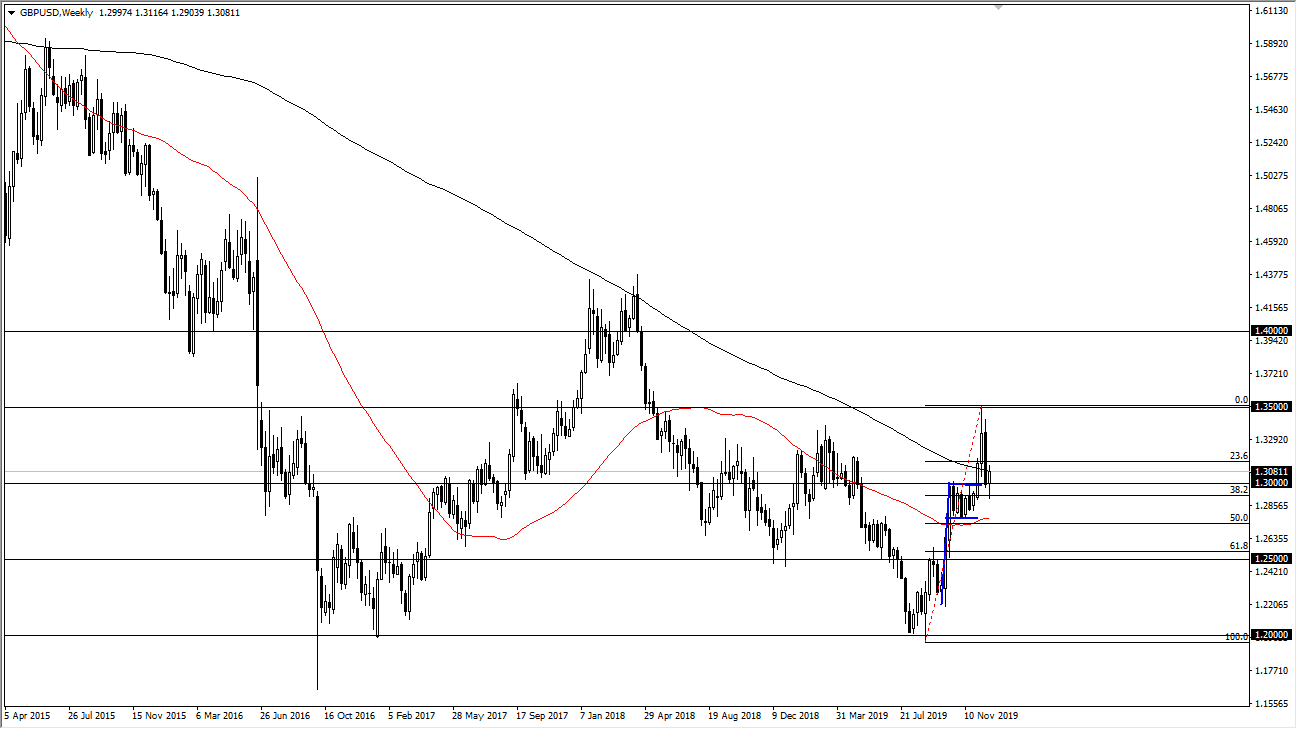

GBP/USD

The British pound has pulled back a bit during the week, but then turned around to show signs of life again. At this point, it looks as if we are going to get a bit of a continuation phase and I anticipate that the next week or so is going to be a “buy on the dips” type of situation. The 1.30 level should continue to attract a lot of buyers, and I think that we are moving into a new phase of the market, where we become comfortable between 1.30 on the bottom and 1.35 on the top.

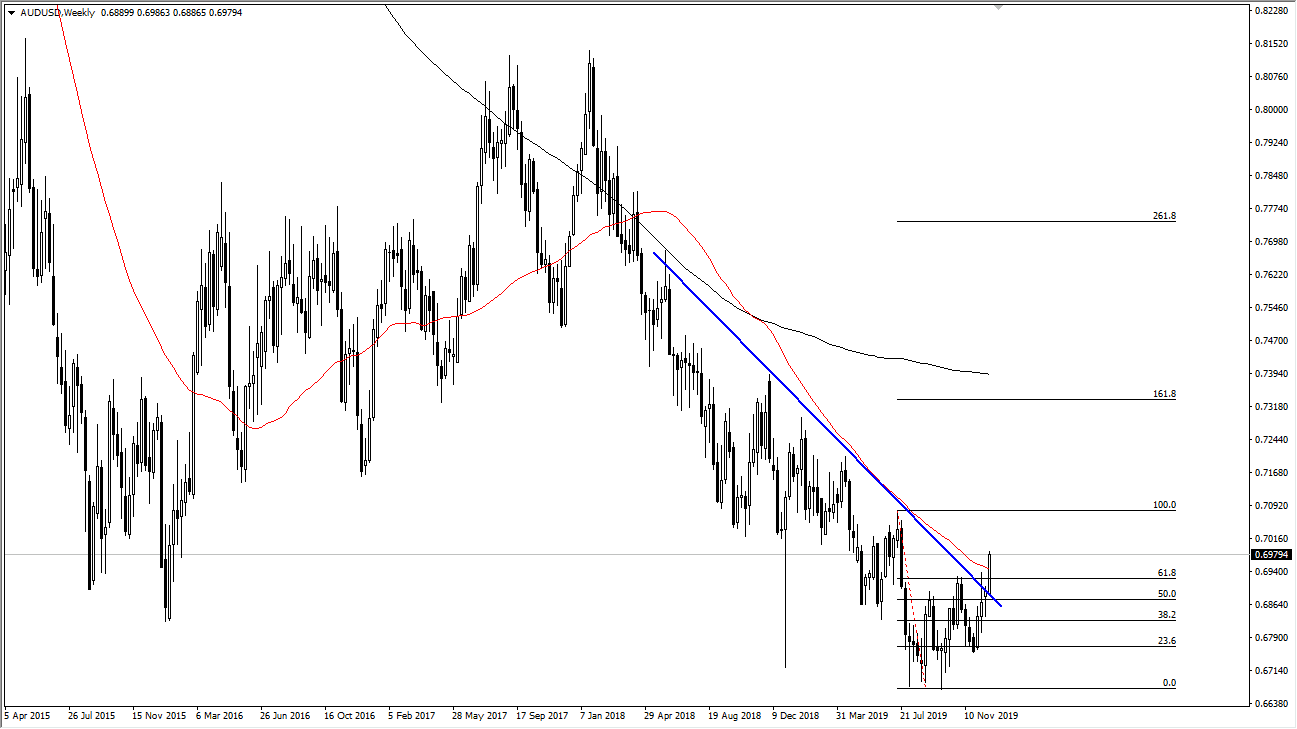

AUD/USD

The Australian dollar has exploded to the upside during the previous week, breaking above the 61.8% Fibonacci retracement level. At this point, I think that we are getting very close to a longer-term move to the upside, especially if the United States and China will go ahead and sign some type of agreement. The Australian dollar is highly sensitive to the situation, and therefore the better things go there, the better things go here. I like the idea of buying short-term pullbacks in this pair, because it’s very rare that a market simply breaks out above a major downtrend line and keeps going. I anticipate that a move back towards the 0.6940 level will start to attract buyers and offer value.

EUR/USD

The Euro has rallied rather significantly during the trading session on Friday, and that ended up forming a very bullish candlestick for the week. We are pressing the 1.12 handle, so on a move above the 1.1250 level I anticipate that the market will go looking towards 1.14 handle. Otherwise, I fully anticipate that we will get a little bit of the selloff and perhaps reach down towards the 1.11 handle which is essentially “fair value” in the market. Keep in mind that this week will be very thin as far as volume is concerned, so I wouldn’t read too much into the candlesticks quite yet.

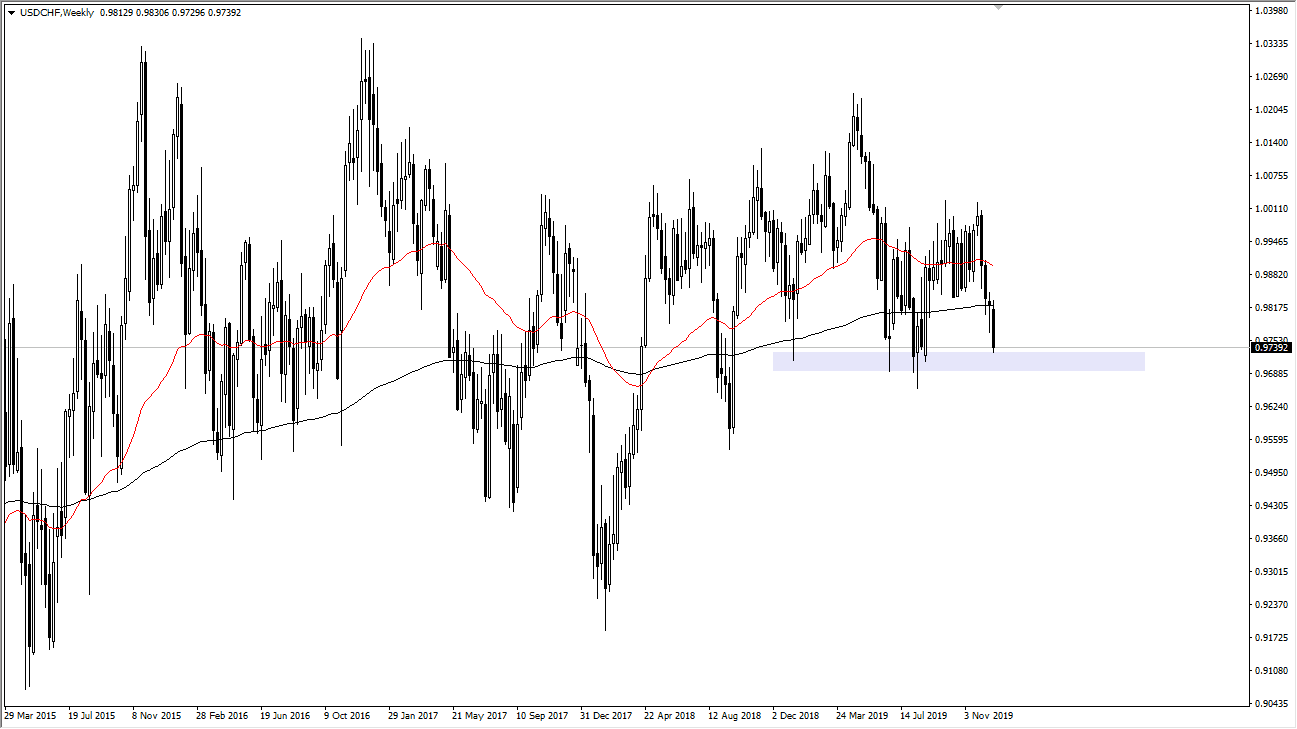

USD/CHF

The US dollar has gotten hit against the Swiss franc, breaking through the back of a hammer from the previous week. That obviously a very bullish sign and now we are threatening the 0.79 handle. If we break down below there on a daily close, then I anticipate that we will go down to the 0.96 level, followed possibly by the 0.95 level. However, rallies at this point could occur, but I would be very suspicious of them until we break above the 0.9850 level.