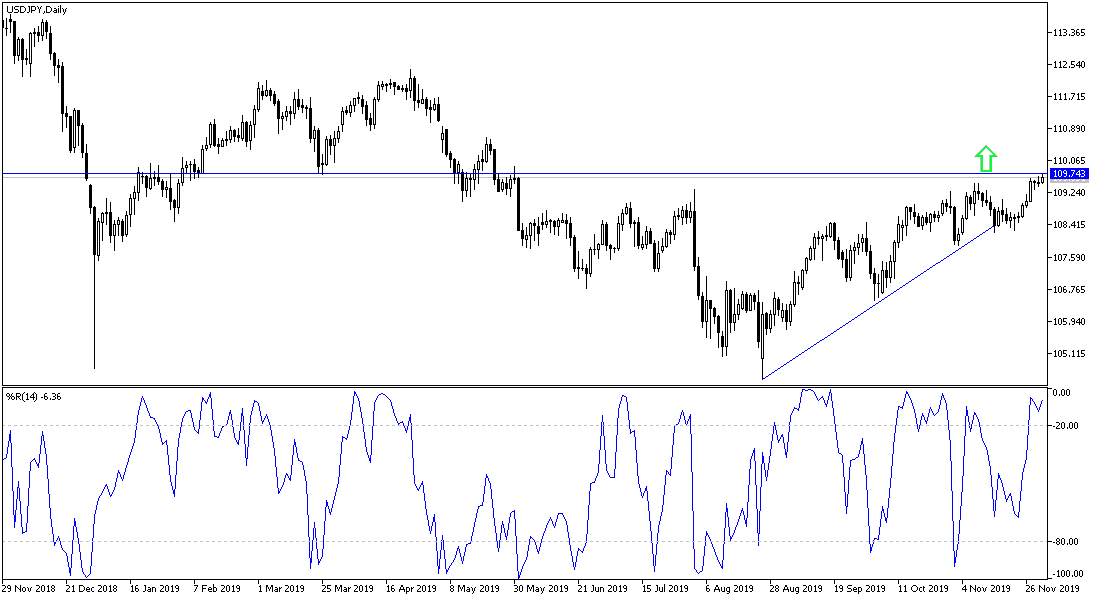

USD/JPY Continued its bullish momentum, as investors risk appetite and attention is cautiously moving towards the date and details of the US-China trade agreement; the main driver of financial markets over the past 18 months. The pair managed to move towards the 109.72 resistance in early trading today, the highest level in six months before, settling around 109.62 at the time of writing.

Besides optimism about the tariff war between the two largest economies in the world, there has been a flurry of positive results from important US economic data, the most notable of which is the country's GDP growth of 2.1%, higher than the forecast of 1.9%. US durable goods orders also rose more than expected, confirming continued US consumer confidence, and rising spending, supported by falling unemployment to a 50-year low and rising income. Consumer spending accounts for 70 percent of US economic activity.

FOREX Markets (Forex) - There was no retaliation from China for President Donald Trump's decision, and after the US Congress unanimously approved the signing of the Hong Kong Human Rights and Democracy Act. Talks between the two sides are still going on at a senior level of officials in the hope of reaching an agreement before December 15, when more US tariffs on China's imports will be approved.

The US Federal Reserve Bank, led by Jerome Powell, remains confident of the country's economic performance and is adhering to its monetary policy and moving it according to the performance of the US economy, not considering the interference of the political administration in the Bank’s work, as it has full independence.

According to the technical analysis of the pair: On the daily chart, the USD/JPY continues to move within a sharp bullish channel, once again indicating strong upward pressure in market sentiment over the long term. The pair has recently approached the boundary line of the overbought territory, but still seems to have enough momentum to cross that zone. Therefore, bulls will target long-term profits around 109.93, 110.51, 111.13 or higher at 111.75. On the other hand, bears are hoping to target profits around 108.96, 108.50, 107.44 or below at 106.92. We still prefer to buy the pair from every bearish level.

As for the economic calendar data today: From Japan, there will be announcement of the rate of capital spending and then the manufacturing PMI. From the US, the ISM Manufacturing PMI and Construction Spending Index data will be released.