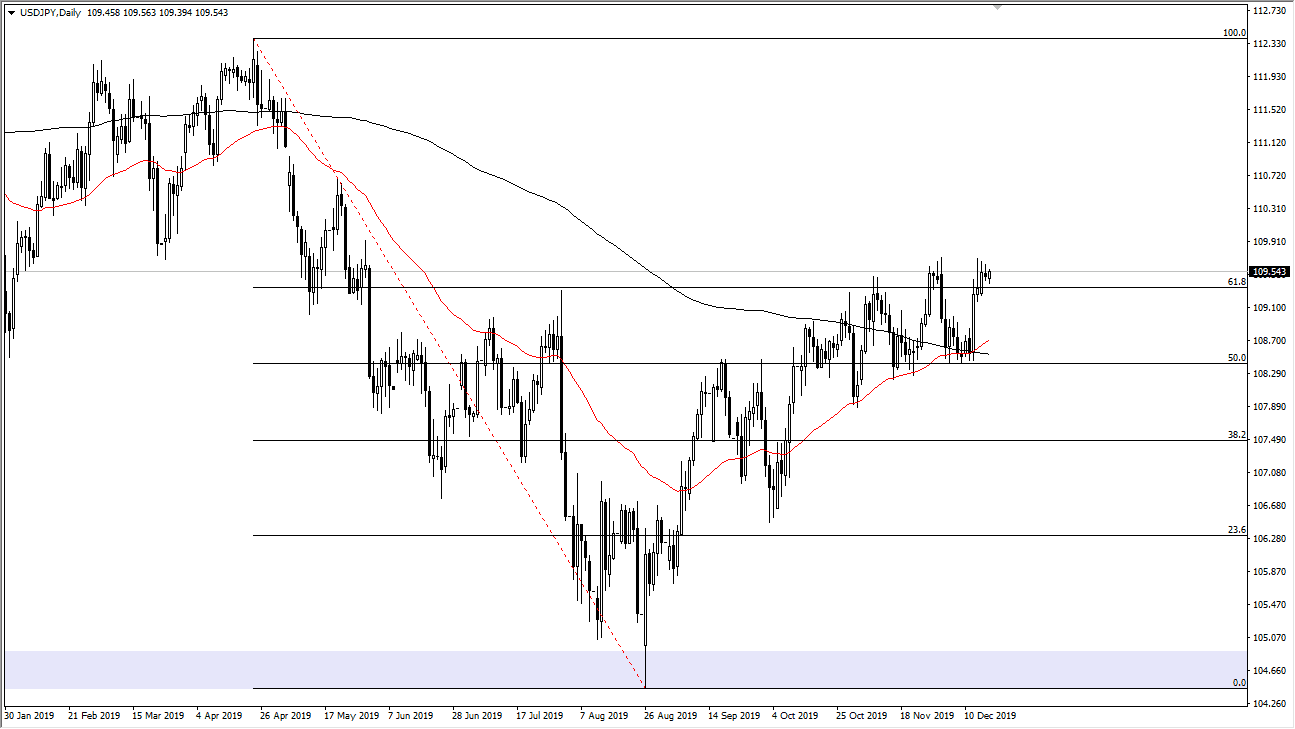

The US dollar has initially tried to rally during the trading session on Tuesday, but as you can see, we have in fact pulled back yet again from the same basic area. The ¥109.60 level continues to be very difficult to overcome, and as a result I think we are likely to pull back from here a little further.

This isn’t to say that I think it’s time to start selling, it’s just that I don’t expect much in the way of being able to continue going higher. This is a risk on/risk off type of situation and as the stock markets have reached pretty extensive highs and overextended areas, it makes sense that the market will perhaps continue to pull back a bit in order to find some value. We have recently had the “golden cross” in this pair down at the ¥108.50 area, and I think we will probably continue to see an attempt to break out but right now there’s no impetus to make that happen in the short term. I believe that given enough time we will probably see this market rollover a bit and attract value hunters.

We need to see the S&P 500 take off to the upside in order to make that happen, as the two markets are so highly correlated. The pair is very likely to be influenced by not only the S&P 500, but the 10 year treasury yield as well, which is historically important. I believe at this point it’s very likely that we will see a bit of profit-taking in multiple markets, so it should lead to more of a “risk off” situation anyway.

To the downside, I think the ¥108 level is a bit of a “floor”, and I would be a bit surprised if we get down there. With that being the case it’s very likely that what we will see is noisy trading over the next couple of days and then generally trading back and forth in this range that we are carving out between ¥108 and ¥109.50, roughly speaking until the end of the year. This of course could change with some headlines coming out of the US/China trade agreement that has yet to be signed or even translated, so there is always that problem that could create it’s self-right back into the equation as well.