The USD/JPY price of the pair did not react much to the announcement a better than expected results for US jobs during the month of November. The biggest gains in the dollar were against the other major currencies, except for the Japanese yen, as the pair stabilized around the 108.53 support at the time of writing. In the vicinity of the uptrend breakout zone, the pair is still affected by disappointment about the future of the expected trade agreement between the United States of America and China. US nonfarm payrolls increased to 266,000 jobs last month, which is an impressive result, meaning that the US economy created more than a quarter of a million new jobs in November, while the unemployment rate fell to its lowest level in several decades to 3.5%. Hourly wage growth rose, but less than expected.

The markets were expecting only 188,000 new jobs to be added, and the US job market has remained in a critical situation in recent months, despite the easing of tensions between the United States and China over recent trade practices, and in the face of pessimism about the global economy. Before announcing the report, Federal Reserve Governor Powell said recently that interest rates and the economy were in "good shape". And the job report numbers will confirm the validity of the Fed's policy, which halted the pace of the US interest rate cut after seeing the payoff from the three interest rate cuts that took place throughout 2019.

The Federal Reserve will announce the next interest rate decision at 19:00 next Wednesday, amid expectations that the US interest rate will remain unchanged. Attention will be paid to the content of the monetary policy statement, which is issued with the decision, and then statements by Federal Reserve Governor Jerome Powell, to learn about the future of the bank's policy in the coming year.

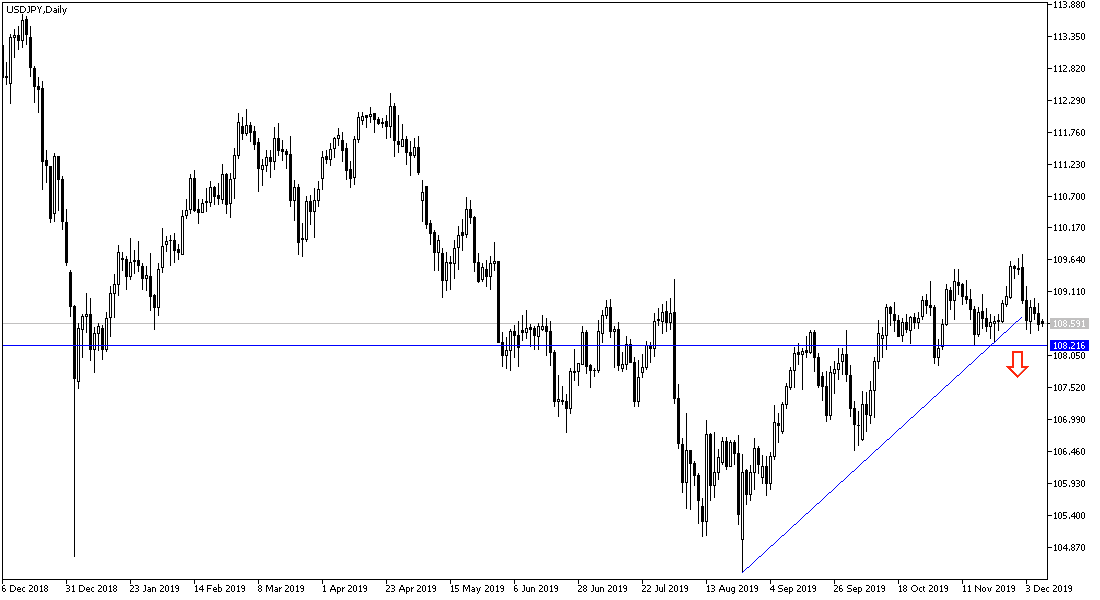

According to the technical analysis of the pair: Breaking the USD/JPY uptrend pair is still valid, and this will be strengthened by moving around and below the 108.00 support as shown on the daily chart below, and any movement below this support will push the pair towards stronger support levels, with the closest being at 107.45 and 106.90. At the same time, they are good buying levels. On the upside, there will be no strong bullish correction without moving towards the 110.00 psychological resistance. Otherwise, the decline will remain the stronger performance for the pair. Markets are cautiously awaiting Trump's decision this week to postpone the imposition, or to implement the US tariffs scheduled for December 15.

As for the economic calendar data today: With the absence of US economic data, the focus will be on the results of the Japanese data; the gross domestic product and the current account.