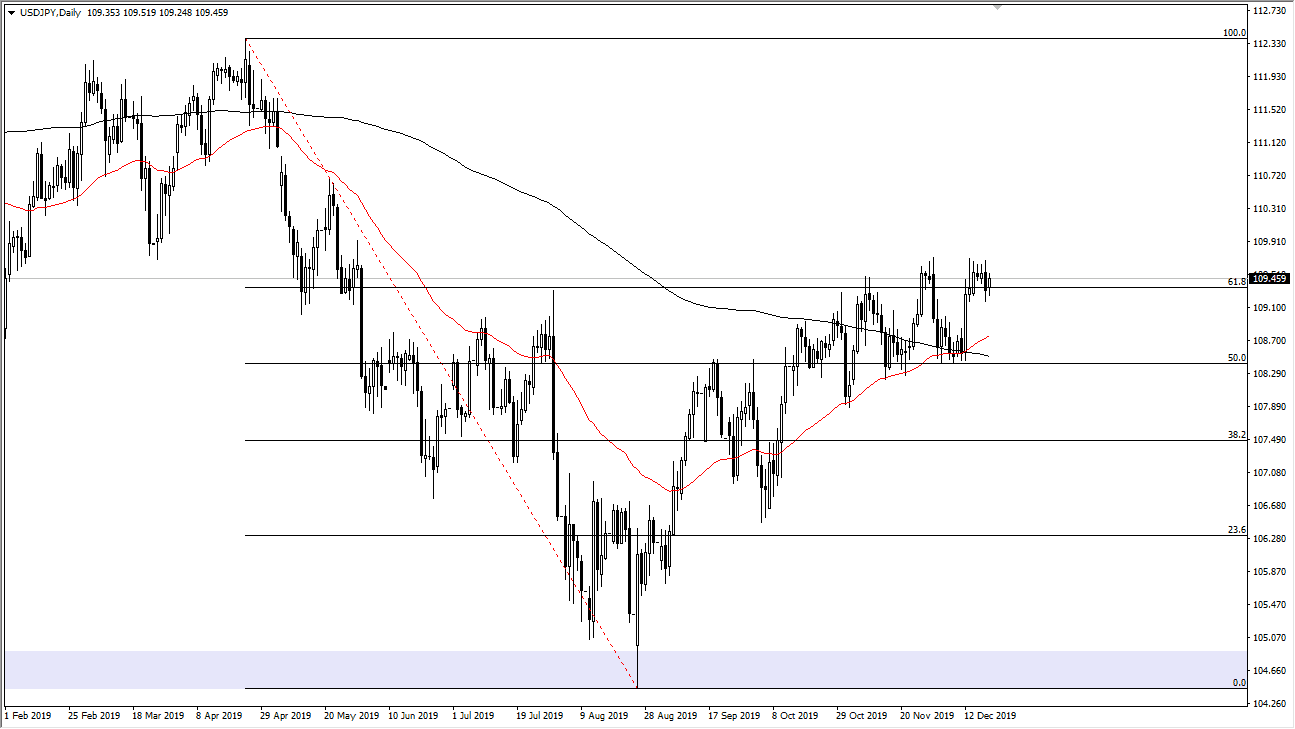

The US dollar has initially fallen during the trading session on Friday but then turned around to show signs of life again. By bouncing the way, it has it looks as if we are going to go looking towards the ¥110 level, an area that has been important more than once. That is an area that if we can break above there, we will go looking towards the ¥111 level, where we have a lot of interest due to the gap that has formed.

If the market does get some news out of the US/China trade war that is positive it should send this market much higher. The breaking of that level would be monumental as the level also sitting at the 61.8% Fibonacci retracement level and of course an area that we have seen a lot of action at previously. If we can break above this ¥110 level, the market will then be very rapid in its ascent towards that gap. Ultimately, I think that we would probably then see a move to the ¥112.50 level which has been important as well and it is also the 100% Fibonacci retracement level.

Having said that, if we pull back from here the market is likely to reach towards the ¥108.50 level, an area where we will see moving averages. A break down towards that area should see plenty of support though, unless of course we get a complete breakdown in the US/China trade situation. I expect a lot of volatility but looking at this chart being at a major resistance barrier and the fact that we are heading into Christmas week, it’s likely that the traders will continue to see a lot of short-term volatility, but ultimately the thin volume will probably continue to be a major issue. With that, I’d be very cautious about putting any serious money into this market as the volatility could be very dangerous to say the least. Ultimately, this is a market that I think will eventually break out, but it may not be until January. I’d be cautious, but I do remain somewhat optimistic. I would be much more interested in buying near the ¥108.50 level. I think that level should continue to hold as significant support as it has more than once. Cautious optimism is probably how I would describe how I feel about this currency pair right now.