For three consecutive trading sessions, the USD/JPY is trying to breach the 109.70 resistance to complete the general trend reversal. The pair is stable around 109.55 at the time of writing. The US dollar gained strong momentum after President Donald Trump announced a "very large stage of the deal" to end the trade war with China, which already prevented more US tariffs from being imposed earlier this week. Current tariffs on both sides are expected to be lowered.

The text of the agreement has not yet been announced, and the agreement itself may not be signed until the first weeks of January, but based on the details provided so far, the deal is stronger than many analysts expected. President Trump said on Friday that he would cover intellectual property regulations, forced technology transfer and a host of other key U.S. concerns about Chinese trade practices including the country's management of the exchange rate.

The announcement gave hope to global financial markets that the agreement will lead to a limited global economic recovery in the coming months. Global economic growth slowed during the 18-month trade war between the world's two largest economies, as the Eurozone and Asian exporters were hit hard by it.

Also contributing to investor risk appetite and the abandonment of the Japanese yen as a safe haven, were the results of the UK elections, which gave an 80-seat parliamentary majority to Prime Minister Boris Johnson, meanwhile, drastically reduced a “no deal” Brexit in 2020. This is also good news, although the global economy continues to suffer. The UK is the world's fifth largest economy and a net importer of goods, and is a major export destination for some economies including Eurozone countries.

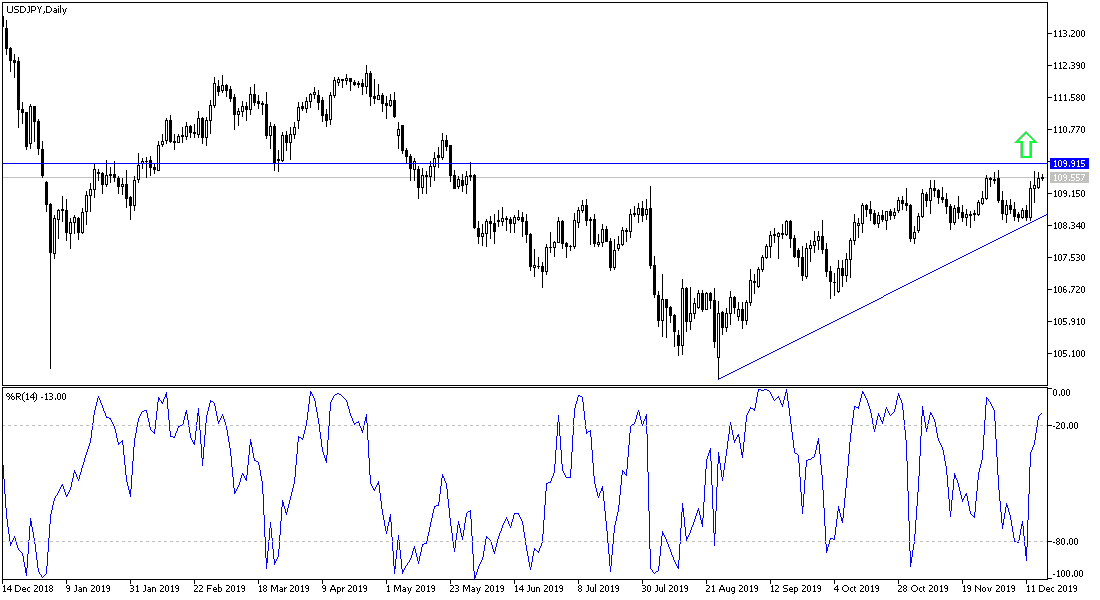

According to the technical analysis of the pair: The USD/JPY bullish correction strength awaits the breach of 110.00 psychological resistance. On the other hand, stability of the pair below the 109.00 level will restore the threat again of a possibility to retreat and evaporate the recent gains. All this will depend on the extent of investor risk appetite. The return of global trade and geopolitical tensions will be in favor of the yen's gains.

As for the economic calendar data today: The US data will focus on building permits, housing starts, and industrial production rate.