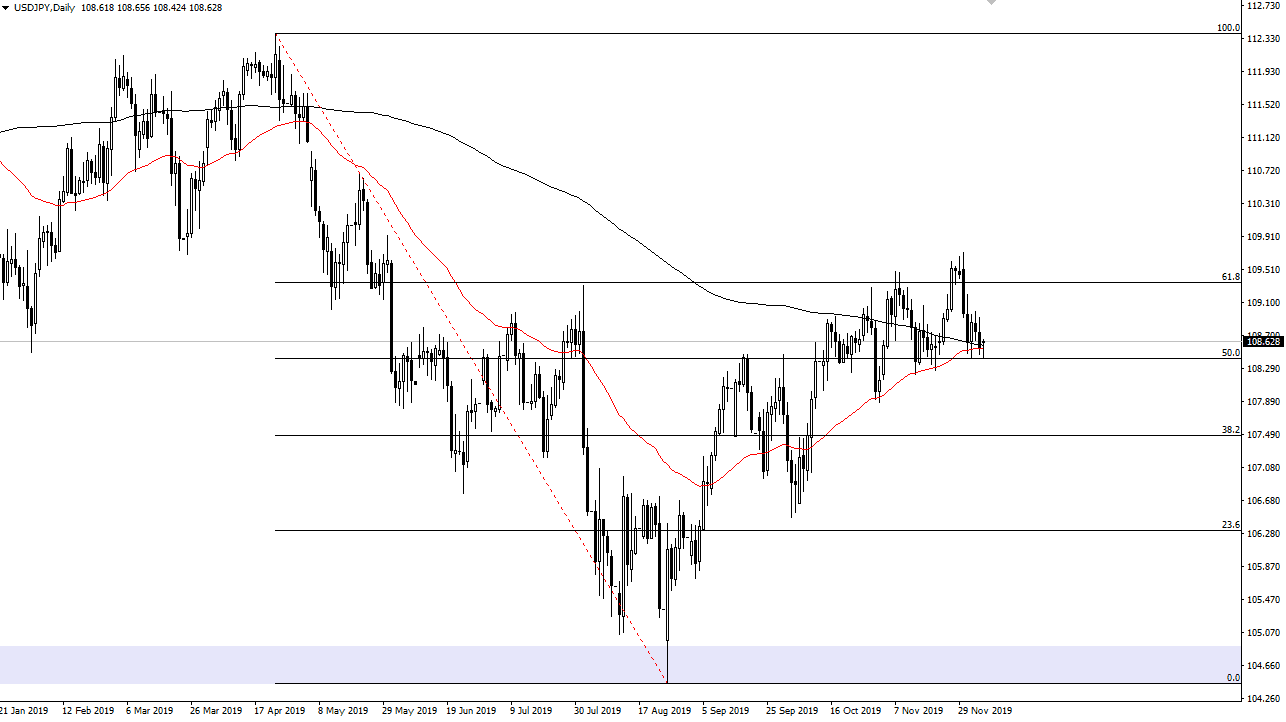

The US dollar had initially pulled back during the trading session on Monday but has turned around to show signs of life again. We are testing about the 50 and the 200 day EMA indicators, both of which are very crucial. At this point, the market is likely to go towards the ¥109.50 level, which was the most recent area of selling. The ¥110 level above is massive resistance, and if we can break above that level, then we can continue the longer term uptrend to go looking towards the ¥111 level, and then the ¥112.50 level.

I do like the idea of buying short-term pullbacks, and in fact that ended up being the trade on Monday. The ¥108 level should be rather supportive, just as the ¥107.50 level should offer as well. Ultimately, this is a market that I think you can continue to pick up value as it occurs, as the Japanese yen is considered to be a “safety currency.” This is going to be highly reflective of what’s going on around the world as far as trade is concerned and of course headlines involving the trade war itself. Ultimately, the Japanese yen will strengthen a bit during the negative headlines, just as it will soften during the week once.

All things being equal, we have been grinding higher and it’s likely that we will continue to go to the upside. If we can continue to see a lot of good news, this market will probably rocket to the upside. Looking at this chart, we are getting ready to have the so-called “golden cross” when the 50 day EMA crosses above the 200 day EMA. That is a very bullish sign, and as a result it would make quite a bit of sense to see longer-term buyers come in and pick this up as well. Looking at this market, you can also see that there is a bit of an uptrend and channel, and it seems to be holding going forward. All things being equal, this is a market that I think continues to be a “buy on the dips” type of situation, but it will probably be for short-term trading only. It’s difficult to imagine a scenario where we break down significantly without some type of massive negative situation coming out of the trade war or perhaps some type of other catastrophic financial headline.