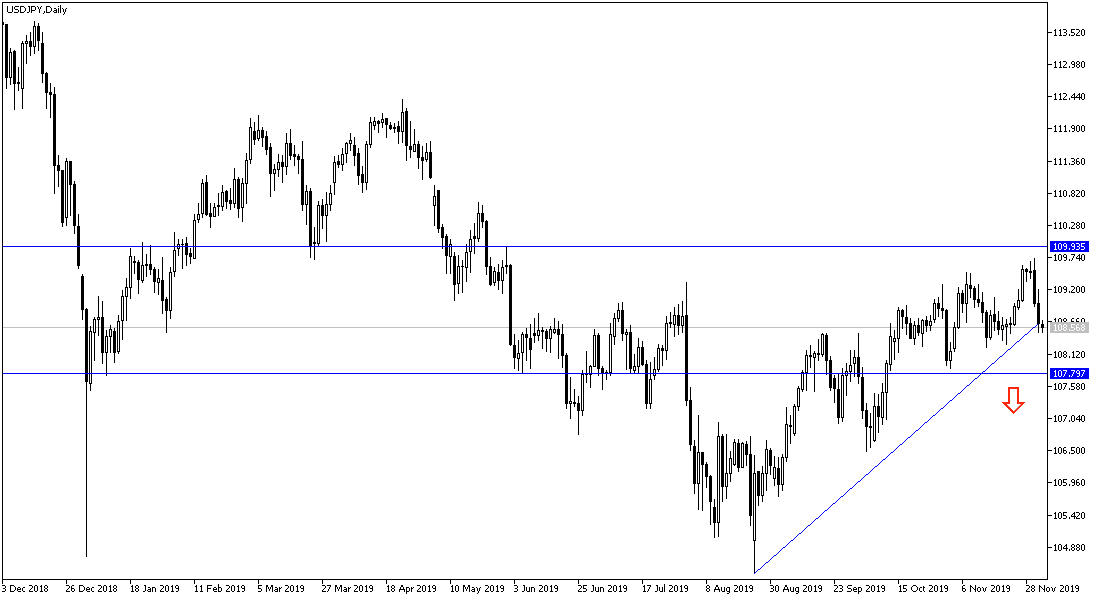

Risk aversion and increased pressure on the dollar after the disappointment of the US statements regarding the Phase 1 trade agreement with China, contributed to the pressure on the USD/JPY, which fell to the108.48 support, and the bearish correction chance is clearly seen on the daily chart below, along with a break of the general trend, which may culminate in a move towards 108.00 support. In an interview with CNBC on Tuesday, US Commerce Secretary Wilbur Ross reiterated President Trump's earlier assertion that the December 15 tariff would go ahead if the deal is not finalized before that date.

Trump said before the NATO summit in London that he had no deadline for the completion of the deal, which he already said on October 11, and has always stressed the near completion of the same. But he then said it was "better" to wait until after the November 2020 election to finalize the deal, which means that retaliatory and strict tariffs remain on imports from China for a long time next year.

The JPY, as a safe haven for investors in times of uncertainty, took advantage of the opportunity and made stronger gains. Amid fresh tensions between the US and China as well as rising Japanese government bond yields, although analysts said there is still more gains for the yen in the future.

Japan is a country of savers with current account surpluses, often on the trade balance as well, while the US and UK runs deficits, which support demand for the currency even in times of uncertainty or conflict. This is an important part of why investors are so aggressive in buying the Japanese yen when their appetite for risk disappears. At present, risk appetite suffers from new uncertainties about the future of US-China trade relations.

A sharp rise in spending by the Japanese government, which has the world's highest debt-to-GDP ratio, could mean an increase in the supply of bonds that will hit markets in the coming quarters.

According to the technical analysis of the pair: USD/JPY may turn towards a change in the trend to the downside by moving towards and below the 108.00 support, which confirms the strength of the breach general trend, and this is clearly evident on the daily chart below. The bullish outlook will not return strongly without the pair moving towards 110.00 psychological resistance. The future of the US-China trade agreement ahead of Dec. 15 will determine the pair's performance in the coming days. We still prefer to buy the pair from every bearish level.

As for the economic calendar today: We will focus on the US session data with the release of the ADP Non-Farm Payrolls Index, then the ISM Services PMI and Crude Oil Inventories.