The US dollar initially tried to rally during the trading session on Thursday but gave back the gains as there have been a lot of back and forth traders in the market. This makes sense though, because it’s the day before the Non-Farm Payroll figures coming out the United States and that of course always moves this pair quite drastically.

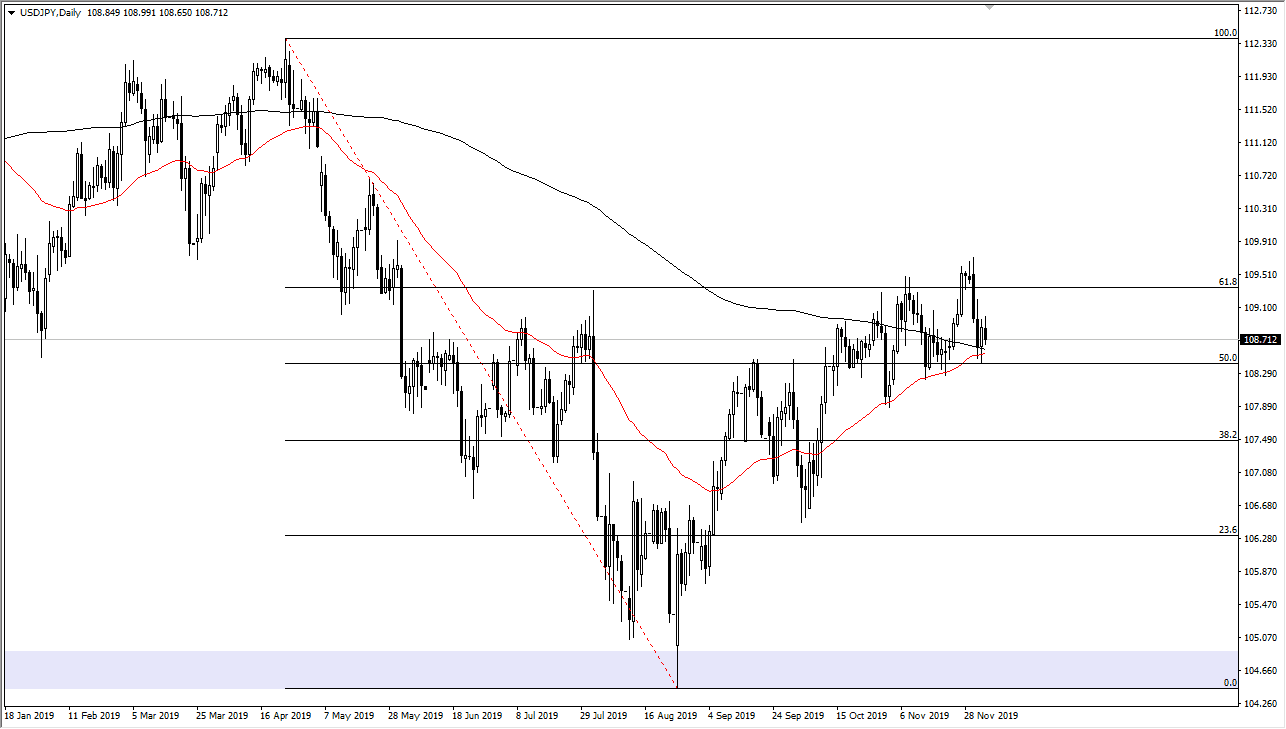

We are currently trading right above the 50 day EMA and the 200 day EMA and dangerously close to the so-called “golden cross” that occurs when the 50 day EMA crosses above that 200 day EMA. This is a longer-term “buy-and-hold” signal, which of course will attract certain traders. For myself, I look at the ¥110 level is a massive barrier that needs to be overcome. If we can get past there, then the market is free to go towards the ¥111 level which is where we see a massive gap, and then perhaps reaching towards the ¥112.50 level.

Pullbacks at this point time should see plenty of support near the ¥108 level, and then again at the ¥107.50 level. This is a market that has been rather relentless in its grinding higher, and therefore I think it’s only a matter of time before we finally do get that breakout. We need good news to make it happen though, and the easiest place to suspect it might come from is the US/China trade situation. Nonetheless, we also have the “Santa Claus rally” in December typically on Wall Street, and that has a bit of an effect over here as well.

If we do get some type of knee-jerk reaction to the downside after the jobs figure on Friday, I’m going to start looking for buying opportunities at the ¥108 level. Below there, I would be looking again at the ¥107.50 level, and then again at the ¥107 level. If we were to break down below the ¥107 level, that could change everything but quite often what happens is that the pair will get erratic and perhaps overreact to the figure in a low liquidity environment, and then correct itself. I fully anticipate that’s probably what we will see during the trading session on Friday yet again as Non-Farm Payroll in the end changes very little.