The US dollar has initially rally during the trading session on Monday, but then broke down significantly as the ISM Manufacturing PMI figure came out lower than anticipated. Beyond that, there are PMI figures around the world that are drifted lower so it’s very likely that people are focusing on the potential of a global slowdown. Remember, this is a very risk sensitive pair and that’s exactly how it acted during the session.

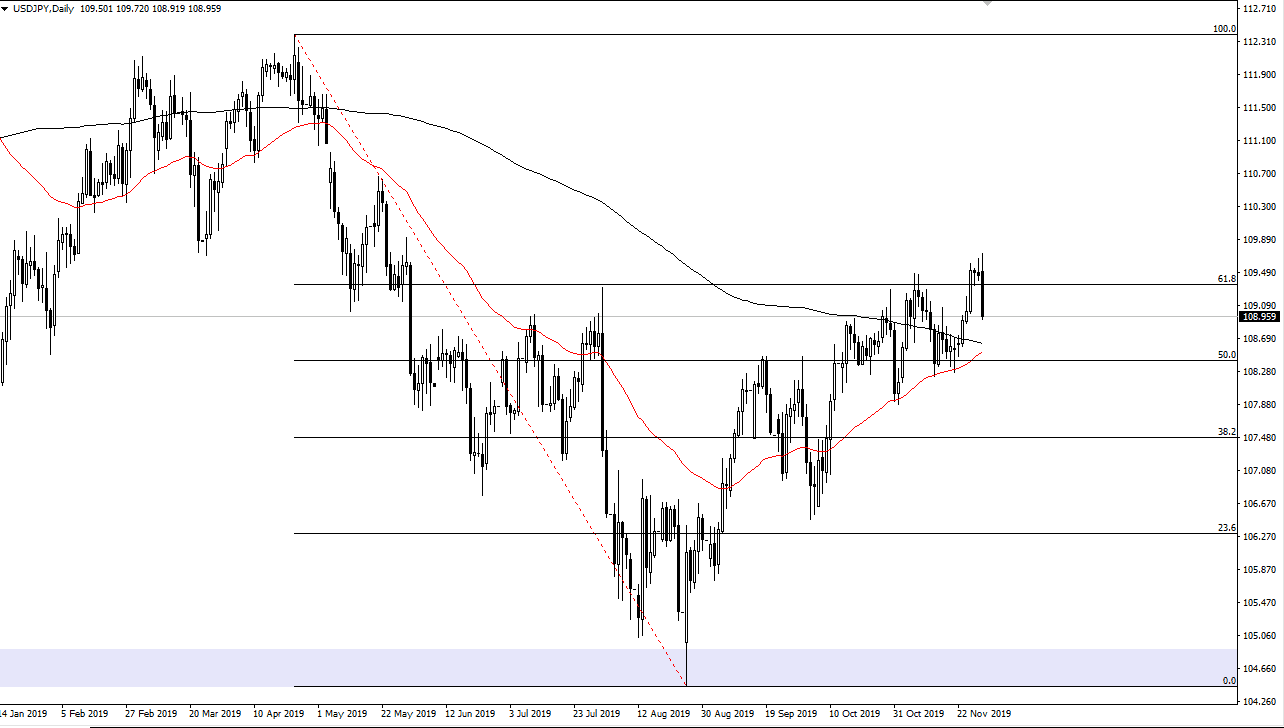

From a technical standpoint, there should be plenty of support near the 200 day EMA which is getting ready to see the 50 day EMA Krause above it. At this point, I suspect that another day or two of volatility continues, and then eventually we continue to go to the upside. If we can break above the ¥110 level, then the market is likely to go much higher. If we were to break above the ¥110 level, then it opens up the door to the ¥111 level, which features a small gap. A break above there opens up the door to the ¥112.50 level.

With the impending “Santa Claus rally” on Wall Street about to happen, it’s likely to drive this pair higher, but we may see a day or two of noise between now and then. The shock of global manufacturing slowing down of course has freaked a lot of people well but longer-term we are still pressing this major resistance barrier, and we haven’t exactly made a “lower low”, so I think it’s only a matter of time before we go higher. I do like the idea of buying this pair, but I won’t do it right now. If we get some type of bounce around the ¥108.50 level, where the two moving averages are moving towards each other, then I might be interested in going long. At this point, the market is likely to see a lot of choppy behavior, so keep your position size relatively small. That being said, I do believe that the tenacity and the absolute stubbornness of the buyers should continue to see this market rally over the longer term and eventually break through all of that resistance above. That being the case, it’s likely that the market will find plenty of noise in the interim, but I think at this point we will probably have enough value hunting underneath to send this market higher.