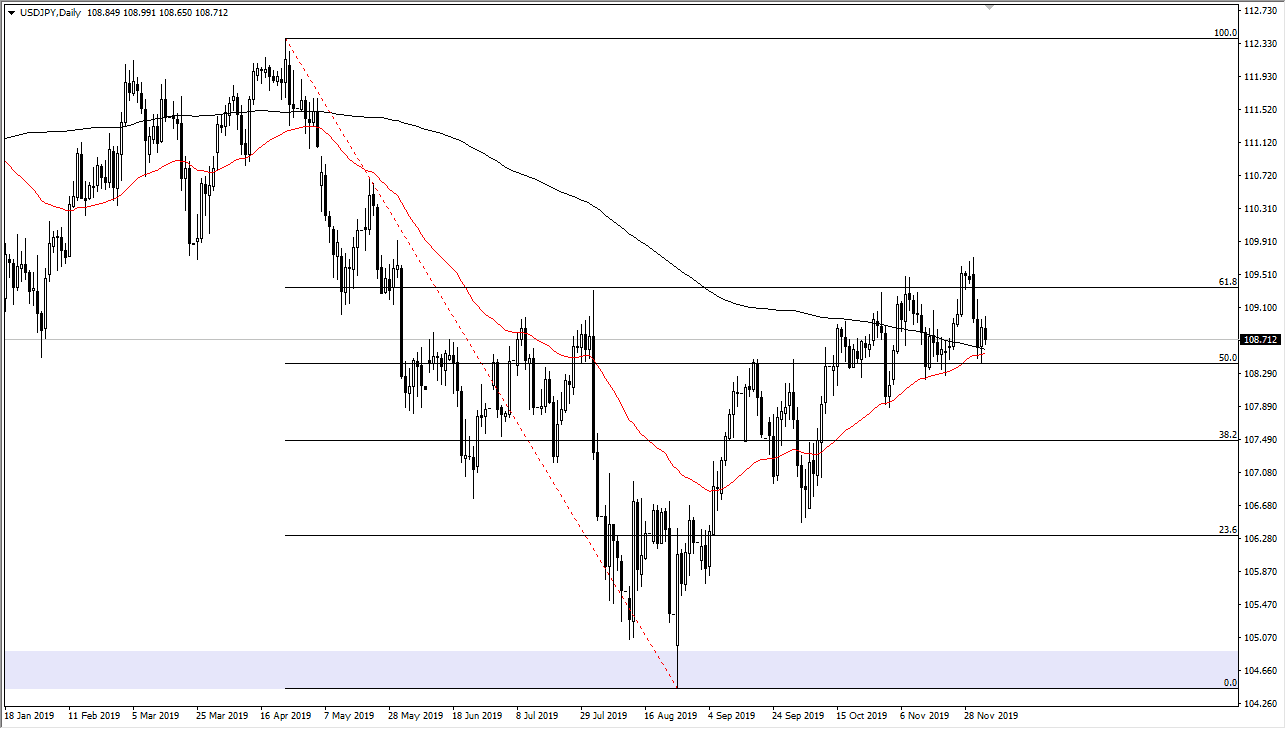

The US dollar initially tried to rally during the trading session on Friday but give back the gains in volatile trading after the Non-Farm Payroll announcement. At this point, the market is showing signs of support underneath, at a previous uptrend line. Overall, the ¥108.50 level has been crucial more than once, and it looks as if it is going to offer support yet again. Beyond that, the 50 day EMA is crossing at this area, and in fact it’s ready to reach above the 200 day EMA. The so-called “golden cross” would then come into play, and that is a longer-term “buy-and-hold” type of situation.

Keep in mind that this is highly risk sensitive, so we will have to see what happens next, but it certainly looks good based upon the fact that we cannot break down below the bottom of this channel. I think given enough time it’s likely that we will go looking towards the highs again, somewhere near the ¥110 level. If we were to break above there, then the market is probably going to go looking towards the gap at the ¥111 level, and then possibly the ¥101.50 level as it is the 1% Fibonacci retracement level.

The US/China trade war continues to rage on and will continue to make massive moves in risk appetite as far as markets are concerned. Looking at this chart, we will probably continue to chop back and forth to the upside. Eventually I think we will find enough momentum to break out to the upside and go much higher. On the other hand, if we were to break down below the ¥108 level, the market is likely to go down to the ¥107.50 level, and then possibly the ¥107 level. This is a market is likely to find plenty of buyers oh, especially as the S&P 500 continues to rocket to the upside and the risk appetite in general is getting better. This is a market that is noisy, but still is in an uptrend and getting ready to make a longer-term “buy-and-hold” situation. This is market should continue to see a lot of reaction to headlines, but I think it is only a matter of time before we have to make a bigger move for the longer-term. As we end the year, it’s very likely that we will have more of a “risk on” move.