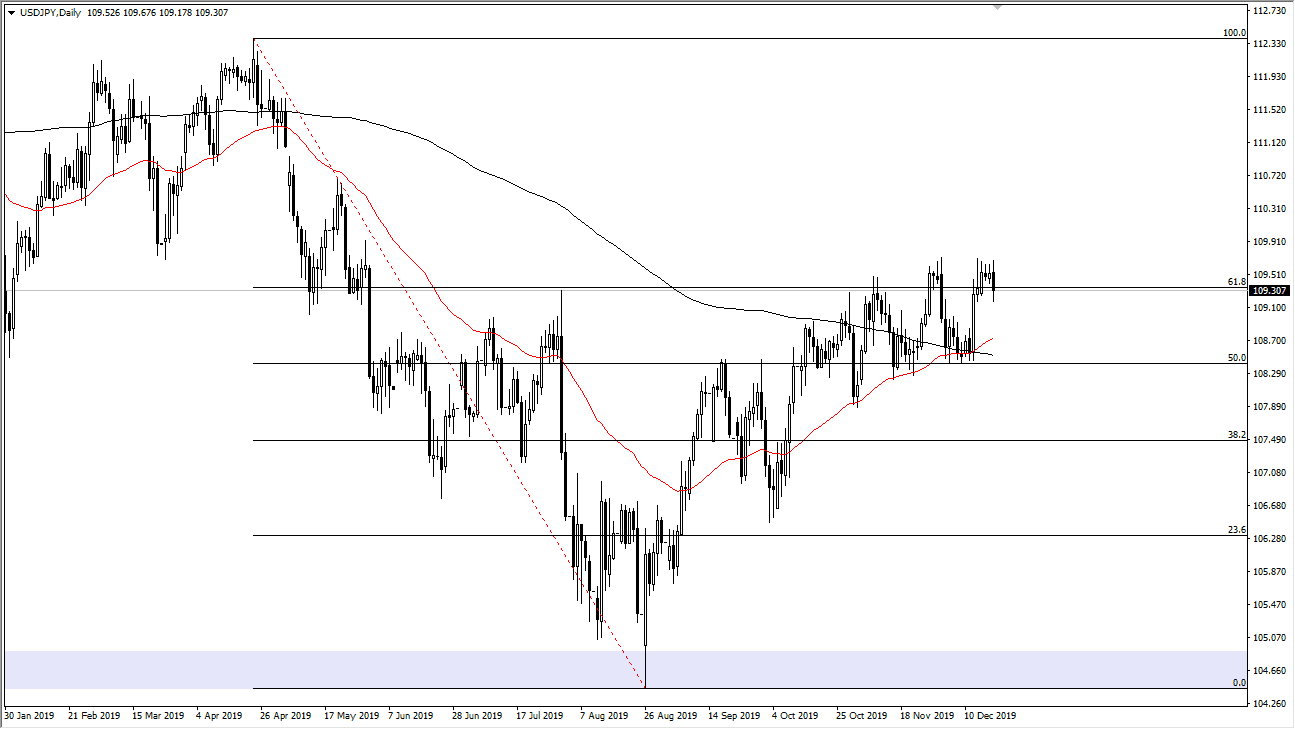

The US dollar has rallied initially during the trading session on Thursday but then broke down significantly to show signs of weakness against the Japanese yen again. At this point, the market looks as if it is ready to continue the overall consolidation between the ¥110 level above and the ¥108 level underneath. With this, it’s very likely that we will continue to see volatility and choppiness, especially as the in the holiday season. The liquidity will be very low and therefore it makes sense that we would see a lot of back-and-forth trading. The market doesn’t have anywhere to be until we get some type of catalyst, which is probably going to be involving the US/China trade situation.

The market breaking above the ¥110 level could send this market much higher, reaching towards the ¥111 level. That is an area where we have seen a massive gap, and that of course will cause a lot of reaction. If we can break above the top of the ¥111 level, then it’s likely that the market will go towards the ¥112.50 level. At that level, we have the 100% Fibonacci retracement level and it will be difficult to break above there. That being said though, with some type of good catalyst coming out of the US/China trade situation it’s likely that the market could go higher. The 50 day EMA has crossed above the 200 day EMA forming the so-called “golden cross”, and as a result longer-term traders may be getting involved at this point as well. That being said, if we get some type of negativity coming out of the US/China trade situation, that could have traders running towards the Japanese yen for safety.

A break below the ¥108 level would wipe out the uptrend and have a lot of trouble shining on this market right away. I do think that the next couple of weeks will be very difficult though, as the sideways action will probably continue as the lack of headlines will continue to be a major problem. The market will continue to see traders face the holidays more than the markets themselves, so I would anticipate that this is a back-and-forth situation for the next couple of weeks unless of course we get some type of trade headlines coming out of either Washington DC or Beijing. Until we get clarity with that, it’s very unlikely that we get any serious momentum.