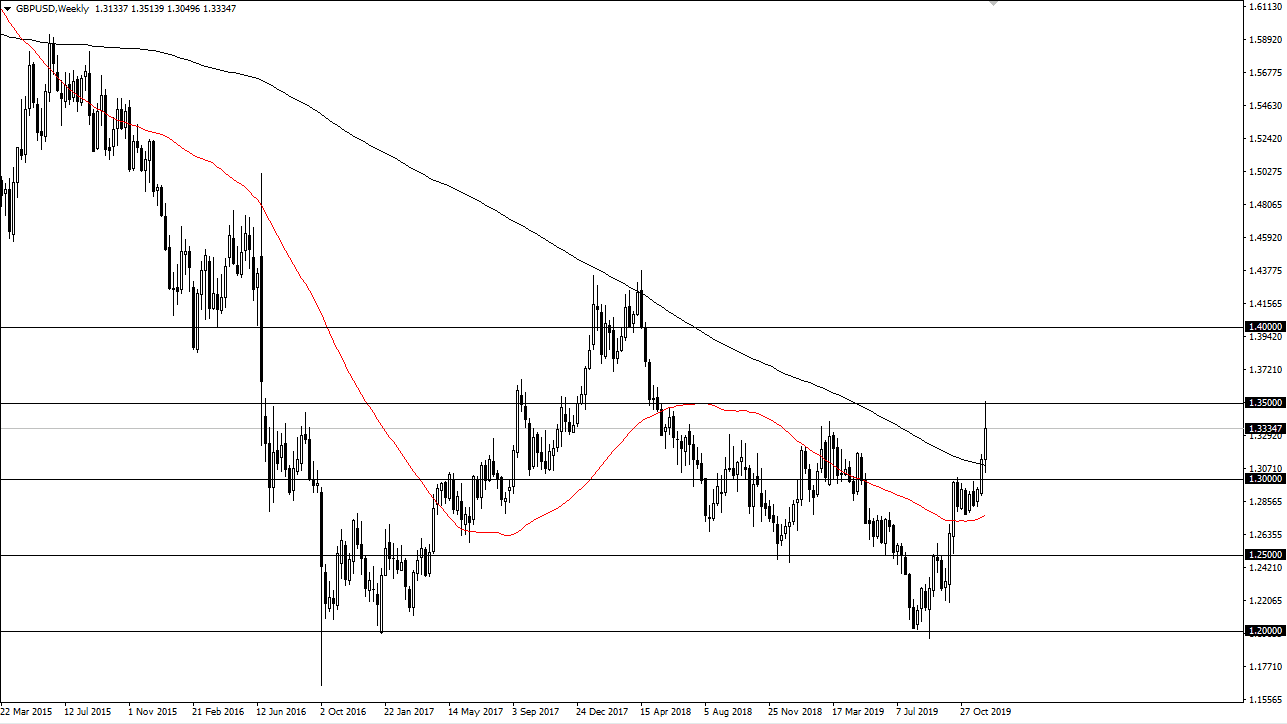

GBP/USD

The British pound has rallied significantly during the week after the elections came back delivering a conservative majority in parliament. Now it looks likely that markets will continue to find buyers on dips, as the 1.35 level above offered a bit of a pushback. Ultimately, this is a market that should continue to offer value on these dips, and now that we will get a Brexit finally, it’s likely that the certainly will translate to a higher British pound. The next target would be 1.40, but this week we probably look for a pullback closer to the 1.32 level, before buyers come back into pick up value.

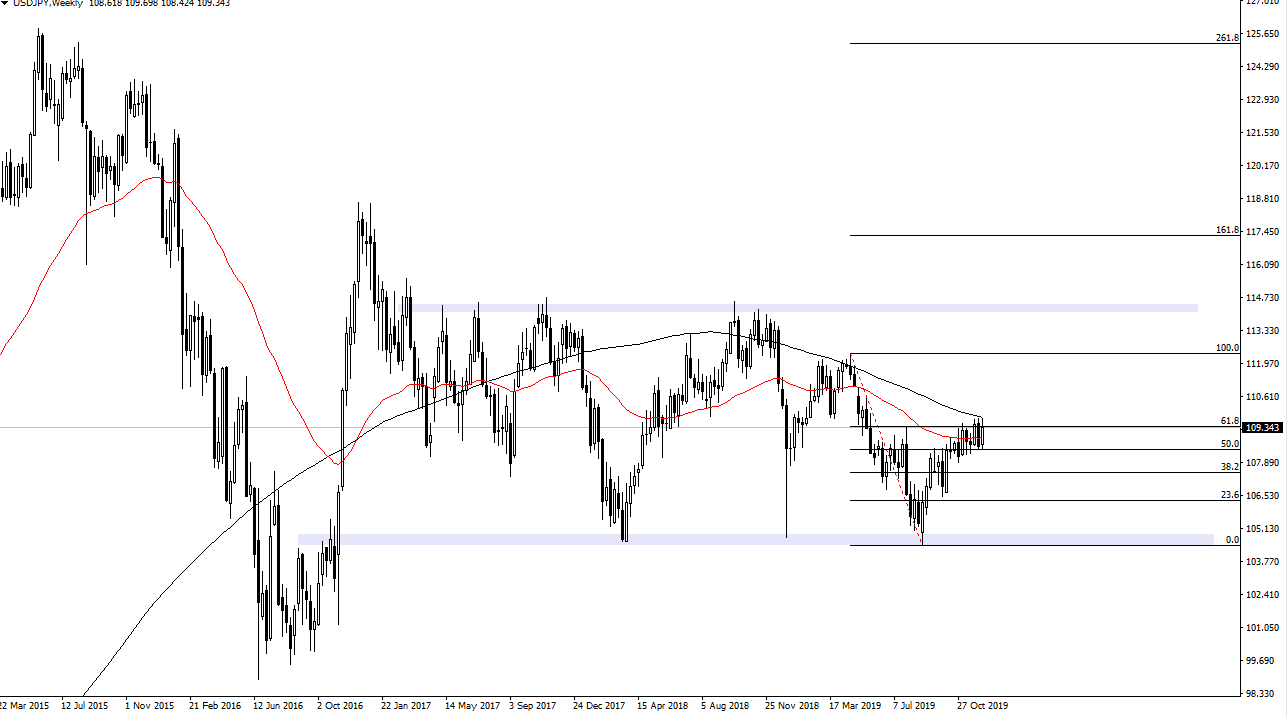

USD/JPY

The US dollar has rallied significantly during the trading sessions that made up the previous week, reaching towards the 200 week EMA again, but continuing to find plenty of resistance above. The ¥110 level continues to be an extraordinarily difficult area to break above, and if we can clear the ¥110 level it’s likely that the market will then go looking towards the ¥111 level. Look at short-term pullbacks as potential buying opportunities, as long as we can stay above the ¥108 level, something that has been massively supportive.

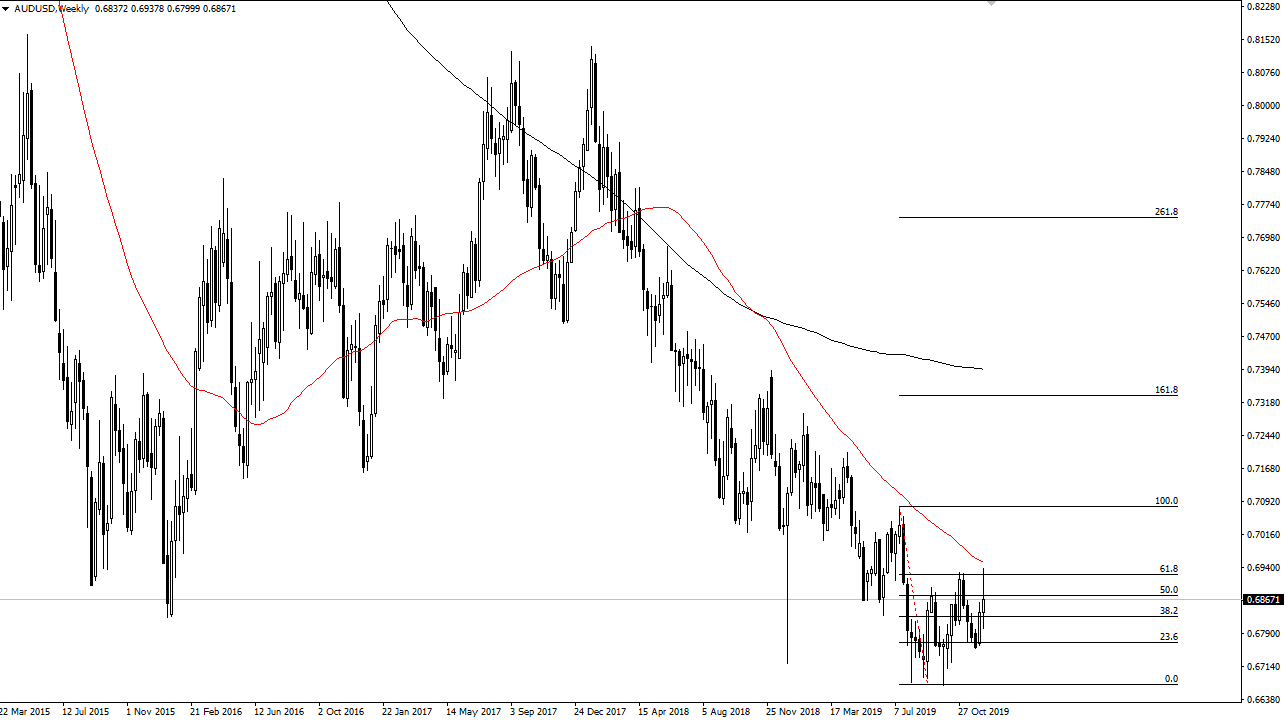

AUD/USD

The Australian dollar has gone back and forth during the week, showing a lot of volatility. At this point, the market looks likely to continue to move back and forth during the week, as we just can’t seem to take off to the upside. The US/China trade situation continues to be a major issue as well, as although we have gotten the so-called “phase 1 deal” agreed to in principle, it’s likely that the volatility continues to be a major issue. At this point, it’s likely that the market will continue to move on the next headline. The fact that we could not rally after that announcement is a bit concerning. If we can break above the high of the week though, then the market is likely to go to the 0.71 handle.

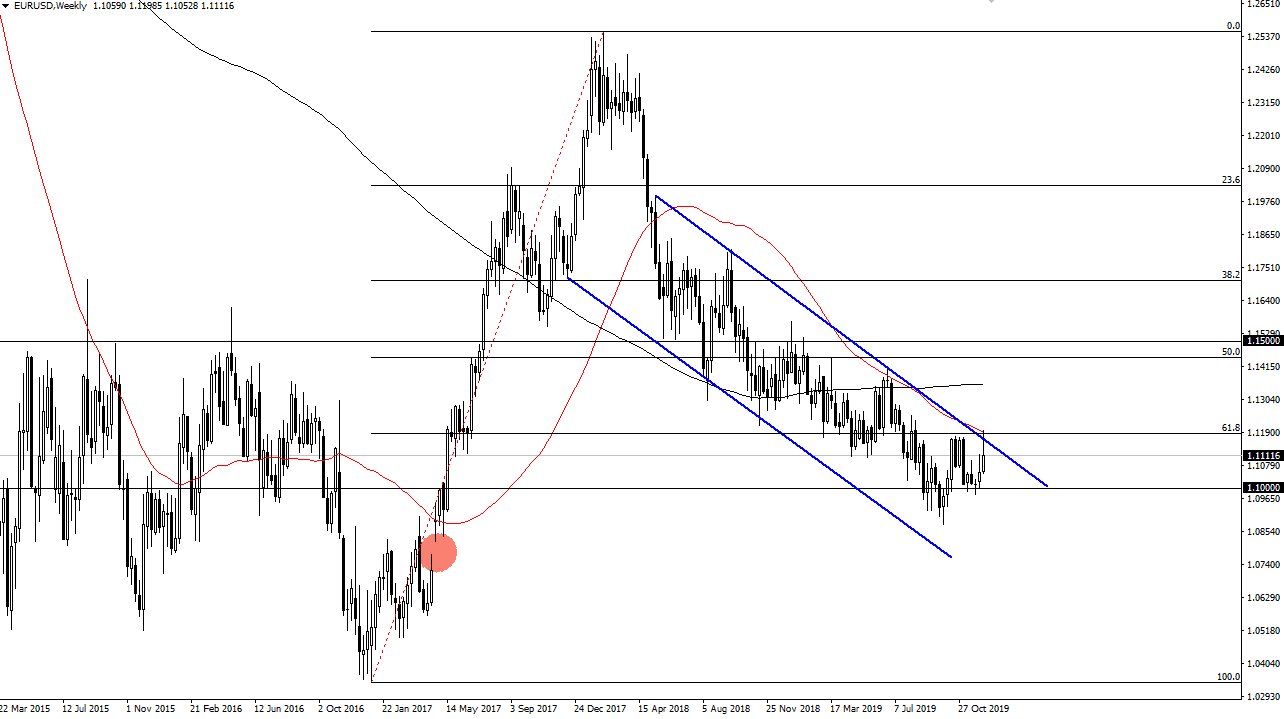

EUR/USD

The Euro has rallied significantly during the week, especially on Friday to reach towards the 1.12 handle. The market has rolled right back over from the 50 week moving average though, and of course the top of the down trending channel. Ultimately, the market is supported at the 1.10 level, and that is an area that if we break down below it’s likely that we would go to the lows.