you that we are beyond all of the noise and drama between the Americans and the Chinese, I really do. Unfortunately, 2020 is probably going to be very much like 2019, where we have the occasional headline cross the wires to spook the markets again and send it in one direction or another. Because of this, I think we continue to see a lot of choppy and volatile conditions going forward, and the next couple of days probably won’t be any different than what we have seen. Quite frankly, this is the worst time of year to trade anyway, and now that the market has nothing to move on, it looks like we are going to simply fall asleep into the holidays. This pair is probably going to stay within the ¥110 level and ¥108 level range until New Year’s Day.