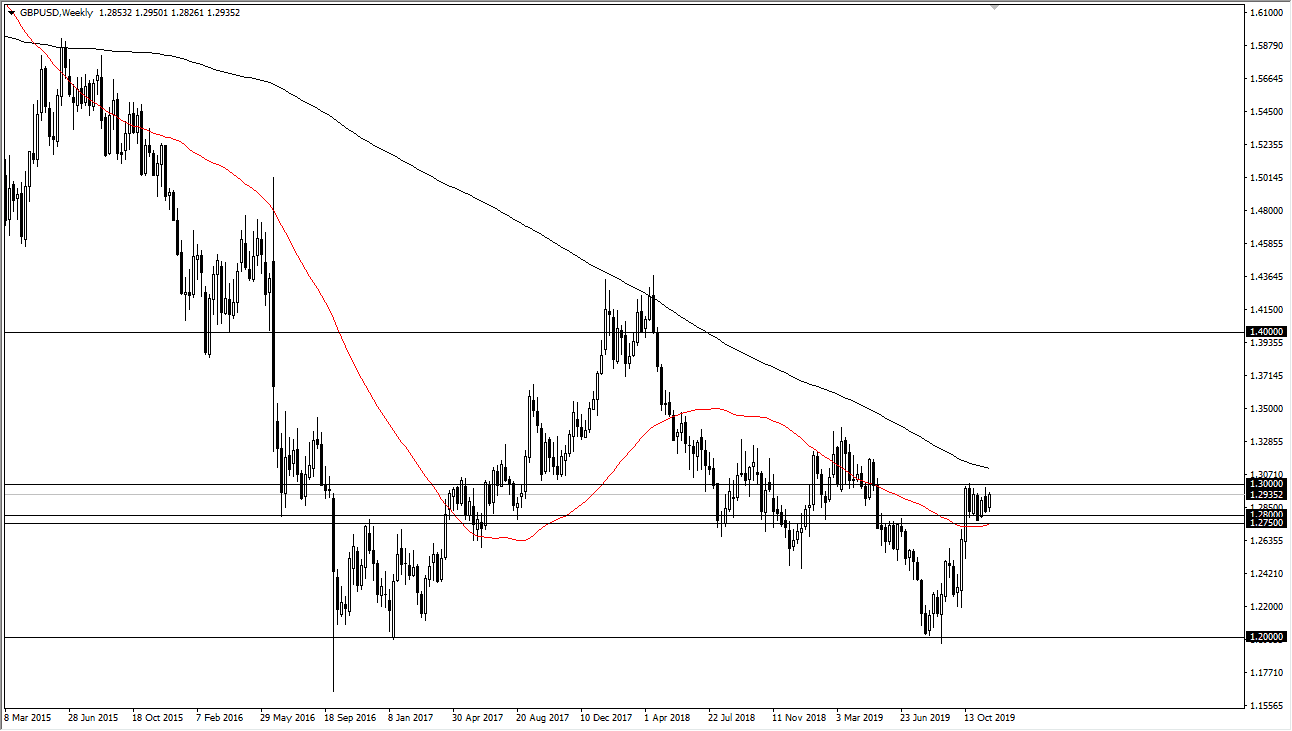

GBP/USD

The British pound rallied significantly during the trading sessions that made up the week, reaching towards the 1.2950 level. The British pound is currently testing the 1.30 level and it appears that we are trying everything we can do break out. Given enough time, I believe that short-term pullbacks continue to be buying opportunities with the 1.28 level offering massive support. I believe it’s only a matter of time before we get the breakout needed.

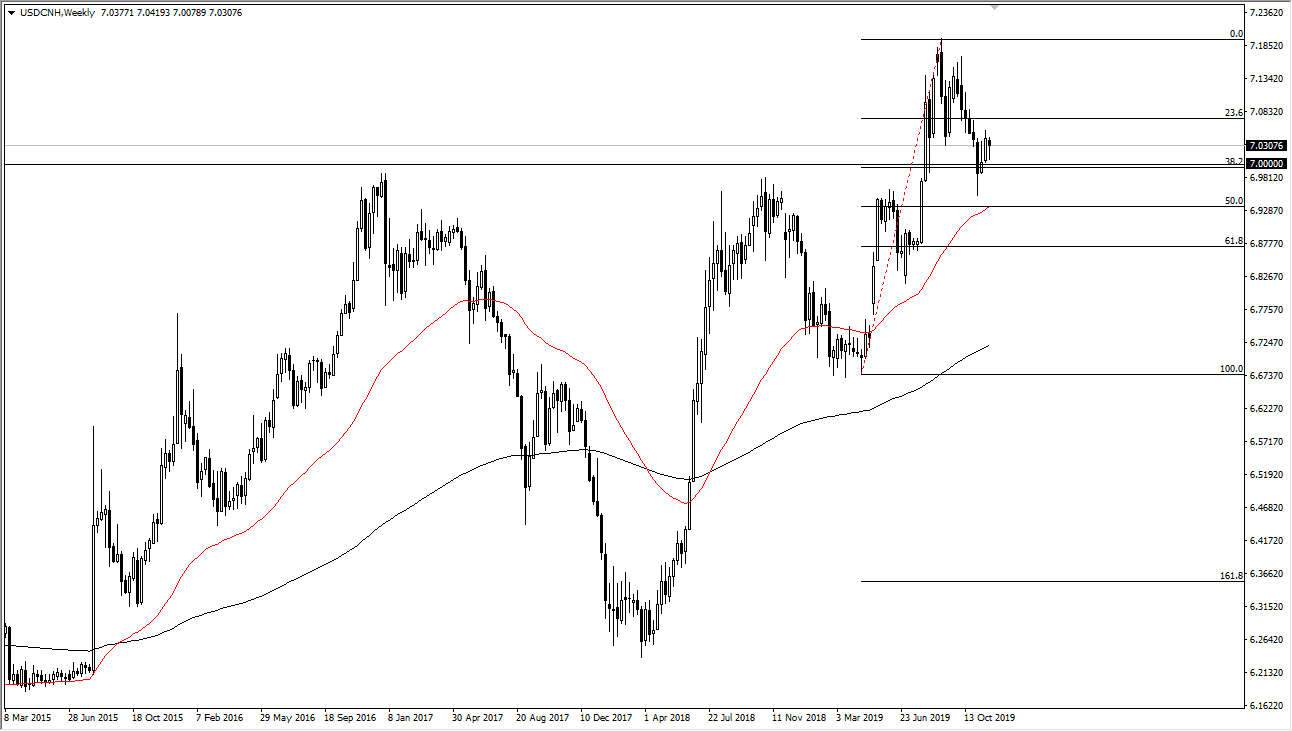

USD/CNH

The Chinese Yuan continues to suffer at the hands of the US dollar, and as a result we are still above the crucial 7.00 level. With this, it suggests that the trade tensions are still front and center when it comes to trading anything China related. Beyond that, the Chinese economic numbers have not been that good, but if the so-called “Phase 1 deal” happens, that could send this market right back down in more of a “risk on” type of move. That being said, the short term I suspect we continue to bounce around between the 7.00 level on the bottom, and the 7.10 level on the top.

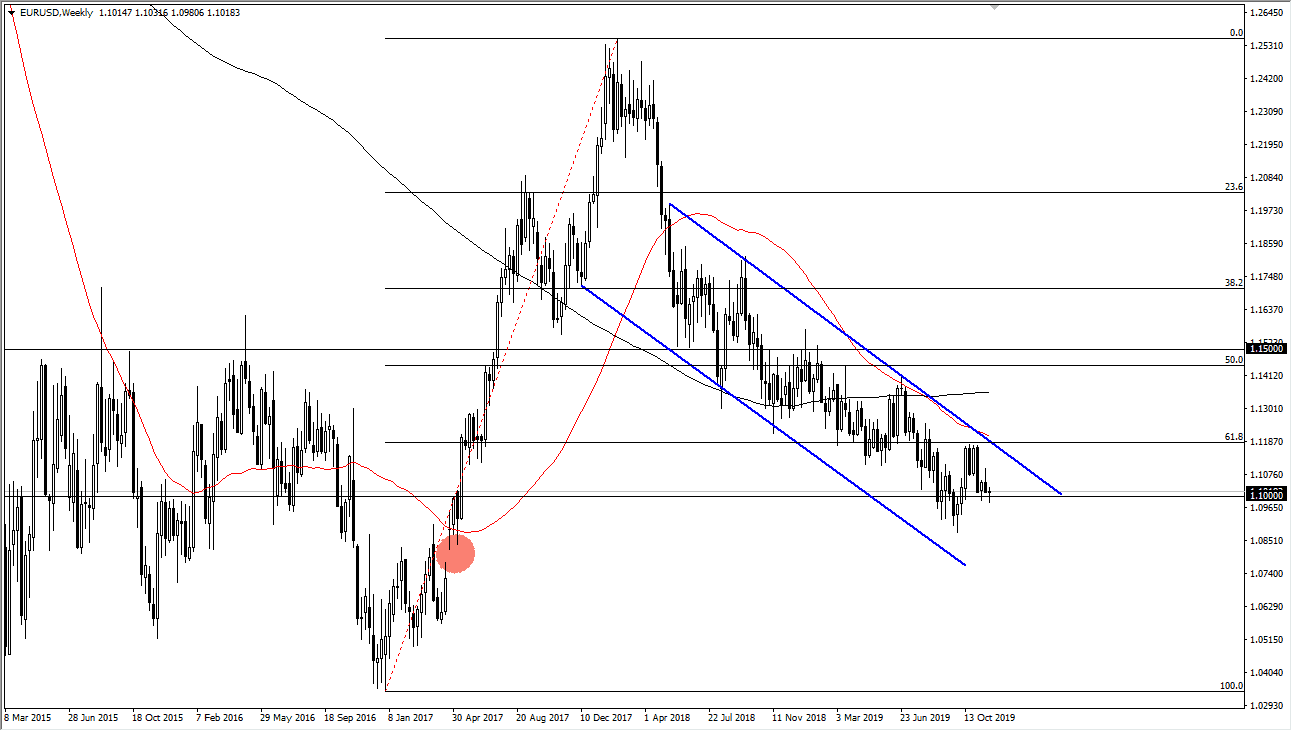

EUR/USD

The Euro had a little bit of a positive move on Friday and has ended up forming a bit of a hammer at the 1.10 level. This was preceded by a shooting star, which was preceded by a hammer. With this, it’s very likely that the market continues to go back and forth at this large, round, psychologically significant figure, but overall, I think we will continue the overall downtrend. In the short term, it’s very likely that rallies will be sold off at the 1.11 handle and of course the 1.12 level. To the downside, if we break down below the lows of this past week, we probably will find the market testing the 1.09 level rather quickly. From a longer-term perspective, there is still a gap down at the 1.075 level that has not been filled.

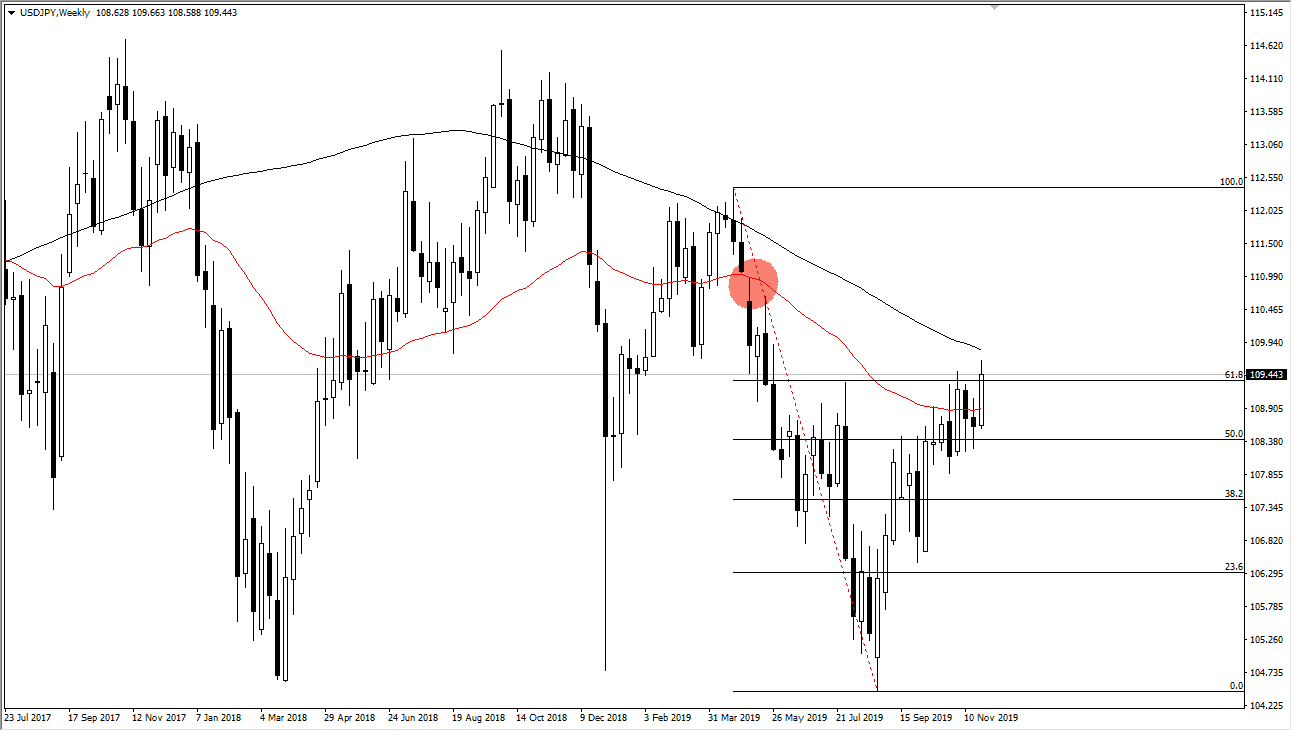

USD/JPY

The US dollar has had a very strong week against the Japanese yen, making fresh gains and a fresh, new high. It’s obvious that the ¥110 level is starting to be chipped away at, and it’s probably only a matter of time before the buyers get through there and continue to go higher. The gap above which has been partially filled is still a significant initial target for me at the ¥111 level, followed by the 100% Fibonacci retracement level at the ¥112.50 level. I have no interest in shorting.